Smart Investments – A Ready Guide For New Investors

As children, you’ve always been taught to save. Parents often reiterate that saving is the route to creating wealth. But savings alone will help you build wealth is a myth. In the fast-paced world and ever-evolving economic scenario, saving is not enough to achieve all the financial goals.

Savings may be essential in your quest to achieve goals, but making smart investments will make them more manageable. However, the fear of losing money instead of gaining returns stops many from investing. When you give up consumption and save, the idea of losing your hard-earned money is not acceptable. So, many tend to opt for safe investments and put their money in fixed deposits or regular savings accounts.

Any money in your savings accounts will lose value over time. One of the reasons is the low-interest rates that savings accounts offer, which cannot keep pace with rising inflation. It means your purchasing power decreases the longer you save.

However, if you make smart investments, you can mitigate the risks and generate high returns without feeling like you may need to purchase a lottery ticket. This blog will focus on why you should invest, how much you should save, and discuss smart investment in India that will help your wealth creation journey.

Why should you invest?

The three key objectives of investing are growth through capital gains, income generation, and financial safety. However, traditional forms of investing have become less effective, with falling interest rates and rising inflation in the last three years.

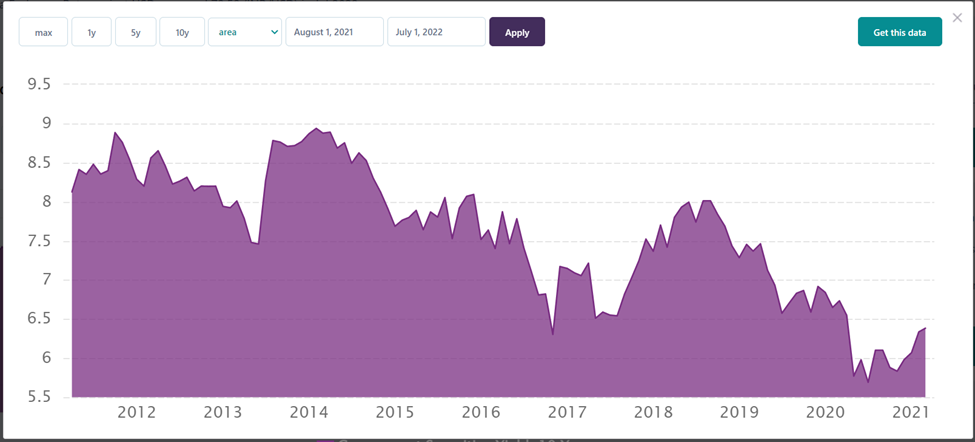

For instance, the inflation rate in India has been hovering above the 6% mark for quite some time now. And the yields on 10-year government securities, the benchmark for 10-year deposit rates, have been steadily falling over the last 10 years and are currently close to 6.4%.

Source: Tradingeconomics.com

Source: ceicdata.com

If you look closely, traditional savings plans like PPF, 10-year deposit schemes, etc., have lost their edge and cannot outperform inflation by a considerable margin due to the falling interest rate over the years resulting in low net capital growth. That is why many cannot achieve all their objectives if they focus on only traditional saving plans.

This is where smart investment can come to your rescue. It helps to potentially build wealth by making your money work for you instead of working hard for your money. Through smart investments in India, you can enjoy higher growth as it combines both the power of compounding and a balanced risk-return tradeoff.

What is Smart Investment?

Smart investments are an extension of basic principles of investing. Making Smart Investments is more goal-oriented and process driven to help you achieve all your future financial goals while creating more value for the money you’ve invested.

Unlike traditional investing, where money is invested in random well-known asset classes with the expectation of capital appreciation and generating passive income (dividend, interest income), smart investing is entirely different. It covers identifying your short and long-term goals, finding the right asset mix, starting early to take advantage of compounding, building a diversified portfolio, investing regularly, and aligning all your investments with your time horizons.

There are many available options for investment, which we will discuss in the later part of the article, but before that, let’s find out how much of your income you should save or invest.

How Much Should You Save Every Month?

Most people in their 20s and 30s struggle to determine how much income they should save to build a secure financial future. So, the answer is you should save at least 20% of your income.

This number was derived from the 50-30-20 thumb rule of budgeting. A rule of thumb is a method or procedure based on practical experience instead of a theory and is time-tested.

The 50-30-20 rule of budgeting states that 50% of the income should go towards meeting needs, 30% for wants, and 20% for savings in smart investments in India. However, as a safe practice, you should not restrict your savings rate to 20% of your income and always make an effort to save more by reducing spending on non-essential items.

The next big question is how and where to save?

There are many smart investment options available where you can start saving. Still, to build a safe and strong financial future, you must initially allocate money to building an emergency fund. The fund size should equal three to six months of ordinary expenses. Then, remember to top up your emergency fund at regular intervals as your expenses and lifestyle change.

How Do Different Smart Investments Work?

Smart investment is not about investing in any new investment option that generates higher returns or doing things differently. It’s more about understanding how the market works, the different smart investment options available, and finding the right investment mix for yourself.

Understand How The Market Functions

The finance world can get incredibly complex if you don’t understand how it works and how to spot opportunities in the market. For instance, if you don’t know how the interest rate hikes or cuts by the central bank affect the equity market valuations, you may end up on the losing side. Therefore, it becomes crucial to understand the fundamental economic events, supply and demand dynamics, social and political developments, and their impact on the market.

The following are smart investment options for new investors:

Stocks: Acknowledged as one the best smart investments, publicly traded companies issue stocks when they raise money from the market to fund their growth. Therefore, when you buy a stock, it means you are purchasing an ownership stake in the company.

The price of stock changes as per the company’s financial performance, supply and demand, industry performance overview, and investor sentiment. Every stock in the market portrays a different picture that you must understand and decide if you should invest in or not.

Bonds: Bonds are debt instruments that governments and corporations issue. Investing in a bond means lending your money to the bond issuer in exchange for a fixed annual interest payment during the bond tenure.

The change in the price of a bond is directly related to the difference in the interest rate the central bank fixes. For example, a 10-year bond issued at a 6% annual yield is trading at Rs 100, and in the following monetary policy review, the central bank cuts the interest rate by 0.50%. This means that credit has become cheaper, and governments and corporations can raise debt at low rates.

Because no new bond will be released at a higher annual yield than 6%, the demand for all existing bonds with higher yields will witness demand and thus result in a price increase. However, the opposite happens when the central bank hikes interest rates. Bonds may not be considered smart investments, but their inclusion gives the necessary risk-reward balance to your portfolio.

Mutual Funds: Marketed as a smart investment, it pools money from investors and invests in a basket of securities per their investment objective. The funds are managed by a qualified fund manager and often try to outperform the benchmark index using their investment strategies. As per the fund category, the fund manager invests in an array of securities, including stocks, bonds, commodities, etc.

Sovereign-backed investment schemes: Smart investment options don’t mean only investment options with high returns. You must also invest in safe investment schemes that provide guaranteed returns to create a balanced portfolio and reduce the impact of market volatility. Some safe investments with high returns in India include Public Provident Fund, National Pension Scheme (NPS), National Saving Certificate (NSC), Kisan Vikas Patra (KVP) 10-year bank fixed deposit schemes, etc.

Although the returns on sovereign-backed investment schemes are lower or ineffective in fighting inflation in the long term, they bring the advantage of tax savings. It helps to improve your overall return rate, as you can keep more funds instead of paying taxes.

Click here to get your personalized a portfolio of 20-25 potential multibagger stocks for 2022.

Critical Components of Smart Investing

Investing only in smart investment options doesn’t make you an intelligent investor. You must be financially disciplined, think about the big picture, and play accordingly to become a savvy investor. The following are the top six ways to become an intelligent investor.

Taking advantage of the power of compounding: Compounding is a potent tool in personal finance that can make or break a person’s finances. Even Albert Einstein called compounding the eighth wonder of the world.

Your investment horizon plays a crucial role and should be used wisely for financial gains. Reinvesting your dividend and interest income helps to supercharge your long-term returns. In addition, as you re-invest using the dividend, the amount of dividend you get also increases, which lets you invest even more and continue the cycle.

Starting early: As discussed above, your investment horizon is key to wealth creation. The longer it is, the better your returns will be. Starting early ensures that your money has enough time to grow, take advantage of multiple market cycles, and compound.

The following table showcases how starting early helps in wealth creation through Public Provident Fund:

| Yearly investment | Rs 24,000 | Rs 24,000 | Rs 36,000 |

| Period (in years) | 35 | 30 | 30 |

| Rate of Interest | 7.1% | 7.1% | 7.1% |

| Invested Amount | Rs 8,40,000 | Rs 7,20,000 | Rs 10,80,000 |

| Total Interest Income | Rs 27,91,657 | Rs 17,52,146 | Rs 26,28,219 |

| Maturity Value | Rs 36,31,657 | Rs 24,72,146 | Rs 37,08,219 |

The person who has started 5 years early earns a higher interest income of Rs 10,39,511 on just Rs 1,20,000 additional sum invested during the period. And, the person who started 5 years later must invest an additional Rs 12,000 annually to match the maturity value of the person who started investing 5 years earlier.

Consistent Investing: Investing at regular intervals (monthly/quarterly) and consistently in smart investment options is paramount to long-term wealth creation. It helps you take advantage of rupee-cost averaging, compounding your returns, and instilling financial discipline in your wealth creation journey.

Building a diverse investment portfolio: As an intelligent investor, you must divide your investments across multiple smart investment options in India to reduce portfolio concentration risk and avert financial loss during volatile market conditions.

Prashant Jain, the eminent fund manager at HDFC AMC, shared one of the investing rules- the “Pareto Principle”. It states that 20% of your effort typically gives 80% results and vice versa. In his career as a fund manager, he said he invested in a total of 465 stocks in the three funds he managed, and only 55 stocks gave him 85% of the gain.

Avoiding herd mentality: Winning in the stock market requires you to overcome the herd mentality, where people behave the same way as others in the group do. The noise in the market drives the fear and greed emotions and affects investors’ decision-making capability.

Every person has a distinct requirement, and the one-size-fits-all concept doesn’t work in investing. Instead, you need to stick to your investment approach and smart investment options and avoid being part of the crowd in the market.

Patience is a virtue: As Buffet says, “the stock market is a device to transfer money from the impatient to the patient”. Successful investing is not rocket science. It requires a fundamental understanding of how the market functions and the ability to wait until the stock can be bought or sold at an attractive valuation. Remember, creating wealth through investing is not an overnight process.

Wrapping up

Smart investing is not complicated or requires any specialized knowledge. It’s simple investing done right with greater awareness and sensibility. Identify your smart investment options, study them, and, based on your financial circumstances and risk tolerance level, curate an investment strategy that helps to meet your short and long-term goals. Remember, any investment option can become a smart investment option, if you can use it to your advantage.

An ideal investment portfolio should consist of different smart investment options (stocks, bonds, saving plans) that are unrelated and do not move in tandem. If you are confused about what percentage of debt securities should be in your portfolio, use the 100 minus your age thumb rule.

The points and features discussed in this article may not be enough, but the smart investment options discussed and thumb rules will help you to kick start your investing journey helping you to build a better financial future.

Read more: About Research and Ranking

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.