Don’t you want to create wealth? Yes, everyone wants to create wealth.

Which brings us to the next question. What is the best way to create wealth?

Smart investing can help you build a corpus to meet your life goals.

But how can you be sure that the stocks you plan to invest in will deliver the planned returns? Stocks are linked to market movements. The probability of gains and losses is equally present.

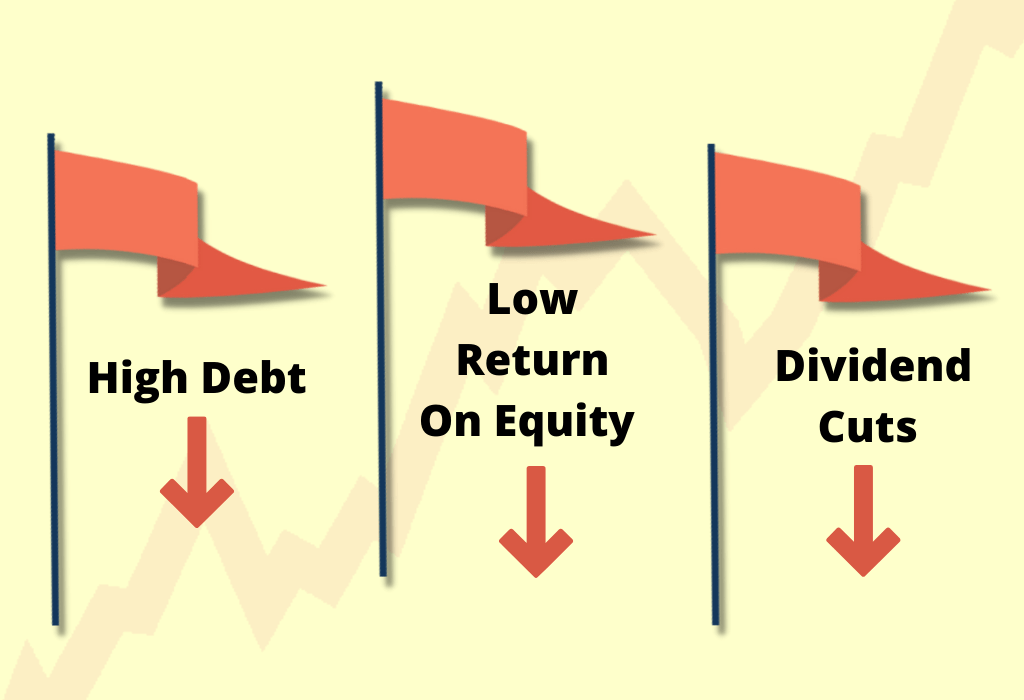

One way of ensuring you can minimise your investment losses will be to spot glaring red flags before you invest in a specific stock. These red flags are nothing but warning signs that function as indicators that you should avoid investing in a particular stock.

How Can You Spot Red Flags in Stocks?

The first step to creating wealth is avoiding bad investments in stocks. Remember, these decisions are life altering because recovering from a series of bad investment decisions can take years.

Luckily, there are ways to spot red flags before investing in stocks.

Here is a list of the top five red flags that should be on your watchlist.

1. Look elsewhere for investing if the company has high debt

Companies take on debt to boost earnings and profit margins. What you need to look at is if the rising debt is more than the combined value of the company’s equity or assets. If the listed company already has debt and accruing more with every passing year, then you can assume that the funds are being used for operational expenses.

Also, look at the debt-to-equity ratio. Run a comparison between your shortlisted stock’s debt to equity ratio and select competitor brands in the sector. You will get the general idea of the industry benchmarks.

If the ratio is extremely high, assume that the cost of borrowing will also skyrocket. It may create a debt trap, a cycle that the company may not be able to get out of. This is a sure shot red flag and you should think twice about investing your hard-earned money in this company’s stocks.

2. Low return on equity (ROE) can be a cause for concern

In addition to debt, you also need to look at the company’s Return on Equity (ROE), capital and investment ratios

These are crucial factors when you are considering investing in the company as the ratios tell you if the company is making more than minimal risk investments. The ratios should be over 15% for most segments.

If the ROE is low, it is not necessarily a terrible thing. It may imply that the capital can be better employed elsewhere. However, if the low ratios continue to persist, then it is wise to consider investing elsewhere.

3. Little or no liquidity for you to exit can result in a loss

You invested in a particular stock and now you want out. For listed instruments that include company stock, the way to exit is to sell your shares in the open market.

If there is an active market for this stock, this should not really be an issue. But there may be a situation where there is no active market for a particular instrument.

This is something that applies to small, listed investments but is more likely to impact Over the Counter (OTC) shares, derivatives, and structured products. What this means is that if there is no buyer, you will not be able to make a sale of your shares.

Therefore, you must check if the company that you are considering investing in offers enough liquidity allowing for a smooth exit. If not, you may want to avoid the stock for now.

4. Diminishing dividend distribution can be a pre-cursor to turbulent times

All is not well if you go through the annual reports of your listed company for the past few years and see that the size of the dividend has been decreasing.

Typically, companies set out their dividend ratio at a level that they know they will be able to pay out. However, if you see that over time, the dividend cuts have reduced then it can imply that things within the company are not going as per plan.

The earnings of the company in question may be under duress resulting in a lower than anticipated dividend yield. This can lead to plummeting share prices.

On the other hand, a high dividend yield makes the share an attractive investment prospect. However, you must check the how sustainable the company offering high dividend yield is.

As far as dividends are concerned, you must look at both these key factors before you make an investment in the company.

5. Delayed release of results can spell bad news for investors

Delayed or postponed annual results releases by a listed company can be a pre-cursor to news that may not be great. The reasons for the delay can be

The auditors of the company not willing to sign off on the financial results could be reason number one. It indicates that investment in this stock may not be a wise move at all.

Moreover, if you find the annual results will release on a Friday or a holiday, then it is quite possible that the reports do not bear good news. It can be a cause of concern because the company is hoping that the analysts will miss the results and the market will have more time to cope with the unwelcome news.

All of these are early warning signs that the company is struggling. So, it does not present a great investment opportunity now.

Bad investment choices hinder financial growth and make it difficult to achieve your life goals. So, before you invest in stocks, make sure you pay attention to any red flags that could hinder your financial progression.

You must thoroughly research a company before you invest in it. Also, remember, we mean investing for the long term and not short term. Creating wealth is possible only when you have the patience to invest in sound companies allowing them to grow.

Want to know more about long-term investing and how you can create wealth? Click here

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.