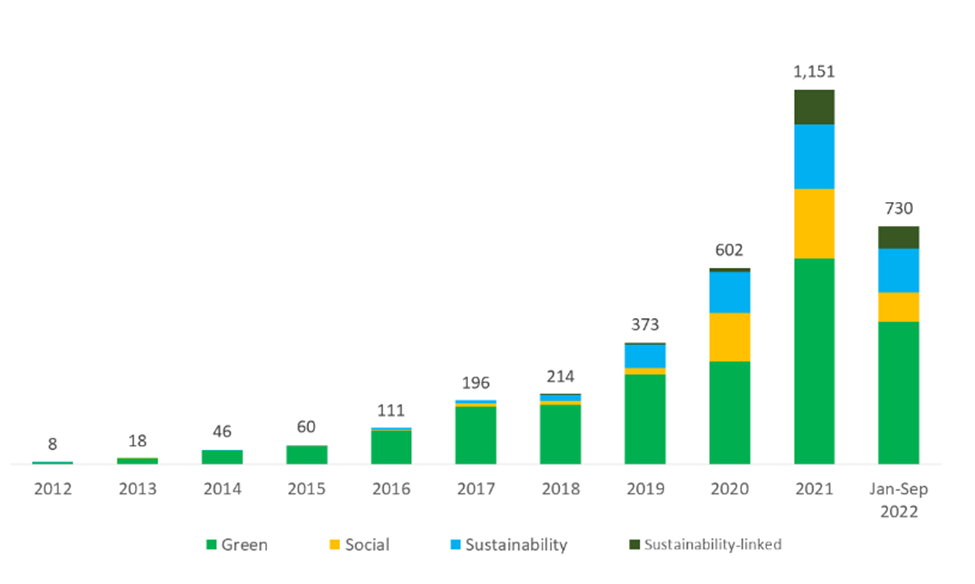

India is striving to reduce its reliance on fossil fuels through various means, one of which is issuing Sovereign Green Bonds. According to World Bank data, issuance of green, social, and sustainability or sustainability-linked bonds surged to USD 3.5 trillion in September 2022, with green bonds representing almost 64% of shares.

18 of the 40 sovereign countries that issued green bonds between December 2016 and September 2022 are low or middle-income countries. Furthermore, to meet the ambitious net zero emissions target by 2070, India must implement climate-friendly policies, which necessitate the pooling of funds.

That is precisely where sovereign green bonds come into play. Recently, the RBI announced the auction of its first green bond, joining at least 25 leading countries that have issued these bonds.

This article will examine the Green Bonds, their hazards, and their benefits.

What are Sovereign Green Bonds?

The government announced the issuance of Sovereign Green Bonds as part of its overall market borrowings in the Union Budget 2022-23. Green bonds will work as a tool to mobilize resources for building green infrastructure, attaining energy efficiency, and meeting sustainable development goals (SDGs). The green bonds issuance of Rs 16000 crore in two tranches this fiscal accounts for just 1.1% of the government’s targeted gross market borrowing of Rs. 14.21 trillion in FY 23. The proceeds from these bonds will be used in public-sector projects to reduce the economy’s carbon intensity.

Green bonds are securities used to finance or refinance projects that contribute positively to the environment or climate and are often referred to as Climate Bonds. These bonds seek to mitigate climate change risks while incentivizing investments through guaranteed interest additions to discourage high-carbon-emitting projects.

Importance of Sovereign Green Bonds

Until the recent launch of the green bond issue in public sector projects, India has financed its climate actions from its domestic resources. Now, the government aims to create a conducive ecosystem to attract foreign investments from countries where green investing is quite popular.

This will not only help in generating additional global resources but also in the transfer of technology from other nations committed to reducing their carbon emissions. The investors will not bear any risk related to the project. Further, there is no cap on foreign investment in these bonds as these are classified as “specified securities” under the fully accessible route.

How Sovereign Green Bonds are Different from Conventional Sovereign Bonds?

The only distinction between conventional and sovereign green bonds is that the proceeds from green bonds will finance environmentally sustainable projects. This specific requirement needs more transparent policy standards and scrutiny in reporting, auditing, and proceeds allocation.

What are the Pros and Cons of Sovereign Green bonds?

Such bonds are an attractive investment option not only for the issuers but also for the investors. With the increasing demand for these bonds, the global market size of green bonds has already surpassed $ 500 billion and is still counting. Let us know more about some of its advantages and limitations.

Advantages of Sovereign Green Bonds

- Green Bonds may offer tax incentives such as tax exemption and tax credits to investors depending on the bond’s jurisdiction and issuer.

- Good investment option for investors who prefer contributing to socially responsible investing rather than better risk and return potentials.

- Safe and secure investment vehicle as guaranteed by fixed interest income.

- Investors with a long investment horizon prefer Green bonds over short-term securities.

- The renewable energy sector has been included in the RBI’s priority lending. As a result, banks must devote a specific portion of their lending to this sector. This will improve credit flow in green bond issues.

Disadvantages of Sovereign Green Bonds

- Lack of liquidity as these are long-term investments for a minimum period of 5 or 10 years. Also, green bonds require an extended period to deliver returns.

- Lack of credit rating and rating guidelines for sovereign green bonds.

- At times, it may be difficult to ensure the end use of these funds, and proceeds may be used for projects that are detrimental to the environment.

- Due to the restriction on proceeds only being used for environmentally sustainable projects, there is a lack of investment diversification.

- Transaction cost due to local currency issuances.

Where will the proceeds of Sovereign Gold Bonds go?

The offer document specifies the details of the project, including its environmental objectives and its potential risks.

Green bonds are typically issued to raise funds for the following categories of projects-

- Energy efficiency projects

- Renewable energy projects

- Pollution prevention and control projects

- Natural resources conservation and land management projects

- Clean transportation projects

- Wastewater and water management projects

- Green building projects

- Climate change adaptation and mitigation

- Biodiversity Conservation

Conclusion

The RBI’s debutante Sovereign Green Bonds, issued in two tranches of Rs. 8000 crores each, are structurally similar to traditional bonds but with a promise to use the proceeds for environmental or climate benefits. Both tranches of green bonds worth Rs. 8000 crores issued by RBI will be 5-year and 10-year bonds with interest rates of 7.10% and 7.29% for SGrBs 2028 and SGrBs 2033, respectively.

But we’ll have to wait and see if investors are interested in the Sovereign Green Bonds. Green bonds offer slightly lower interest rates than conventional bonds, which may demotivate investors seeking high returns; and second, the green bond is a rupee-denominated paper, which may deter foreign investors seeking stable returns. The domestic and global demand for green bonds, which facilitate investment in environmental causes, cannot yet be predicted.

FAQs

Who are generally the buyers of Sovereign Green Bonds?

Green bonds are generally purchased by institutional investors with an Environment, social, and governance (ESG) mandate or an environmental focus. Other buyers may include investment managers, governments, and corporate investors. And retail investors as well, but in small numbers.

Who issues the Sovereign Green Bonds?

These bonds are issued by-

● Corporations

● Government

● Multilateral Organizations

It is critical to label the bonds as green bonds in public documents at the time of issuance. Furthermore, no more than 5% of the revenue can be used for anything other than climate and environmental projects.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4.2 / 5. Vote count: 15

No votes so far! Be the first to rate this post.