Overview of Auto Stocks

Since 2020, automakers worldwide have sacrificed sales volumes due to chip shortages. So acute was the shortage that car manufacturers had to cut back on production and were restricted to producing fewer variants of car models. For instance, Jaguar Land Rover, in response to the challenge, focused on high-margin products to reduce the financial impact.

Due to the chip shortage, global auto companies lost $210 bn in revenue, losing 7.7 mn vehicles in production in 2021. And 2022 was the same as companies struggled to match demand. According to the Federation of Automobile Dealers Association (FADA), best-selling car models came with an average waiting period of 6-12 months.

So, after two years of facing severe headwinds in the form of chip shortages, inflation, a fractured global supply chain, and rapidly changing customer preferences, are auto stocks looking good in 2023? Should you invest in them? Let’s find out.

How Auto Stocks Performed in 2022

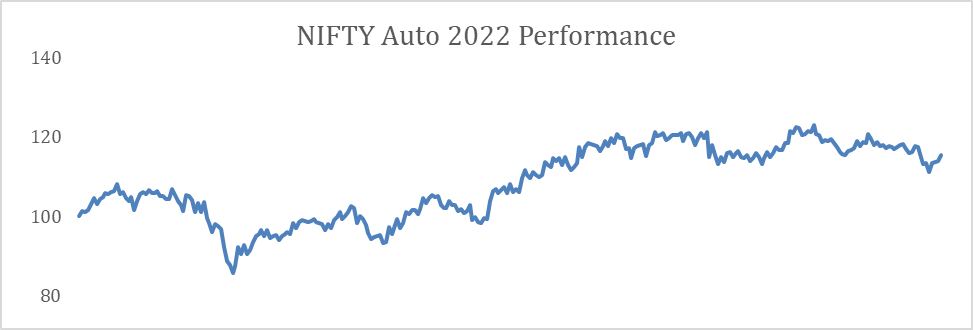

Compared to other sectors of the economy, auto manufacturers recorded decent business performance with improving sales in 2021. So, the Nifty Auto Index rewarded investors for the third consecutive year, rising 15.3% in 2022, outperforming the broader Nifty 50 index.

9 out of 10 stocks in the Nifty Auto index settled 2022 in green, with Mahindra & Mahindra and Tube Investments leading the chart.

A disrupted global supply chain resulting in runaway inflation and higher crude prices was a concern in the first half of 2022. A sharp correction in crude and metal prices supported the auto stocks.

Why are Auto Stocks in Focus of Investors Worldwide?

The global automobile sector is rapidly transitioning from the internal-combustion engine (ICE) to battery-electric vehicles. And the transition has opened up new investment opportunities in the sector. A bit of background about the quick transition to electric mobility worldwide.

On 4th November 2016, The Paris Climate Agreement came into force. 194 countries, including India, signed it. The PCA is a legally binding international treaty to strengthen global response towards climate change and keep global temperature rise below 2 degrees Celsius above pre-industrial levels. The countries also agreed to make efforts to limit the temperature increase to 1.5 degrees Celsius.

And the key to meeting the commitments in the Paris Climate Agreement is cutting down on fossil fuel consumption and reducing greenhouse gas emissions. According to iea.org, the transport sector has the highest reliance on fossil fuels, accounting for 37% of the CO2 emissions in 2021.

Therefore, governments are making efforts through policy schemes to make a quick transition to e-mobility and increase the share of renewable energy sources to reduce the impact of climate change globally.

ICE to Electric Transmission in India

The transition from ICE to Electric transmission in India was slow during the initial years but picked pace in the last year. Between 2008-2021 total EV registrations stood at 7.3 lakh units (2W, 3W, 4W combined), whereas, in 2022, total EV registrations reached close to 6 lakh units.

Concerns like range anxiety, lack of road charging infrastructure, and higher price compared to ICE vehicles are now a thing of the past. With improved battery technology and charging infrastructure, EVs are now finding greater acceptance in society.

The central government’s FAME and the state government’s multiple EV programs make owning EVs affordable, resulting in greater EV penetration. The 3W category is witnessing the fastest transition, followed by 2W and 4W. In the 4W EV category, Tata Motors is the leader, with over 80% market share in 2022.

Road Ahead for Auto Stocks in India

Auto stocks are going through a transition phase, and stocks focusing more on EV play are benefitting. With improving chip supply, auto companies can focus on increasing production and sales revenue.

In Q3 FY23, Tata Motors reported a 15% rise in wholesale volumes in Jaguar Land Rover on improved chip supply, indicating the worst days for the auto industry are behind. With the EV transition, there exists a massive chance of wealth creation by investing in the EV theme and selecting the right stock.

However, the rising interest rate is negative for the sector as it translates into a higher price for vehicles, thus impacting demand.

Auto Stocks to be in Focus in 2023

In the emergence of the EV revolution, auto ancillary, battery technology, and manufacturers, auto OEM stocks will be in focus in 2023. The following are some of the auto stocks that will be in focus in 2023:

Tata Motors: Tata Motors is one of the multibaggers’ of recent time in the auto industry, rising from ₹64 on 30th March 2020 to a peak of ₹536 on 15th Nov 2021. The stock has underperformed in the last few quarters but remains in investors’ focus due to its strong EV play. And the turnaround in the Jaguar Land Rover (JLR) segment could help Tata Motors’ share price move north.

Ashok Leyland: Ashok Leyland is one of India’s largest commercial vehicle manufacturers and has also doubled its play in the EV segment. The company plans to make its EV arm- Switch Mobility, a global EV company and is positioning itself at the forefront of the commercial EV market.

TVS Motor: Among all the 2W listed companies, TVS Motor is one of the top-selling EV manufacturers in India. In December 2022, the company sold 11,071 units of electric two-wheelers, and the stock price has grown over 70% in the last year.

Tube Investments (TII): In the auto ancillary segment, TII is one of the best-performing stocks, with a 58.17% return in the last year and a 78.25% CAGR return in the previous three years. The company is a tier-I supplier to auto majors in India and has also invested in the clean mobility segment. In November 2022, it acquired a 50% stake in green energy startup X2 Fuels, the company engaged in converting waste to fuel.

Amara Raja Batteries: Under its flagship brand, Amaron, the company has made many strategic investments in shoring up its EV battery manufacturing capacity. Although the stock has underperformed, it continues to stay in focus as demand for EVs grows.

You may want to check other auto stocks: Mahindra & Mahindra, Bajaj Auto, Samvardhana Motherson International Ltd., Sona Comstar, Exide, Hero Moto Corp, Bharat Electronics, Tata Power, etc.

Conclusion

With strong play in the EV theme, increasing automobile exports, better visibility of chip supply, and softer metal prices will benefit the auto stocks in 2023. However, you must be careful with your investments as global uncertainty remains high amid war and fears of an impending recession in the US and Europe that can impact auto stocks.

Disclaimer Note: The stocks and financials mentioned in this article are for education purposes only. They shouldn’t be considered as a recommendation by Research & Ranking. We will not be liable for any losses that may occur. The securities quoted, if any are for illustration only and are not recommendatory.

FAQs

Are auto stocks cyclical?

Yes, auto stocks are cyclical, as households and businesses can defer purchases if they are short of cash.

Which auto stocks gained the most in 2022?

Mahindra & Mahindra, Tube Investments, are some of the best-performing auto stocks of 2022.

Which auto company is the leader in the 4W EV segment?

Tata Motors is the leader in the 4W EV segment in India, with over 80% market share.

How useful was this post?

Click on a star to rate it!

Average rating 3.7 / 5. Vote count: 11

No votes so far! Be the first to rate this post.