Guess what? 2022 was very unusual for the Indian stock market. For the first time, public-sector banking stocks ruled the space and took a massive lead over private bank stocks regarding price growth and returns to their investors.

The Nifty Bank index, which has 85% of its constituents as private banks, delivered a price return of 21.2% in the last year. At the same time, the Nifty PSU Bank index grew 70.7% during the same period.

This blog will look at the top banking stocks that delivered spectacular returns in 2022 in both the private and public sectors and understand whether these stocks will perform in 2023.

4 Top Private Banking Stocks in 2022

- Federal Bank

- IndusInd Bank

- Axis Bank

- ICICI Bank

Before we look at the banking stocks in-depth, let us see what a few oft-used jargons mean.

Jargon to understand

Capital Adequacy Ratio or CAR refers to the bank’s available capital to the risk-weighted credit exposure

*NPA refers to non-performing assets, meaning the percentage of loan book that has gone bad or unrecoverable

*CASA refers to the percentage of total deposits kept in the current and savings accounts.

Federal Bank

Federal Bank became the unusual hero in the Indian private-sector banking stocks in 2022. The Kochi-based bank was incorporated in 1931 as Travancore Federal Bank. It operates through its network of over 1,450 branches spread across 29 states and union territories. In addition, Federal Bank has a presence in Middle Eastern countries through representative offices.

The bank is one of the most financially stable banks among Indian banks and has successfully weathered multiple economic and business cycles, emerging stronger every time. In Q2FY23, the bank posted its highest-ever net profit of ₹740 crores, up by 51.95% YoY. Other key financial metrics as of 30th September 2022:

- Capital Adequacy Ratio (CAR): 13.84%

- NPA: 0.78% (down by 34 bps YoY)

- CASA: 36.41%

Federal Bank is one of the top-performing private banking stocks in the Indian stock market, and its stock price rose by 67.53% in the last year. The 52-week high and low prices are ₹142 and ₹80.6, respectively.

IndusInd Bank

The Hinduja Group flagship bank, IndusInd Bank, was established by Srichand P Hinduja in 1994, and Indus Valley Civilization inspired its name. It is the fifth largest private sector bank, with over three crore customers served through over 6,000 distribution points and branches across the country.

In Q2FY23, the bank posted a net profit of ₹1,805 crores, up by 57.50% YoY, and a net interest margin (NIM) of 4.24%. Other key financial metrics as of 30th September 2022:

- Capital Adequacy Ratio (CAR): 18.01%

- NPA: 0.61% (down by 19 bps YoY)

- CASA: 42%

IndusInd Bank’s share price rose by 37.38% in the last year, making a 52-week high and low of ₹1,276 and ₹763, respectively. In 2022, the bank announced a final dividend of ₹8.5.

Axis Bank

Axis Bank is the third-largest private bank in the country and formerly known as UTI Bank, which began its operations in 1994. The bank operates through a network of 4760 branches spread across the country.

In Q2FY23, Axis Bank posted a net profit of ₹5,625 crores, up by 66.32% YoY, and net interest margin (NIM) came in at 3.96%. Other key financial metrics as of 30th September 2022:

- Capital Adequacy Ratio (CAR): 17.72%

- NPA: 0.51% (down by 57 bps YoY)

- CASA: 46%

Axis Bank’s share price rose by close to 37.61% in 2022, with 52-week high and low prices are ₹959 and ₹618 respectively.,.

ICICI Bank

ICICI Bank is India’s second-largest private sector lender and was founded in Vadodara in 1994. however, before it was known as ICICI and was formed in 1955 at the initiative of the World Bank, the Government of India, and representatives of Indian Industry to provide medium and long-term financing to Indian companies.

In the July-September quarter of FY23, the bank reported a 27.54% growth in net profit to ₹8054 crores, and the net interest margin came in at 4.31% compared to 4% in Q2FY22. Other key financial metrics as of 30th September 2022:

- Capital Adequacy Ratio (CAR): 18.27%

- NPA: 0.70% (down by 61 bps YoY)

- CASA: 45%

ICICI Bank’s share price rose 20.36% in 2022, and the 52-week high and low prices are ₹958 and ₹642. In addition, the bank paid ₹ five as a final dividend to shareholders in 2022.

4 Top Public Sector Banking Stocks in 2022

- Bank of Baroda

- Indian Bank

- Union Bank

- Bank of India

Bank of Baroda

Among all the banking stocks, Bank of Baroda is the top-performing banking stock in 2022, with a 126.60% increase in price in the last year. The 52-week high and low levels are ₹197.20 and ₹81.60.

The spectacular rise in share price is due to strong operational performance, healthy credit growth, and improved asset quality. In Q2FY23, the bank posted a net profit of ₹3,272 crores, up by 49.07% YoY, and the net interest margin came in at 42.77%. Other key financial metrics as of 30th September 2022:

- Capital Adequacy Ratio (CAR): 15.25%

- NPA: 1.16% (down by 167 bps YoY)

- CASA: 42.77%

Analysts expect a re-rating of the stock due to improved asset quality, a fall in the cost of funds, and healthy credit growth driving better earnings for the bank.

Indian Bank

Indian Bank, which recently absorbed Allahabad Bank in April 2020, is a medium-sized bank started in 1907. The bank operates through 5,728 branches spread across the country, with a more significant presence in central, southern, and eastern states.

The bank has showcased significant improvement in operational performance in 2022. In Q2FY23, the bank posted net profits of ₹1,244 crores, up by 13.50% YoY, and NPA fell by more than 170 bps YoY to 1.5%. Other key financial metrics as of 30th September 2022:

- Capital Adequacy Ratio (CAR): 16.15%

- NIM: 3.20% (up by 31 bps YoY)

- CASA: 40.94%

Indian Bank has given a stellar return to its investors in the last year, and its share price rose by 104.41%. The 52-week high and low prices are ₹306 and ₹130.90, respectively. In June 2022, the bank declared a final dividend of ₹6.50.

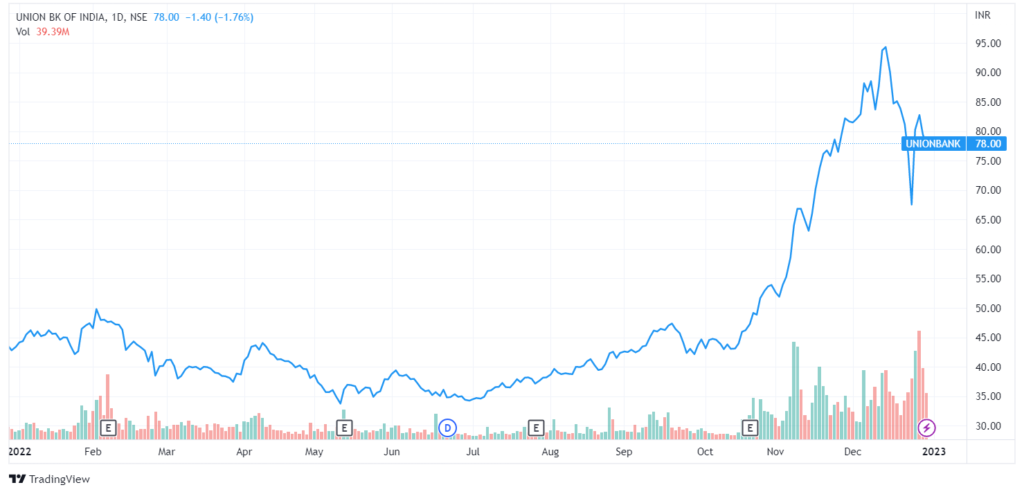

Union Bank of India

Incorporated in 1919, Union Bank is a Mumbai headquartered bank that operates through a network of 8,700+ branches and serves close to 16 crores of customers. In April 2020, Andhra Bank and Corporation Bank merged into Union Bank, helping it to expand its reach to every state of India.

In Q2FY23, Union Bank posted 22.76% YoY growth in net profit to ₹1,839 crores, and net interest margin rose by 20 bps YoY from 2.95% to 3.15. The bank has significantly improved its operational performance in the last few quarters. Some other key financial metrics are:

- Capital Adequacy Ratio (CAR): 14.50%

- NPA: 2.64% (down by 197 bps YoY)

- CASA: 35.63%

In 2022, Union Bank’s share price rose by 85.25%, and the 52-week high and low prices were ₹96.4 and ₹33.5. An asset quality improvement track and healthy loan growth help the share price grow.

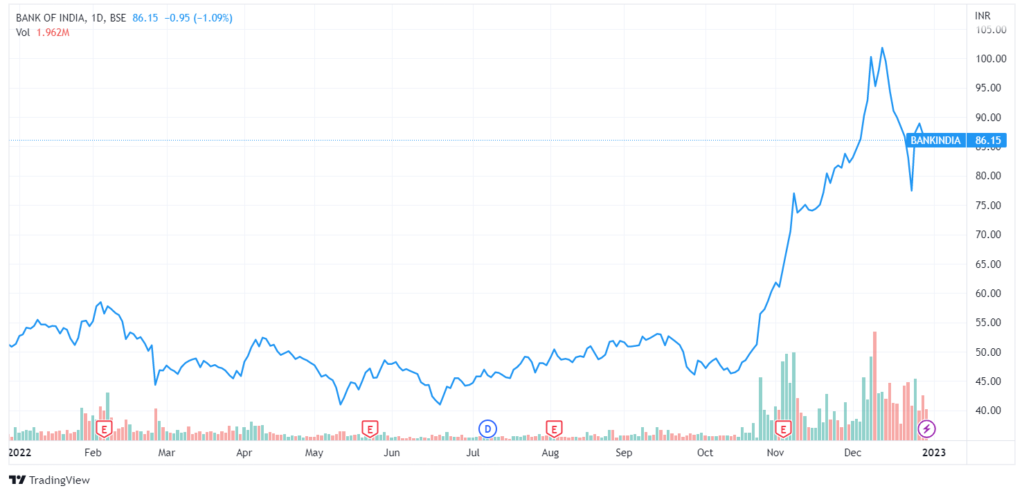

Bank of India

Bank of India was founded in 1906 by a group of eminent businessmen and was under private ownership till 1969, when the Government of India nationalized it. Over the years, it has spread its wings across the nation and has more than 5,100 branches and a presence in 18 foreign countries.

In Q2FY23, the bank recorded a 29.85% YoY decline in net profit to ₹752 crores due to higher provisions. The net interest margin for the bank came in at 3.04, up by 62 bps YoY. Other key financial metrics are:

- Capital Adequacy Ratio (CAR): 15.51%

- NPA: 1.92% (down by 87 bps YoY)

- CASA: 44.12%

In 2022, the Bank of India’s share price rose by 71.69%, and the 52-week high and low prices were ₹103.50 and ₹40.40, respectively.

Conclusion

The rise in the price of banking stocks in India can be attributed to many factors, such as reduced slippages, cleaning of books leading to robust balance sheets, healthy rise in credit growth, rising interest rates environment, etc.

Analysts expect banking stocks to gain from India’s healthy credit and steady economic growth rates. However, in a volatile market, one should be careful while investing in stocks and do due diligence.

Disclaimer: The numbers mentioned in this article are for information purposes only. He/she should not consider this a buy/sell/hold recommendation from Research & Ranking. The company shall not be liable for any losses that occur.

FAQs

What are the top banking stocks in 2022?

Public sector banking stocks outperform private bank stocks. For example, the Bank of Baroda share price rose by 125% in 2022, followed by Indian Bank, whose share price rose by 90%.

Which is the largest bank in India by market capitalization?

HDFC Bank is the largest bank in India by market capitalization and has a total market cap of ₹9.15 lakh crores as of 29th December 2022. In addition, HDFC Bank is the top-performing banking stock over the long term, giving a CAGR return of 17% in 10 years.

How useful was this post?

Click on a star to rate it!

Average rating 3.5 / 5. Vote count: 11

No votes so far! Be the first to rate this post.