It is human nature to associate countries with successful businesses that originate from them. When we talk about companies like Google, Apple, and Microsoft, we immediately know that these businesses come from the United States of America. For India, it is undeniably the Tata Group of companies.

Tata Group is home to more than 30 businesses, of which 29 are listed. These companies span ten business verticals, with each establishment having secured a strong foothold in their respective industries. Over the years, businesses have consistently performed and delivered healthy returns for their stakeholders. Therefore, it is fair to say that some Tata stocks are the most valuable ones on the market today.

One such Tata company that has had a fantastic journey is Titan. With the titan share price rising skyrocketing, the company has delivered 25,914.8% during its lifetime.

The Birth of Titan -History

Titan Company LTD Journey began as a joint venture between the Tamil Nadu state government and the Tata group in 1984. It was initially called Titan Watches Limited, which was later renamed Titan Industries in 1993.

Several Tata companies and their associates, such as Questar Investments, Tata Sons, and Tata Press, collaborated with Tamil Nadu Industrial Development Corporation (TIDCO) to promote Titan in the initial phase. The primary objective of launching the brand was to revolutionize the Indian watch market. As a result, Titan was one of the first Indian companies to introduce analog electronic watches in over 150 designs to Indian consumers.

Over the company’s four-decade history, Titan has evolved into a premier lifestyle brand and is the world’s largest integrated watch manufacturer. Pioneering customer-centric innovation, the company’s portfolio of products includes key segments like jewelry, watches, fragrances, eyewear, and Indian dress wear.

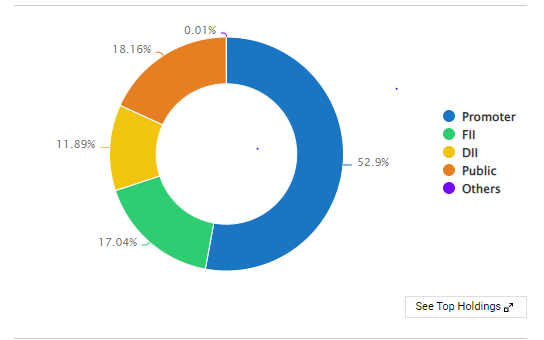

Shareholding Pattern

As of September 2022, the majority owner of Titan company is the Tata group, while FIIs, DIIs, the Public, and Others hold the rest. Led by MD C K Venkataraman, Titan is one of India’s most respected and admired companies. This is because it has always been at the forefront of leveraging cutting-edge technology to delight its discerning customers.

Titan Financial Company Analysis

Imbibing the Tata ethos and values, Titan has always remained a customer-centric brand, ensuring they always make the right choice for their people, partners, customers, and communities by creating long-term value. The Titan share price is not the only aspect of the company that demarcates it from its competitors in the market.

Since 1984, Titan has experienced phenomenal overall growth. From a one-product company, it is a business enterprise home to 16 brands and over 2000 retail stores. In addition, the company supports more than 7000 employees committed to delivering profitable and responsible growth for its shareholders.

In the last ten years, the company has recorded a staggering 40% growth with a sales CAGR of 13%. Titan’s current market capitalization stands at Rs 2.3 trillion in the financial year 2021-22.

The company hit record revenues of Rs 274.56 billion in the fiscal year 2021-22, an uptick of 32% on a year-on-year (YoY) basis. The EBITDA experienced a massive 87% increase from Rs 18.82 billion to Rs 35.25 billion last year.

Despite the slight fluctuations in the Titan share price, the company’s operating profit increased by 90.5% YoY during the fiscal. Operating profit margins decreased to 11.4% in the financial year 2021-22 as against 8.0% in the fiscal year 2020-21.

Net profit for the year grew by 124.5% YoY, whereas net profit margins increased from 4.5% in the fiscal year 2020-21 to 7.6% in the financial year 2021-22.

Look at Titan’s Revenue for 2021-22.

| March 2021 (Rs. In Million) | March 2022 | % Change | |

| Net Sales | 207,830 | 274,560 | 32% |

| Other income | 1,870 | 2,380 | 27.3% |

| Total Revenues | 209,700 | 276,940 | 32% |

| Gross profit | 17,230 | 32,830 | 90.5% |

| Depreciation | 3,750 | 3,990 | 6.4% |

| Interest | 2,030 | 2,180 | 7.4% |

| Profit before tax | 13,320 | 29,040 | 118.0% |

| Tax | 3,530 | 7,060 | 100.0% |

| Profit after tax | 9,790 | 21,980 | 124.5% |

| Gross profit margin | 8.0% | 11.4% | |

| Effective tax rate | 26.5% | 24.3% | |

| Net profit margin | 4.5% | 7.6 % |

The benefits of a steady increase in the Titan share price also reflect positively on the company’s balance sheet. Titan’s current liabilities stand at Rs 105 billion. The debt-to-equity ratio is 0.6x. Long-term debt decreased to Rs 20 million compared to Rs 90 million during the fiscal year 2020-21, a drop of 77.8%. Current assets rose 32% and stood at Rs 175 billion, while fixed assets rose 13% and stood at Rs 36 billion in the financial year 2021-22.

Here’s a snapshot of Titan’s balance sheet as of March 2022.

| Statement | March 2021 (Rs. Mn) | March 2022 | % Change |

| Net worth | 74,930 | 92,970 | 24.1% |

| Current Liabilities | 77,140 | 105,120 | 36.3% |

| Long-term Debt | 90 | 20 | -77.8% |

| Gross profit | 163,470 | 210,070 | 28.5% |

| Current assets | 131,970 | 174,540 | 32.3% |

| Fixed Assets | 31,500 | 35,530 | 12.8% |

| Total Assets | 163,470 | 210,070 | 28.5% |

The Titan share price also impacted the company’s net cash flows, which now stand at Rs 380 million in the financial year 2021-22.

Titan Share Price History

What started out as the ‘watch projects’ for the Tatas have now transformed the lifestyle industry in India. Today, the company is no longer limited to just watch manufacturers. The diversification of the product portfolio has been one of the primary reasons for the rise in the Titan share price.

When Rakesh Jhunjhunwala bought 80 m Titan shares between 2002-2003, they were priced at Rs 3 per unit. Today, they are trading in the vicinity of Rs 2600 apiece.

This pins Rakesh Jhunjhnwala’s holding value of 5.1% in Titan at a staggering Rs 118.5 billion.

Let’s look at Titan’s share price history since it became a listed company in 2002.

Over the last year, the Titan share price has increased from Rs 1,763.3 to Rs 2,013.4, registering a gain of Rs 250.1 or around 14.2%. The stock price has recorded a CAGR of 24% over the last 10 years.

There has been one instance where the Titan share price has undergone a stock split since it became a listed company. In June 2011, the company announced a 10:1 stock split and a 1:1 bonus. Even though the stock split did not really impact the existing investors in the company, the input cost for those who had purchased Titan shares in August of 2002 decreased by 10% of the actual price.

During the stock split, where the Titan share price became 1/10th of what they were trading in June 2011, the Tata Group also announced a 1:1 bonus share for its shareholders. As a result, existing Titan shareholders who had purchased the Titan shares in 2002 saw their bonus shares decrease by 50%.

This meant that the stock split had decreased the input cost to 10% of the actual cost, and the bonus share issuance saw another drop in their cost prices to 5% of their basic buying level. Therefore, those who bought the stock when the Titan share price was Rs 3 apiece saw the actual cost of one share come down to Rs 0.15 per share due to the 10:1 stock split and the 1:1 bonus share announcement.

Despite the stock split, which was long-term investors of Titan from the time that the Titan share price was Rs 3 per share saw their investment grow by 16,900 times in the last 20 years.

To put things into perspective, anyone who may have invested Rs 1 lakh when Titan shares were priced at Rs 3 apiece would see their investment grow to Rs 169 crores in these 20 years. So the Titan share price growth has been 845% over the last two decades.

Given the history of the Titan share price, the stock is one of the most successful in the Indian stock market in the last few decades. Titan has delivered 279.9% returns in the previous ten years.

The company’s earnings per share (EPS) stands at Rs 24.5, an improvement from the EPS of Rs 11.0 recorded last year. The company’s EPS has grown from Rs 4.9 to Rs 10.9 between 2011 and 2021, with an average 17% increase YoY. Moreover, long-term investors in Titan have not only gained from the rise in the Titan share price but have earned hefty dividend payouts. Bonus shares and buyback of shares.

Titan’s Future Plans

The Titan share price has witnessed this growth trajectory over many years as the company progressively moved towards strategic brand transformation. The legacy lifestyle brand is on its way to becoming a more evolved, edgy, and young organization focused on pioneering customer-centric innovation by leveraging cutting-edge technology to satisfy its target audience.

Not all of Titan’s divisions have delivered a profit for the company. However, its unprofitable Titan Eye vertical recorded its best-to-date performance in 2020-21. As a result, the company restructured the verticals by shutting around 15 unviable stores and is looking to shift focus from frames to lenses.

The company has been working on ambitious expansion plans, exploring its options to introduce new verticals, with Titan’s wearable divisions leading the way.

Titan has recently acquired a Hyderabad-based technology and wearables firm known as HUG Innovations, which is expected to pivot the company towards embracing innovative technology. In addition, Titan is keen to invest in collaborating and creating capabilities to drive growth in this segment. Going forward, this is sure to have some impact on the Titan share price.

Titan currently holds the number two position in the smart wristband segment and is eager to skyrocket sales in the foreseeable future. Titan is driving this by announcing the opening of 27 stores in the financial year 2022-23, with a pipeline of another dozen odd stores scheduled to open by the end of this fiscal year.

Over the last nine months, the company has been in hyper-expansion mode by opening 125 stores under its wearables division. The aim is to increase the network count from 707 to 1000 by the end of the financial year 2022-23.

International expansion is also on the radar for Titan by taking its jewelry vertical global. The watches-to-jewelry maker has a blueprint of launching around 20 international stores in key international markets like the United States, Canada, and Gulf Cooperation Council (GCC) countries in the next three years.

Analysts predict that the Titan share price may increase by a few good notches if this effort becomes successful. Having said that, Titan plans to make some inroads into domestic markets, including smaller cities and towns across all three key divisions.

Titan is also exploring its options of penetrating underperforming segments like deodorants, fragrances, and Skinn and Fastrack perfumes into emerging markets. Taneira, its premium Indian dresswear brand, is the latest addition to its portfolio of lifestyle products expected to be a core revenue driver for Titan in the next 18 to 24 months.

Conclusion

Titan expects to hit a 40% growth in its top line and 50% in EBITDA by 2023, which could help the company grow.

Disclaimer Note: The numbers mentioned in this article are for information purposes only. He/she should not consider this a buy/sell/hold from Research & Ranking. The company shall not be liable for any losses that occur. The details shared above are based on the quarterly and annual reports of Titan’s share price and are meant for information purposes only. However, we suggest doing your due diligence before you make investment decisions. Please do not consider it a buy, sell, or hold call from Research & Ranking.

Who owns Titan?

The Tamilnadu Industrial Development Corporation Limited and Tata Group own 52.9%, while the rest are held by FII, DII, Public, and others.

Name the Peers for the Titan Company?

Rajesh Exports, Kalyan Jeweler, Vaibhav Global, and PC Jeweler are well-known Peers of Titan.

What was Titan’s EPS in March 2022?

Titan’s EPS in March 2022 was 24.49.

Read more: About Research and Ranking

Now Read: Multibagger Stocks for 2023

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 20

No votes so far! Be the first to rate this post.