IT stocks are considered the safest bet in any market condition. With consistent dividend payouts and stock price growth, IT stocks have generated massive wealth for investors over the long term. The Nifty IT index, the benchmark index that captures the performance of Indian IT companies, has grown at a CAGR of 22.28% in the last five years, whereas the broader Nifty 50 index has a CAGR of 12.90% in the same period.

Following are the top IT stocks of 2022 based on market capitalization

Top IT Stocks of 2022

| Company Name | Market Cap in Rs (Cr) |

| Tata Consultancy Services Ltd. | 12,02,145 |

| Infosys Ltd. | 6,40,267 |

| HCL Technologies Ltd. | 2,81,855 |

| KPIT Technologies | 19,435 |

| Tata Elxsi | 39,683 |

| Sonata Software | 8,007 |

2022 was a year full of uncertainties and social, political, economic, environmental, and health crises. These crises impacted businesses worldwide. So, how have the top IT stocks fared amidst this tumultuous market? Let’s take a look?

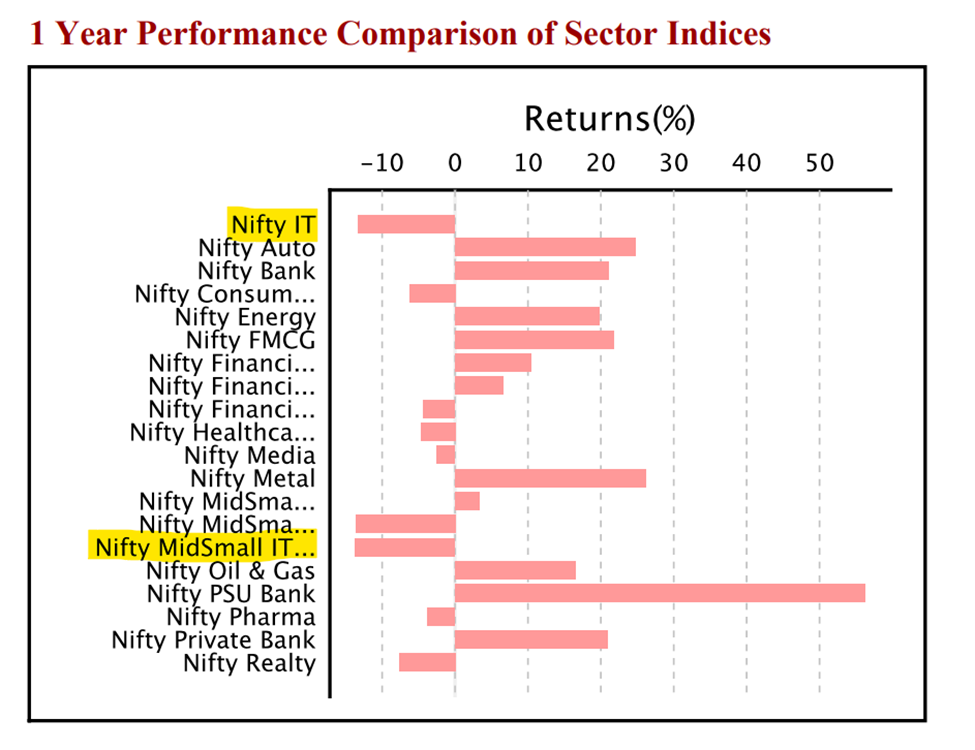

The chart above shows that the Nifty IT and Nifty MidSmall IT and Telecommunication index have fared poorly compared to other sectoral indices in 2022.

Let us understand how each stock mentioned below fared in the market

Tata Consultancy Services (TCS)

TCS is the largest IT service-providing company in India by revenue and headcount. In FY2022, TCS reported its highest-ever revenue of ₹1,91,754 crores and net income of ₹38,327 crores. And in Q2 FY23, the company reported revenue of ₹55,309 crores and a net income of ₹10,431 crores. It has around 600,000 employees worldwide on its payroll.

During 2022, the TCS share price was affected by worsening global macroeconomics; however, the impact was limited due to strong order books and new client additions. Compared to the Nifty IT index, which fell by close to 26% from its peak in 2022, the TCS share price is down by 11% during the same period. It paid a total dividend of ₹45 in the calendar year 2022 in the form of final and interim dividends.

Infosys

Among all the large-cap IT stocks, Infosys showcased a strong business performance and has a robust balance sheet with a total cash reserve for the quarter ending September 30, 2022, at $3.289 billion.

The company has over 3,30,000 employees on its payroll, and in FY 22, revenue rose by 21% to ₹1,21,641 crores, and the net profit was up by 14.3% to ₹22,110 crores. And in Q2 FY23, the revenue rose by 23.4% to reach ₹36,538, and net profit grew by 11.1% to ₹6,021 crores.

Infosys has been a real multibagger for investors. If an investor had bought 100 shares in Infosys IPO in 1993 for around ₹9,500, the value of those 100 shares would be more than ₹15 crores. In 2022, the Infosys share price fell 19% from its peak; however, in the last 5 years, the CAGR has been 24%. It made a 52-week high of ₹1,954 in January 2022. It paid a total dividend of ₹32.50 in the calendar year 2022 and announced a share buyback worth ₹9,300 crores.

HCL Technologies

HCL Technologies is the third-largest IT services company in India in terms of revenue and has expertise in Digital, Cloud, and Engineering. Its IPO was launched in 1999 and created a milestone in Indian corporate history as the IPO was oversubscribed by 27 times and created demand for over ₹20,000 crores for the issue.

In FY22, the company’s revenue increased by 13.6% to ₹85,651 crores and net profit increased by 6.9% to ₹19,951 crores. And, in Q2 FY23, HCL Tech’s revenue grew 19.5% YoY to ₹24,686 crore, and net profit is up by 6.3% YoY at ₹3,489 crores.

The HCL Tech share price has given a CAGR return of 20.65% over the last 10 years. In 2022, due to weakness in the broader market, HCL Tech’s share price has given negative returns to its investors. The stock is down by 18% from its 52-week high level of ₹1,359. It paid a total dividend of ₹40 in the calendar year 2022.

KPIT Technologies

KPIT Technologies is a leading IT services and product engineering services provider to automobile companies and is playing an instrumental role in developing next-generation software-defined vehicles. The company has been one of the best-performing IT stocks in 2022 amid the volatile market conditions. KPIT Technologies is a part of the Nifty MidSmall IT and Telecommunication index and has risen by over 28% in 2022. During the year, the stock made a high of ₹801 on 10th January 2022.

The stock market listed the KPIT Technologies share on 22 April 2019. In the last three years, it has given its investors a CAGR return of 94%. The rise in stock price is backed by solid business performances, where the sales revenue has compounded by 56%, and net profit has compounded by 50% in the last three years.

Tata Elxsi

Tata Elxsi is a leading design and technology services provider to the automotive, transportation, communication, broadcast, and healthcare & pharma industry. It functions independently of its sister company Tata Consultancy Services. It has emerged as one of India’s most preferred IT stocks and is a consistent compounder. Its share price over the last 10 years has grown at a CAGR of 49%; in 2022, it grew by 9.77% as of 30 December 2022.

In FY22, Tata Elxsi reported 35.8% YoY growth in revenue to ₹2,470.8 crores and 49.3% YoY growth in net profit to ₹549.7 crores. For the first time in history, Tata Elxsi reported a net profit of over ₹500 crores.

The company is known for providing stellar returns to its investors and has always been in investors’ focus. In the post-Covid market rebound, the Tata Elxsi share price rallied from ₹600 apiece to a high of ₹10,238 on 12th August 2022. The stock was listed in March 1995, and ₹1 lakh invested then is now worth over ₹12 crores.

Sonata Software

Sonata Software is a Bengaluru-based IT service and consulting company founded in 1986 as the IT unit of India Organic Chemicals. In 1994 it spun off to be created as an independent entity, primarily providing IT services and solutions to enterprises based in the United States, Europe, the Middle East, and India.

In FY 22, the company’s total revenue rose by 32.88% YoY to ₹5,655 crores, and net profit grew by 54.30% YoY to ₹376.43 crores. In Q2 FY23, the company posted 55% YoY growth in revenue to ₹1,496 crores, and PAT grew by 24% to 112.7 crores.

Sonata Software has given stellar returns to its shareholders over the long term. The 10-year CAGR return is 41%. In 2022, the stock gave a negative return to its shareholders and fell 15% from its 52-week high of ₹694. But it has fared better than the benchmark index.

Final Words…

Barring a few sectors, 2022 has been highly volatile for the market amid slowing global GDP growth and fears of a recession in 2023. And the IT sector in India also felt the heat greatly.

So, will IT stocks bounce back in 2023? In the event of a recession in the US and Europe, IT stocks are expected to remain under pressure. Will a slowdown in the US economy affect the sector’s valuation?

Tracking Nasdaq can hint at any upcoming bounce in IT stocks in India, as the Nifty IT index and Nasdaq show a high correlation. A crisis or crash is an excellent opportunity to invest in fundamentally strong IT stocks with proven business records for long-term wealth creation.

Disclaimer Note: The numbers mentioned in this article are for information purposes only. He/she should not consider this a buy/sell/hold from Research & Ranking. The company shall not be liable for any losses that occur.

FAQs

Why are IT stocks falling?

IT stocks in India have fared the worst since the 2008 financial crisis. Multiple factors are impacting the price of IT stocks, such as slowing global GDP growth, rising inflation due to the energy crisis and disrupted global supply chain, tight global liquidity conditions, and rising fears of a recession in the US and Europe.

Which is India’s biggest IT stock by market capitalization?

Tata Consultancy Services- TCS is the biggest IT stock in India, with a market capitalization of $142.53 billion. The second biggest IT stock is Infosys, with a market cap of $76.59 billion as of December 27, 2022.

Which IT stocks have had the highest returns in the last 5 years?

Tata Elxsi and KPIT Technologies have given their shareholders stellar returns over the long-term period. KPIT Technologies is listed in April 2019, and in the last three years, it has given a CAGR return of 95%. And Tata Elsi has given its shareholders a CAGR return of 47% in the last five years.

How useful was this post?

Click on a star to rate it!

Average rating 1 / 5. Vote count: 1

No votes so far! Be the first to rate this post.