Introduction

The Indian economy is expected to become the third largest economy by 2030, and the steel industry will play a pivotal role in this growth journey. With large raw material reserves, a strong base of technically skilled workforce, and one of the fastest-growing markets in the world, India has definite structural advantages for a booming steel industry.

The National Steel Policy 2017 seeks to create a globally competitive steel industry in India with a 300 million tonne steelmaking capacity and 160 kg per capita steel consumption by FY30-31.

Tata Steel is expected to be a huge beneficiary of this policy. The company has aggressive plans to expand its capacity and is taking all the proper measures to achieve them.

Let us understand what the company is doing and what shareholders should expect here.

Tata Steel Overview

Tata Steel is one of the world’s leading steel producers, with operations in 26 countries and a commercial presence in over 50 countries.

Tata Steel’s diversified product portfolio includes flat and long steel products, tubes, bearings, and other steel products for various automotive, construction, engineering, and packaging industries. The company also has a presence in mining and raw materials through its subsidiaries.

Tata Steel has a strong presence in India, with production facilities in Jamshedpur, Jharkhand, and Odisha. It also has operations in Europe, Southeast Asia, and Canada. The company has a total production capacity of 34 million tonnes per annum (MTPA) and employs over 70,000 people worldwide.

In recent years, Tata Steel has undergone a significant restructuring and divestment program to focus on its core businesses and improve profitability. The company has also invested in new technologies and digitalization to enhance its operations and efficiency.

Tata Steel Journey

Tata Steel has a long and illustrious history that spans over a century. Here are some of the critical milestones in the company’s journey:

- 1907: Tata Steel is founded by Jamsetji Tata in India.

- 1911: The company began production at its Jamshedpur plant, then known as Tata Iron and Steel Company (TISCO).

- 1937: TISCO becomes the first Indian company to manufacture stainless steel.

- 1956: The company sets up a research and development center to develop new technologies and products.

- 2004: Tata Steel acquires Singapore-based steelmaker NatSteel, marking the company’s entry into the Southeast Asian market.

- 2007: Tata Steel acquires Anglo-Dutch steelmaker Corus Group in a $12 billion deal, making it one of the world’s largest steel producers.

- 2013: The company launches its first branded retail product, Tata Tiscon, a high-strength steel rebar for the construction industry.

- 2016: Tata Steel sells its long products division to Greybull Capital, marking a significant step in the company’s restructuring and divestment program.

- 2018: Tata Steel completes its acquisition of Bhushan Steel, a major player in the Indian steel industry.

- 2019: Tata Steel and Thyssenkrupp abandon plans to merge their European steel businesses after the European Commission raises antitrust concerns.

- 2020: Tata Steel announces plans to cut 3,000 jobs in Europe as part of its ongoing cost-cutting efforts.

Throughout its journey, Tata Steel has faced numerous challenges and demonstrated resilience and a commitment to innovation and sustainability. The company continues to evolve and adapt to changing market conditions while focusing on delivering high-quality products and services to its customers.

Tata Steel Management Profile

Mr Natarajan Chandrasekaran is the Chairman of Tata Steel Limited and Tata Sons, the holding company of the Tata Group. He has been associated with the Tata Group for over 30 years and has held several leadership positions.

Mr T.V. Narendran has been the CEO and Managing Director of Tata Steel Limited since 2017. He joined the company in 1988 and has held various roles in India and abroad, including in the company’s operations in Thailand, Singapore, and Europe.

Mr Koushik Chatterjee has been the Executive Director and CFO of Tata Steel Limited since 2013. He is responsible for the company’s financial management, including capital allocation and risk management.

Mr Anand Sen is the President of TQM and Steel Business at Tata Steel Limited. He is responsible for the company’s steel business in India and oversees the implementation of total quality management practices.

Mr Rajiv Singh: Chief of Tata Steel’s long products business. He has over 30 years of experience in the steel industry and has held various leadership positions within the Tata Group.

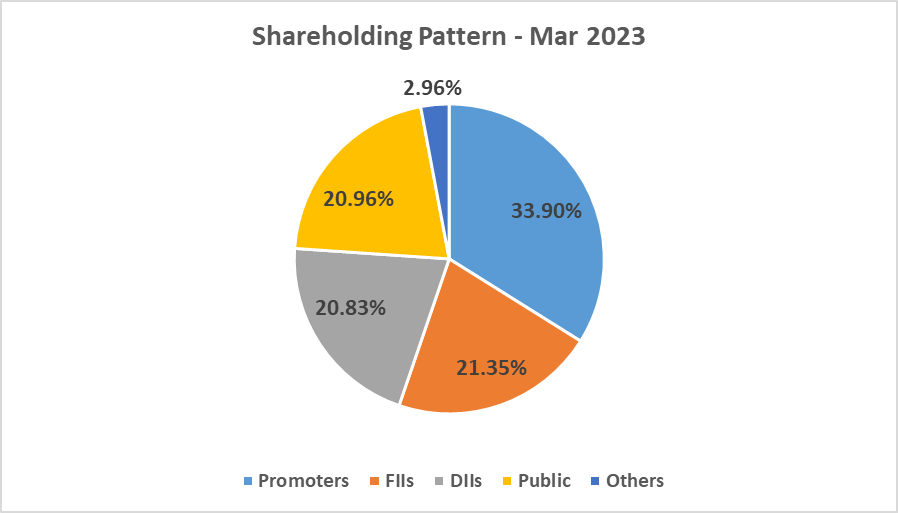

Tata Steel Shareholding Pattern

Steel Industry Overview:

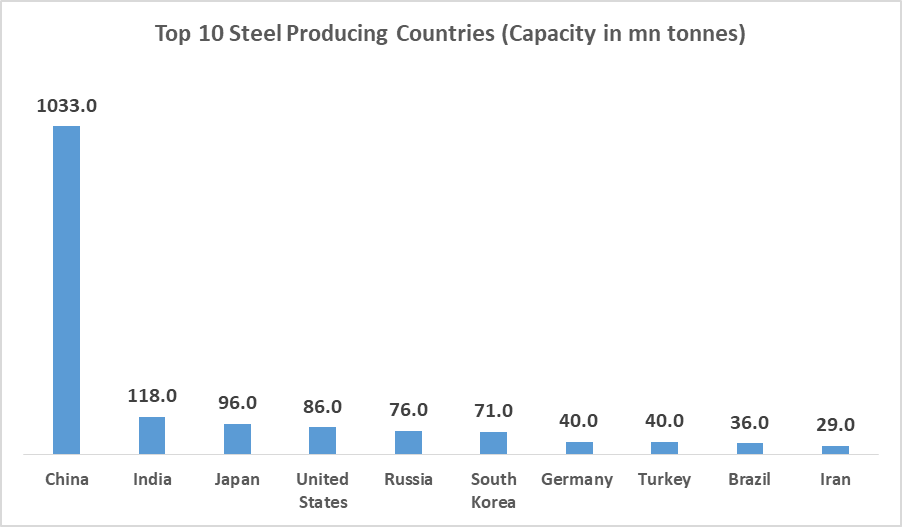

China is the world’s largest producer and consumer of steel, accounting for approximately half of global production and consumption (as shown in the chart below). As such, China plays a significant role in shaping the global steel sector.

China’s rapid industrialization and urbanization over the past few decades have led to a surge in demand for steel, which has driven its production levels higher. However, this has also led to concerns over the excess capacity in the global steel sector, as China’s production levels have far outstripped its domestic demand.

This excess capacity has put downward pressure on global steel prices. In addition, it has led to tensions with other major steel-producing nations, such as the United States and Europe, who have accused China of dumping steel on their markets.

In recent years, the Chinese government has taken steps to address the issue of excess capacity by cutting back on production and investing in environmental upgrades and more advanced technologies. Although challenges remain, these efforts have helped alleviate some of the pressures on the global steel sector.

Here is a list of the world’s top steel-producing countries and their steel production capacity as of March 2022.

Tata Steel Production Capacity

Tata Steel is the 10th largest steel producer in the world, with an annual crude steel production capacity of 34 MTPA. In addition, it is one of the world’s most geographically diversified steel producers. It has steel manufacturing and downstream facilities in India, the UK, the Netherlands, and Thailand, while raw material mines are in India and Canada.

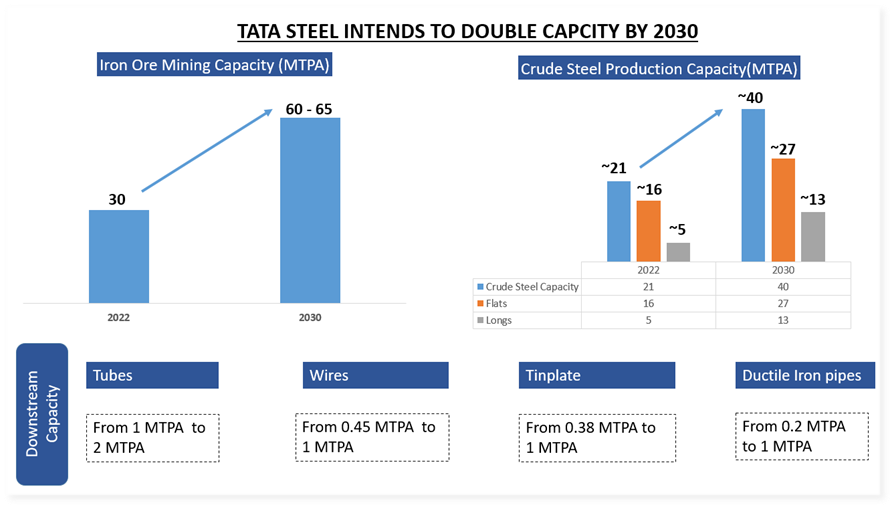

Capacities of various divisions are as follows:

- Tata Steel India – 19.6 MTPA

- Tata Steel long products – 1 MTPA

- Tata Steel Europe – 12.4 MTPA

- Tata Steel South East Asia – 1.4 MTPA

The company’s long subsidiary (Tata Steel Long Products) acquired Neelachal Ispat Nigam Ltd (NINL) on Jan 22, which has an idle 1.1 MTPA steel plant capacity.

India is also expected to be the dominant manufacturing base for Tata Steel. Currently, almost ~60% of the total production capacity is in India.

Tata Steel Company Analysis

The company caters to the following broad industry segments:

- Construction

- Automotive

- General Engineering

- Industrial

- Agriculture

Tata Steel’s primary operating segments have been identified basis the different geographical areas wherein significant entities within the Group operate. These operating segments are as follows:

- India business

- Tata Steel India

- Tata Steel Long Products

- Other Indian Operations

- Europe business

- Tata Steel Europe

- South East Asia business

- South East Asian Operations

- Rest of the World

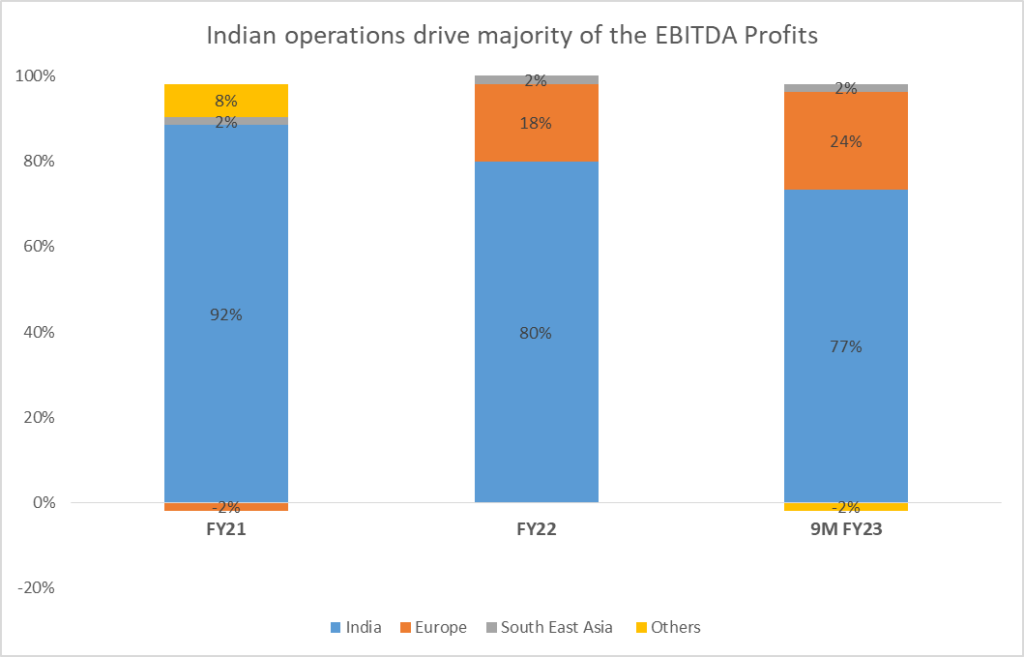

Tata Steel’s India business contributes ~50% of the revenue, followed by Europe and South East Asia.

Tata Steel Unique Advantages

Beneficiary from India Growth Story:

Tata Steel will be doubling its steel production capacity from ~20mtpa to 40mtpa in India (as shown in the chart below). Its Indian operations have shown resilience through steel cycles due to the advantage of captive raw materials compared to non-integrated European operations. As a result, the company targets to increase the share of more profitable Indian steel production from 57% in 2020 to 73% by 2030.

Tata Steel also completed deleveraging, and the company’s net debt declined by 29,390Cr (~$4Bn) in FY21, surpassing the annual deleveraging target of $1Bn. Consequently, its net debt-to-EBITDA ratio in Dec 2022 has dropped to a healthy level of 1.76x from 5.9x in FY20 and 3.2x in FY19. In addition, the deleveraging has enabled the company to continue critical capital expenditure.

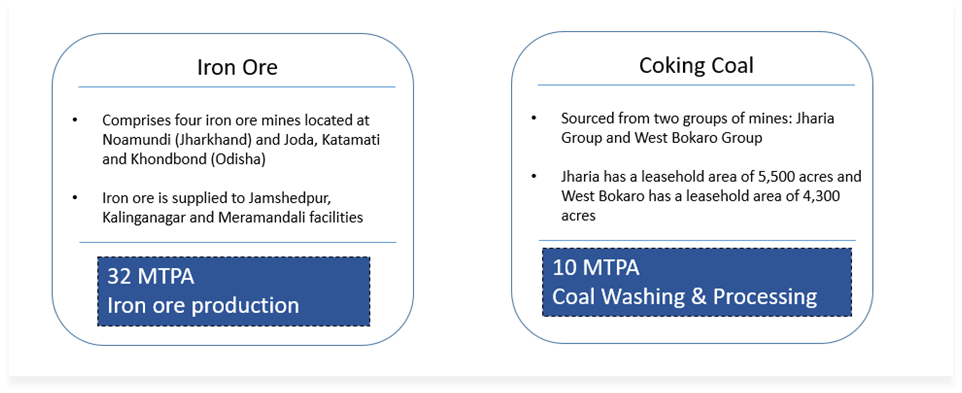

Fully Integrated Operations:

Captive mining can be a positive for steel companies in many ways. Captive mining refers to a company owning and operating its mines to extract raw materials like iron ore, coal, and other minerals used in steelmaking.

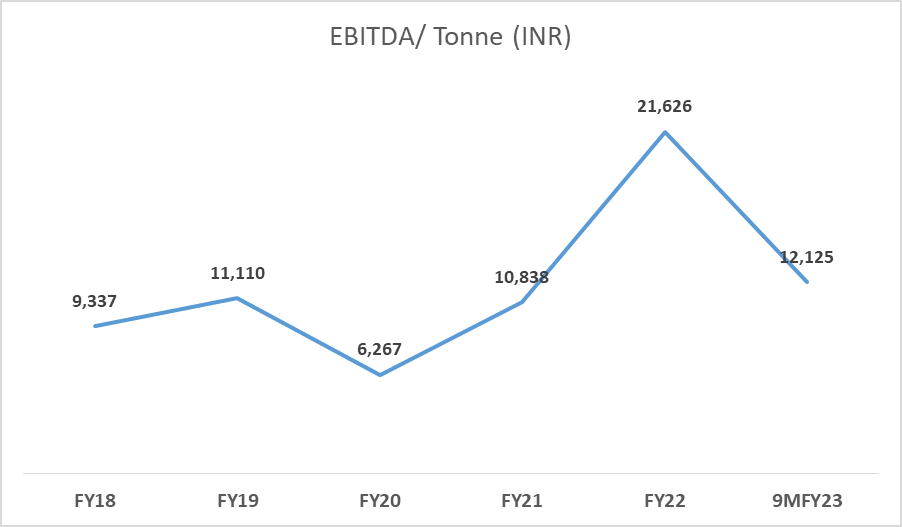

By having their mines, steel companies can ensure a steady and reliable supply of raw materials, which can help to reduce costs and improve efficiency. It can be crucial in markets with uncertain raw material availability or volatile prices. For instance, Tata Steel meets 100% of its iron ore requirements in India through its captive iron ore mines and about a quarter of its coking coal requirements from its coal mines. These captive mines provide a structural hedge to the price risk of these commodities.

Through acquiring Bhushan Steel, Usha Martin, and NINL, Tata Steel has more iron ore mines. The company won Gandhalpada Iron Ore Block (315 mtpa reserves) and has paid a premium of 141.25% to secure its iron ore need beyond FY30. Having integrated operations allows Tata Steel to be one of the lowest-cost producers in the world.

Tata Steel Financial Analysis

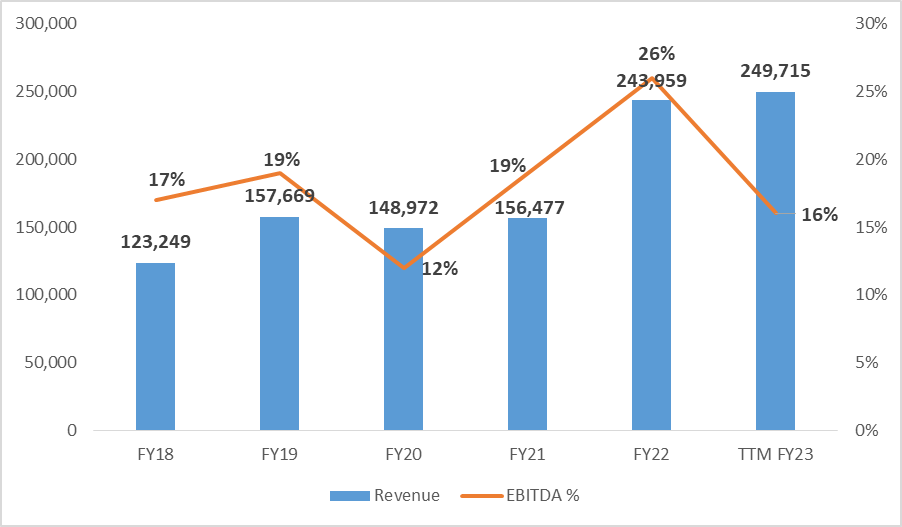

The company has grown its Revenues and PAT at a CAGR of 17% and 77% over the last five years. The financial year 2022 was one of the best years for the company due to the Covid-19 pandemic. Steel prices rose significantly during the COVID-19 pandemic, particularly in the latter half of 2020.

The pandemic caused disruptions in global supply chains, leading to a shortage of steel in the market. So, it posted the best EBITDA margin of 26% during FY22 from a low of -1% in FY16, entirely led by the movement of steel prices due to the global demand-supply situation.

Tata Steel has diversified global operations, with most revenue coming from India, Europe, and South East Asia. Regarding profitability, Indian operations drive the majority of the EBITDA in the consolidated entity. India operations are one of the most profitable in the industry on the back of the value-added mix, pricing power, and lower raw material costs.

The company sources 100% of its iron ore requirements from captive mines, leading to industry-leading EBITDA/tonne. However, Europe operations have led to a negative drag on profitability because of the higher cost structure.

Tata Steel Share price analysis

The company’s stock outperformed many other companies and industries relatively well during the COVID-19 pandemic. It has delivered a 54% CAGR over the last three years. (from April 2020 to April 2023).

Stock’s performance is directly linked to the movement of global crude steel prices. So, you must understand the movement of raw material prices to estimate the company’s future performance and share price.

Tata Steel Share Price Target

Steel being a commodity, the company is a cyclical stock. It means that the company’s financial performance is highly influenced by the overall state of the economy and tends to follow the business cycle.

During economic expansion, steel demand tends to rise as construction activity increases, which can lead to higher profits for the company. Conversely, during an economic contraction, steel demand tends to decrease, which can result in lower earnings for the company.

As a result of this cyclical nature, the stock price of Tata Steel may experience significant fluctuations depending on the overall economic climate. It’s worth noting, however, that Tata Steel may also be influenced by other factors, such as demand-supply mismatch due to some global events or supply chain issues.

Tata Steel Growth Potential

However, some long-term trends will lead to improvement in the company’s performance:

- Increased demand for steel products due to the country’s economic growth by 2030. India is the fastest growing economy in the world, and with China + 1 strategy of various global conglomerates, the economic growth is set to boom in the coming years

- The company has an action plan in place to increase its India operations from 19.6 MTPA to 40 MTPA till FY 2030

Key risks:

- European business continues to drag the overall performance of the company; further losses could exacerbate the company’s problems in the continent

- The critical raw materials for the industry – iron ore and coking coal have been volatile recently. While the company fulfils its iron ore requirements from its captive mines, the coking coal requirement is primarily met through imports which have shown volatility in prices impacting the company’s margins

- The steel industry is inherently cyclical and sensitive to shifting business cycles. Therefore, the slowdown in demand for steel and oversupply from the international markets (especially China) at cheaper rates will adversely affect the Indian steel industry.

Disclaimer Note: The stocks and financials mentioned in this article are for education purposes only. They shouldn’t be considered as a recommendation by Research & Ranking. We will not be liable for any losses that may occur. The securities quoted, if any are for illustration only and are not recommendatory.

FAQs

Is Tata Steel a good buy for the long term?

The stock is cyclical; hence performance of the stock is subject to the business cycles of the steel industry. However, the company has delivered a CAGR of 14% over the last ten years (from April 2013 to April 2023). The company has robust growth plans till 2030, and it is one of the lowest-cost diversified producers of steel globally and is expected to do well going forward.

What is the face value of Tata Steel shares?

The face value of a share is INR 1.

Will Tata Steel give dividends in 2023?

For the year ending March 2022, the company declared an equity dividend of 510.00%, amounting to INR 51 per share. The company has a good dividend track report and has consistently declared dividends for the last five years.

Read more: About Research and Ranking

How Long-term investing helps create life-changing wealth – TOI

How useful was this post?

Click on a star to rate it!

Average rating 3.9 / 5. Vote count: 28

No votes so far! Be the first to rate this post.