Tata Capital plans to consolidate its subsidiaries with an eye on its potential listing. Focusing on efficiency, cost reduction, and regulatory compliance, it aims to streamline its operations and strengthen its position in the Indian financial services market.

This move involves merging some subsidiaries, divesting non-core subsidiaries, and reducing the number of subsidiaries to achieve a streamlined business structure.

Let’s understand more about this consolidation.

Streamlining Operations: Tata Capital to consolidate 19 subsidiaries

Tata Capital, the financial services arm of the Tata Group, recently announced plans to consolidate its 19 subsidiaries to simplify its business structure, improve compliance, and meet regulatory requirements.

It is the holding company for six businesses:

- Three financing companies – Tata Capital Housing Finance, Tata Financial Services, and Tata Cleantech Capital, and

- Three investing and advisory companies – Tata Securities, Tata Capital Singapore, and Private Equity.

The central bank recognizes Tata Capital Financial Services as a systemically important non-deposit accepting non-banking financial company. It intends to enhance its ability to serve its customers more effectively and efficiently by streamlining its operations.

Consolidating its subsidiaries aligns with the company’s strategic objective of becoming a more focused and agile financial services provider. It intends to leverage its strong brand and reputation to expand its market presence and offer its customers a broader range of products and services.

Tata Capital Consolidation Plan

What It Involves and How It Will Streamline the Business?

The consolidation plan involves merging some of its subsidiaries, such as the housing finance and affordable housing units, to create more efficient operations. In addition, the company is exploring options to divest non-core subsidiaries, such as Tata Capital Forex and Tata Cleantech, which are unrelated to its core businesses. The aim is to streamline its business structure and focus on core businesses that offer high-growth potential. This consolidation plan will reduce the number of subsidiaries from 19 to a smaller number.

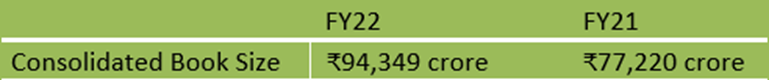

In FY22, the company’s consolidated income was ₹10,253 crore, up from ₹9,988 crores in the previous year, and its profit after tax on a consolidated basis increased by about 46% year-on-year to ₹1,648 crores.

The consolidated return on assets for FY22 was 2%, and the return on equity was 15.6%. These impressive financial results show the company is in a strong position to implement its consolidation plan successfully and capitalize on future growth opportunities.

Through this move, the company expects to enhance its competitiveness while allowing it to respond more quickly to changing market dynamics and customer needs. Industry experts believe the consolidation is a step in the right direction. ICRA, a rating agency, has assigned a positive outlook to the company’s long-term rating, citing its efforts to improve its business structure and reduce costs.

Let’s take a closer look at the benefits of the consolidation plan.

Maximizing Growth: Benefits of Consolidation Plan

- Consolidating subsidiaries will improve efficiency and coordination among businesses under the holding company.

- Reduced duplication of functions and resources will result in significant cost savings.

- The company will position itself for potential future growth by focusing on core businesses.

- The consolidation will ensure better compliance with regulatory requirements and reduce the risk of penalties and other sanctions.

Reserve Bank of India and Tata’s consolidation plan

Tata Capital is consolidating its subsidiaries to meet the Reserve Bank of India’s regulatory framework, which mandates non-banking finance companies to maintain a certain level of net-owned funds. It plans to improve its financial position by streamlining its business structure and meeting the NOF requirements.

Tata Capital’s Consolidation Timeline

The company has already begun the consolidation process aiming to complete it by the end of the financial year 2022-23. However, they haven’t announced a timeline for a potential listing. Analysts expect that this move will prepare the company for a successful IPO in the future.

Impact of Consolidation on Tata Capital Services

Considering the consolidation aims at improving efficiency and focusing on core businesses, there will be no impact on the services the company offers.

Final Words

The consolidation plan is a strategic move expected to benefit the company in the long run. Streamlining its business structure and focusing on core businesses will help the company position itself for future growth and success in the Indian financial services market.

The potential for a future IPO is an added incentive, allowing the company to raise capital and expand its operations further. Overall, the consolidation plan is a positive development that could be worth watching in the next few months.

FAQs

What companies are being considered for consolidation by Tata Capital?

The company is considering the consolidation of Tata Capital Ltd., Tata Capital Financial Services Ltd., Tata Cleantech Capital Ltd., Tata Capital Housing Finance Ltd., Tata Securities Ltd., and Tata Capital Pte Ltd., Singapore, and its subsidiaries.

What extent of consolidation is Tata Capital considering for these companies?

The company plans for a full consolidation, with Tata Capital Ltd. as the holding company and all other companies as its subsidiaries.

Why is Tata Capital consolidating its subsidiaries?

The consolidation is to prepare the company for future growth and a potential listing. With a more streamlined business structure, focus on core businesses, and meet the regulatory framework of the Reserve Bank of India. Doing so will position the company for success in the Indian financial services market.

Will the consolidation have any impact on the customers of Tata Capital?

The consolidation will not impact the consolidated entities’ day-to-day operations, and customer service will continue uninterrupted.

Will Tata Capital’s consolidation plan lead to any job cuts?

The company has not announced any job cuts due to the consolidation plan. The focus is to streamline the business structure and improve efficiency.

How useful was this post?

Click on a star to rate it!

Average rating 4.7 / 5. Vote count: 20

No votes so far! Be the first to rate this post.