There are two schools of thought in the market regarding deploying surplus corpus over the long term- investing in stocks or buying a house. Both options have a significant return potential over time, but investment economics differs significantly. Therefore, be informed before jumping to any conclusion, and understand the effectiveness of both investment options.

So, should you invest in stocks or real estate? First, let’s compare to know the better investment option for the long term -stocks or real estate.

Overview: Stocks vs. Real Estate

Investing in stocks and real estate is an investor’s choice, and it should depend on the long-term financial goals, risk appetite, responsibilities, and financial situation.

Let’s look at the primary differences between investing in stocks and real estate.

Ease of Investment

All you need is a trading account and a Demat account to invest in stocks. You can open these accounts with any stock broker at minimum charges. And, with some basic research about companies and sectors, you can begin to invest in stocks.

However, it needs hard work to start investing in real estate. You must identify potential properties, physically evaluate a property, negotiate on the prices, finalize the property documents, seek legal advice, etc., to take full possession of the property and become an owner.

Please note- It’s easy to begin investing in the stock market, but finding multibagger stocks can be time-consuming and tricky. That’s why you have financial advisors like us. Fill up the form below to get a multibagger portfolio that suits you.

Recurring Costs

There are small recurring costs associated with holding shares in your Demat account or investing in stocks, such as account maintenance charges, depository participant (DP) charges, SEBI Charges, GST, etc. Profitable companies regularly give dividends to shareholders, generating extra income streams apart from capital gains compared to buying property.

In real estate, recurring costs are usually in thousands or lakhs, including maintenance, property taxes, utility costs, etc., further driving up ownership costs.

Liquidity Stocks can be sold at very short notice without many hiccups at the prevailing market rate in just a few clicks. Whereas selling a house is a lengthy process. You must find a buyer, check the market value, agree on the selling price, and complete the registration process. The entire process can take up months to complete. Needless to say, the high brokerage charges also eat your profit margin.

Returns on Investment: Stocks vs. Real Estate

The big question is, what is the return on investment on both asset classes over 20 years? First, let’s check a few calculations.

Returns in equity stocks

While it is difficult to accurately determine the return on equity investment due to price volatility, stocks tend to outperform other asset classes by a significant margin over the long term.

For instance, Sensex, the barometer of the Indian stock market has grown at a CAGR of over 14% over the past 20 years. And, in 20 years, Nifty50 has given negative returns only four times. Therefore, we will take a conservative annual return percentage of 12% to calculate the return on investment from equity stocks.

On an investment of ₹ 10 lakh over 20 years, the sum will compound to ₹ 96.46.89 lakh at a 12% annual rate of return. Further, if you invest ₹10,000 each month for the next 20 years, your total investment of ₹ 24 lakh would grow close to ₹1.82 crores at 12% per annum.

You can check the estimated returns on your investments using an online compound interest calculator or SIP calculator.

Returns in real estate

As the return on investment in real estate varies significantly depending on location and quality of construction, it becomes difficult to determine the actual return on investment from buying a house. Therefore, we will take returns on REITs as our reference point.

REIT, introduced in 2019 in India, currently offers yields in the range of 5.1-5.5%. REITs or Real Estate Investment Trusts are modeled on the lines of mutual funds that own and operate real estate to generate income. For instance, companies managing REITs lease out properties and collect rent, which is distributed to investors as dividends after deducting all the expenses.

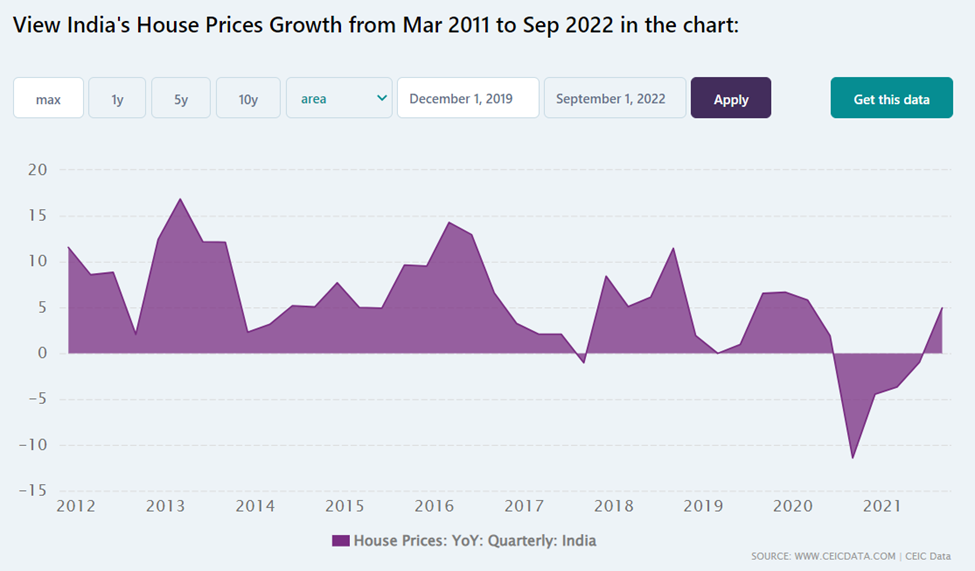

The investment of ₹ 1 lakh in REIT will be worth around ₹3.20 lakh at a 6% rate of return in the next 20 years. As per the CEIC data, d between March 2011 and September 2022, the average house price growth in India recorded was 5.1%.

Also, if you are buying a house to live in, it is not considered an investment because no monetary benefits are associated.

Cost of Buying a House On A Home Loan

Many tend to invest in house property by taking a home loan and repaying the loan amount through equal monthly installments (EMIs) over a long period. However, it pushes up the cost of ownership significantly.

For instance, on a home loan of ₹25 lakh for a tenure of 20 years with an 8.20% interest rate, the monthly home loan EMI comes out at ₹ 21,223. Therefore, the total amount payable during the period will be ₹ 50.93 lakh, more than the value of the home loan.

However, instead of taking a home loan, if you do a stock SIP of ₹ 21,223 for the next 20 years at a 12% rate of return, the investment would grow to ₹1.85.1 crores.

Conclusion: Should You Invest In Stocks or Buy A House

As stated earlier, your decision to invest in stocks or buy a house entirely depends on your financial objectives and risk appetite. Buying a home as an investment may look attractive as it creates a physical asset. Still, the associated costs and low rate of return make it an unattractive investment option over the long term.

As a sensible investor, you should not reject or fall in love with any particular asset class. On the contrary, if the asset class aligns with your financial objective, you should consider investing in it. But, for wealth creation over the long term, the economics and the past returns on investment suggest equity is better.

FAQs

Should I invest in stocks or real estate?

The decision must be aligned with your financial objectives and goals. But, for wealth creation over the long term, the economics and the past returns on investment suggest equity is better.

What are the disadvantages of investing in real estate?

Some of the major disadvantages are:

-A considerable upfront investment,

– Illiquid,

– High transaction costs, and

– Recurring costs.

How do you invest in stocks?

You can invest in stocks by either directly purchasing them from the stock market via a broker or investing in equity-linked mutual funds.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.