Changing global macroeconomic factors such as inflation, economic tightening, interest rate fluctuations, rising commodity prices, and concerns about an impending recession have spawned a rush of new investors looking to generate extra income. However, the bud of retail participation that flourished during the pandemic quickly withered due to the raging volatility that burned holes in the pockets of new investors.

We will review the top 5 Things Not To Do If You Are New Investors. The goal is to help this emerging class of investors who resist investing due to the fear of making losses. And keep reading until the end for some super-useful tips for new investors on fueling your growth engine and boosting your returns.

So, without wasting time further, let’s get the ball rolling…

Mistake 1: Not Having Clear Investment Objectives

As a new investor, the first question you must ask yourself is, “What do I want to achieve with this investment?” To put it another way, define your investment goals and risk tolerance before you start investing. You are almost certain to have a mishap if you drive with your eyes blindfolded. The same formula applies to investing.

New investors are more often enticed by the latest investment fad or short-term gains, but this is not the proper investment strategy to follow. Create your investment portfolio for long-term investment goals only after evaluating your risks and potential gains, with a focus on wealth preservation and safety. Nothing could be more disastrous than putting your short-term savings or emergency funds at risk in the stock market.

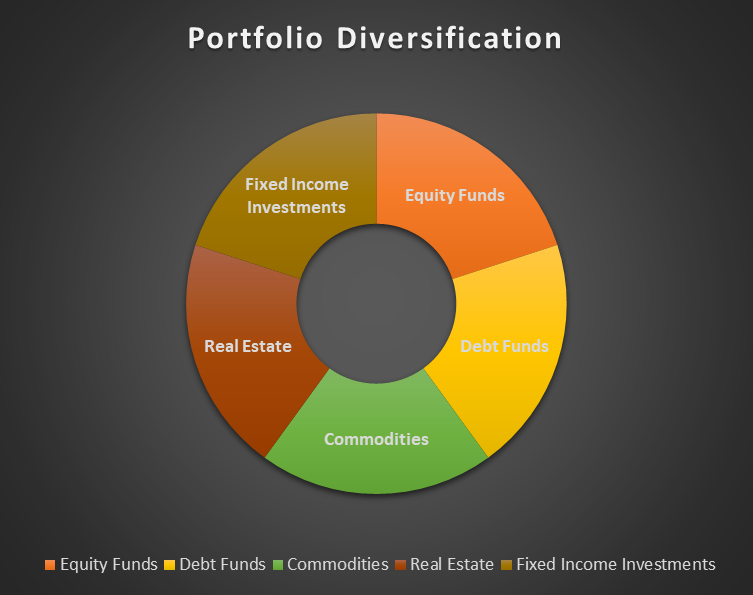

Mistake 2: Failure to adequately diversify one’s portfolio

Portfolio diversification is the process of investing your money across different asset classes to diversify your risks and maximize your returns.

As new investors, you can choose to mitigate your investment risk by diversifying your portfolio across various asset classes, namely-

- Equity investments that include Mutual Funds, Domestic, and Global Stocks, ETFs

- Debt instruments that include Bonds, Debentures, Inflation-linked Bonds, etc

- Commodities and Metals like Bullion (Gold, Silver), Cereals, Agricultural Commodities, Energy, etc.

For the younger segment of new investors with significantly higher risk capacity and appetite, it is recommended that you allocate a greater portion of your assets to equity with a long-term horizon. If your risk tolerance is high but your risk appetite is low, you should focus on debt or fixed-income instruments regardless of your age. Fixed-return investments may sound appealing to new investors, but they frequently fail to outperform inflation.

Mistake 3: Lacking Emotional Control

In the case of new investors, emotions often impede investment decision-making. Many investors buy or sell their investments based on the decisions of another successful investor without understanding the deeper implications.

Experts base their decisions on information gleaned from multiple trustworthy sources, and by the time it becomes public, it has already been factored into market pricing. New investors are often so swayed by a particular stock/mutual fund that they continue to buy the dips, believing that the compounding effect will increase their returns. This strategy may fail if prices fall as a result of a policy or macro change that has an irreversible impact on stock performance.

Mistake 4: Trading Too Much and Too Often

Trading too frequently can hurt your returns because the higher the number of operations, the higher the transactional cost. New investors believe they are keeping track of the market by aligning their portfolio composition and investment strategy with changing trends.

Frequent portfolio reconfiguration not only leads to impulsive transactions but also eats into your returns through additional transaction costs. As a result, new investors must be wary of the temptation to trade too much or too frequently, as this may expose their portfolio to unanticipated risks.

Mistake 5: Avoid Panic Selling When the Market starts to Decline

This is one of the most common mistakes that new investors make. Taking a deliberate approach to risk and reward will ensure that you invest by your risk tolerance. Remember that no investment is risk-free, but you can minimize your risk by investing in fundamentally sound stocks. You may believe the money you keep in your bank account or cash you hoard is risk-free, but it is not.

Your bank could fail, or rising inflation could reduce the value of your cash, so every investment carries some risk. As new investors, you must accept that cyclical price fluctuations are an unavoidable part of the equity investing process. Avoid selling your investments during a downturn, as it can turn your notional losses into actual ones.

5 Tips For New Investors To Boost Their Investment Returns

We have compiled a list of five tips for new investors that, if followed, will not only keep you out of stock market pitfalls but will also help you make informed and disciplined decisions.

- Don’t keep reshuffling your portfolio in search of unreliable media reports or stock recommendations on social media that promise quick profits.

Numerous self-proclaimed market experts will share their insights on the next multi-bagger stock to buy to earn explosive returns in a short period. Remember, for new investors, that investing necessitates patience, discipline, and careful planning.

- It is critical for new investors to stick to the investment plan they devised when first entering the stock market, taking into account long-term market trends. It can be difficult to ignore the global commotion, which includes market movements, interest rates, dividends, oil, and commodity prices, but keep in mind that it is not constant.

- Let’s accept this, investing in individual stocks without market knowledge is intimidating for new investors. If you lack the necessary expertise and confidence, don’t be afraid to consult with a reputable investment advisor.

However, engaging in unworthy services may cost cheap, but it can reduce your returns in the long run, so do your research thoroughly before making a decision.

- Only invest the chunk of funds you have set aside for achieving long-term objectives like your retirement planning or funding your child’s future education, or beating inflation. Simply put, it is any goal for which you have an investment horizon of 7-10 years. Staying committed for longer periods helps new investors ignore market noises and let the compounding work for them.

- The famous saying, “Bulls make money, bears make money, but pigs never do,” clearly conveys the message that to make sustainable profits, you must overcome your greed. Accept that even institutional investors make mistakes in market timing and incur losses. Often, new investors will hungrily wait for profits to grow further rather than take away what the venture offers and end up losing money.

Key Takeaways

Mistakes are an indispensable component of the investing process. Through this article, we hope to provide new investors with the knowledge they need to avoid making mistakes that could result in losses to their returns. The losses are sometimes so severe that they lose motivation to continue investing.

Our goal will be accomplished if we can provide new investors with the knowledge and judgment to determine which roads can lead to financial freedom and which should be bypassed to avoid losses. To sum it all up, as a new investor, you should limit your investments to good large-cap companies that have historically provided consistent returns, hold your opinion, invest for the long term, and be patient if you want to make money in the stock market.

Hope you found this helpful!

FAQs

What things must I know as a new investor?

The three main things all new investors must know before starting their investment journey are-

● Set your Goals clearly

● Assess your Risk Appetite

● Understand the prospects of the investment you are entering into, and learn about the taxes, charges, etc.

Is it important to know about the grouping of shares in BSE as new investors?

Based on what the stock represents, the BSE classifies the shares as “A”, “T”, “S”, “Z”, and “B”. Group A stocks are highly liquid, with high trading volumes, and thus suitable for investment. Group “T” stocks are less risky because intraday trading is not permitted.

Group B is one category lower than Group A in terms of liquidity and a few other parameters, whereas group “S” refers to small businesses with limited liquidity. New investors should avoid group “Z” stocks because they do not meet BSE listing standards.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4.6 / 5. Vote count: 8

No votes so far! Be the first to rate this post.