Very Low Women Participation in Investment

One of the many old wives’ tales circulating in a traditional household is that men are better investors and women are better savers. We’ve all seen our mothers make small savings creatively to support their kids’ higher education or purchase a new home. Unfortunately, despite having a cushion of savings, women’s investing inhibitions are worsened by a lack of knowledge, male dominance, fear of losing money, or societal pressures.

Over the years, successful female investors have beautifully torn down the prevalent notion that investing is a male bastion. Indian women, investors are breaking stereotypes with increased participation, narrowing the gender-investment gap. As a result, women investors are shifting from better savers to successful investors, with their investment returns beating the broader stock market.

We want to share an interesting fact as International Women’s Day approaches. An ET Money research in 2020 suggests that women investors earned 10% more than their male counterparts on their investing platforms. That sounds like a pleasant surprise, right?

So, we dedicate this article to all women investors striving to overcome their fears and lack the confidence to start investing. We will also share insights on the financial ability that makes women great investors.

So wear your reading glasses and prepare for five reasons women make excellent investors. But, before we get started, let us first understand the obstacles that Indian women investors face when they begin their investing journey.

Three Most Common Barriers Indian Women Investors Face

1. Lack Of Knowledge On How To Do It

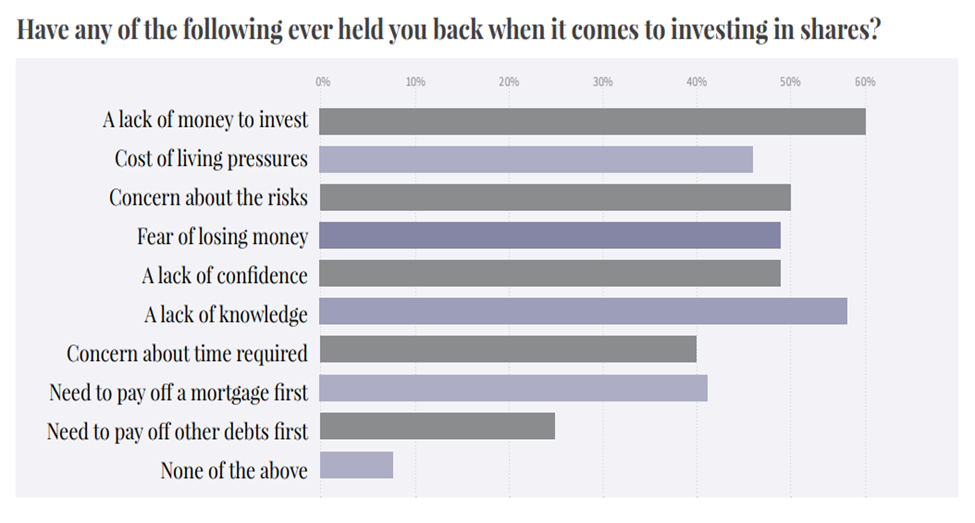

Real-world experience, access to educational resources, particularly those geared towards women, and discussion in peer groups all contribute to investment knowledge. A gender gap survey found that 48% of women consider themselves knowledgeable enough to be investors, compared to 59% of men. It has been identified as the second most common roadblock to Indian women investors getting started.

2. Confidence to Invest in Self Ability

In India, whether working or not, many women still rely on their husbands to make critical financial decisions such as investments. It is amplified by the fear of being judged by society, the fear of failure, inflation, market volatility, and various other inhibitions. When Indian women investors lack confidence due to inadequate guidance, they do not understand investment risk. As a result, they lose their investment in low-interest-bearing instruments that generate returns much lower than the inflation rate.

3. Lack of Capital to Invest

According to the 2019 Women’s Agenda Investing Report, 59% of women refrain from investing due to a lack of funds. Women who fall back financially on their husbands lack the disposable income to invest. For financially independent Indian women investors, the situation is no better. They are constantly surrounded by fears of maintaining liquid or risk-free funds for financial security in case of unfavorable incidents such as job loss, divorce, living cost pressures, debt, etc.

Now, we’ll go over the five factors that make women great investors, which you must understand if you want to be a successful female investor yourself.

1. Long-term Investment Approach

Indian women, investors are not easily swayed by flashy bandwagons and invest their time thoroughly researching investment opportunities. They are generally not swept up by the latest asset class making headlines. Aside from an outcome-based approach, they invest in the long term rather than for the thrill of it.

2. Greater Mental Fortitude

Indian women investors have demonstrated mental fortitude and decision-making tenacity when making investment decisions. Successful investors must be optimistic and confident in their choices. Therefore, women investors are more disciplined and stick to a plan to achieve their financial goals promptly.

3. Deliver better and consistent returns

According to studies, women are less vulnerable to rash decisions and frequent switches during rallies and tumbles than men, who transact 45% more frequently. Indian women investors outperform male investors in terms of returns by 0.4% because they are less active in making frequent transactions and focus on long-term goals. As a result, they are better at timing the market and avoiding additional switching fees.

4. Risk-averse

Successful female investors avoid chasing good tips or whims because they are risk averse. Investors prefer reasonable age-based asset allocation to high-risk and high-yielding investment options, indicating that capital protection with reasonable gains is their top priority. It in no way implies that female investors do not diversify their portfolios.

On the contrary, according to research, women are likelier to choose comparatively safer investment options for better investment outcomes. The returns may be low at first, but they increase over time.

5. Curiosity and enthusiasm

It is generally found that successful female investors trust the process more than the outcome. To put it in simple terms, they always seek knowledge of “how” and “why” rather than blindly following any investment advice. Understanding the nuances allows them to make better informed and controlled financial decisions. In addition, curiosity improves their research and helps them understand the inherent risks.

Key Takeaways

Indian women investors have proven their dexterity in handling both the household chores and the investment arena. However, traditionally male investors are believed to have a psychological, societal, and financial edge over women investors, often becoming overconfident and taking knee-jerk reactions that adversely impact their portfolios.

Successful female investors are disciplined, focused, and have natural multitasking and investing abilities. You will be delighted to learn that female fund managers have increased to 32, accounting for 24.9% of all fixed income assets (excl money market instruments and liquid and overnight funds). Still, the statistics are bleak and drastically low, leaving plenty of room for improvement through financial education, family support, and a little encouragement and support.

We hope you enjoyed reading this blog and that it inspires you to begin your financial empowerment journey soon.

FAQs

What are the three best low-risk investments for women?

If you are an Indian women investor with a low-risk appetite and your focus is capital protection, then you may choose one of the following investment vehicles- 1. Public Provident Fund (PPF), where you can get tax benefits and attractive ROI @ 7.1% 2. National Savings Scheme (NSC) also gives you a tax benefit and offers 7% interest on your investment 3. Balanced or Debt funds schemes in Mutual Funds.

How to become a successful female investor?

To become a successful female investor, you must be patient and avoid impulsive purchases or sales. Second, following the rules of personal finance, take a balanced approach to investing. Third, invest for the long term because the risk of loss increases dramatically in the short term.

What lessons to take from Indian women investors?

First, Indian women investors never hesitate to ask “why” and “how”. Before making any financial decision, they conduct extensive research into the viability of the investment. Second, most women invest with a specific goal in mind. Investing with set objectives allows them to stay focused and outperform the market. Third, women are consistent investors who wait for the right time to enter or exit the market.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 3 / 5. Vote count: 1

No votes so far! Be the first to rate this post.