The financial services landscape is vital for today’s economy. It includes sectors like banking, insurance, and investments. Technology is reshaping the financial services landscape, bringing digital solutions, automation, and Artificial Intelligence and Machine Learning advancements. These changes improve efficiency and customer experiences and create new opportunities.

Financial institutions must adapt to digital transformation, enhanced security, personalized services, and sustainable investing to succeed. Embracing these trends meets customer expectations and improves efficiency unlocking new opportunities.

One popular trend is the Buy Now, Pay Later (BNPL). It lets consumers make immediate purchases and pay in interest-free installments. This convenient option has reshaped finance, offering flexibility and convenience.

Let’s dive in and understand the trends evolving in the financial services landscape.

Traditional to Trendy: Change in the Financial Services Landscape

The financial services industry involves traditional institutions like banks, credit unions, and disruptive fintech companies. Tech giants and e-commerce platforms are also entering the sector. These players are reshaping the industry and driving the evolving trends in the financial services landscape. It’s essential to keep up with these changes to stay competitive and meet customer needs effectively.

Digital Transformation in Financial Services Landscape: Key Trends

The financial services landscape is witnessing a significant shift towards digital transformation. It includes adopting digital banking and online financial services and integrating AI and ML technologies. In addition, mobile applications are playing a crucial role in providing personalized customer experiences. Therefore, staying updated with these evolving trends is vital to effectively navigate the changing financial services landscape.

Enhancing Financial Security

Security and Fraud Prevention in financial services landscapes is crucial. Cybersecurity measures, biometric and multi-factor authentication, and blockchain technology ensure secure transactions. In addition, protecting against fraud is vital for trust and industry integrity.

Empowering Personalized Financial Solutions

Customizing financial products to match customer preferences, leveraging personal financial management tools and budgeting apps, and employing data analytics for tailored advice.

Impact Investing: Driving Positive Change

Growing emphasis on environmental, social, and governance (ESG) factors, the rise of impact investing and sustainable finance initiatives, and the integration of ethical considerations in investment decisions.

Buy Now, Pay Later (BNPL) Transforming Financial Services Landscape

Buy Now, Pay Later (BNPL) is a growing trend in the financial services landscape.

Meaning of BNPL

BNPL is a payment option that allows consumers to buy now and pay later, usually without interest. It’s a popular choice, especially for online shoppers, as it provides short-term lending with the convenience of point-of-sale installment loans.

It allows consumers to make immediate purchases and delay payment until later. In addition, with BNPL, customers can conveniently split their payments into manageable installments, often without interest charges.

Interest-Free Purchases with BNPL

It allows consumers to make immediate purchases and delay payment until later. In addition, with BNPL, customers can conveniently split their payments into manageable installments, often without interest charges.

You can access high-value purchases without paying the total amount upfront. You can better align payments with your cash flow. This flexibility has led to a surge in the adoption of BNPL services.

Merchant Benefits: Boosting Sales with BNPL

Merchants also gain advantages from embracing BNPL. By offering BNPL options, businesses can increase sales as customers are more inclined to purchase when payments are spread out. Moreover, BNPL promotes customer loyalty, incentivizing shoppers to choose specific merchants over competitors.

The combination of increased sales and customer loyalty makes BNPL appealing to businesses seeking to boost revenue and build lasting customer relationships.

Factors Driving the Popularity of BNPL Among Young Consumers

- Convenience: BNPL provides a highly convenient payment method, allowing quick processing and deferred repayment.

- Credit Accessibility: It addresses the lack of credit availability for individuals without a job or good credit scores, using alternative data for credit analysis.

- Offline Integration: BNPL integrates with offline QR code payments, expanding its reach to major stores and Kirana merchants.

- Instant Refunds: Unlike traditional e-commerce portals, BNPL ensures immediate refunds when orders are canceled.

- Interest-Free EMIs: BNPL offers interest-free Equated Monthly Installments (EMIs), making purchases more affordable for young consumers.

BNPL Growth Projections: A Promising Future in Financial Services Landscape

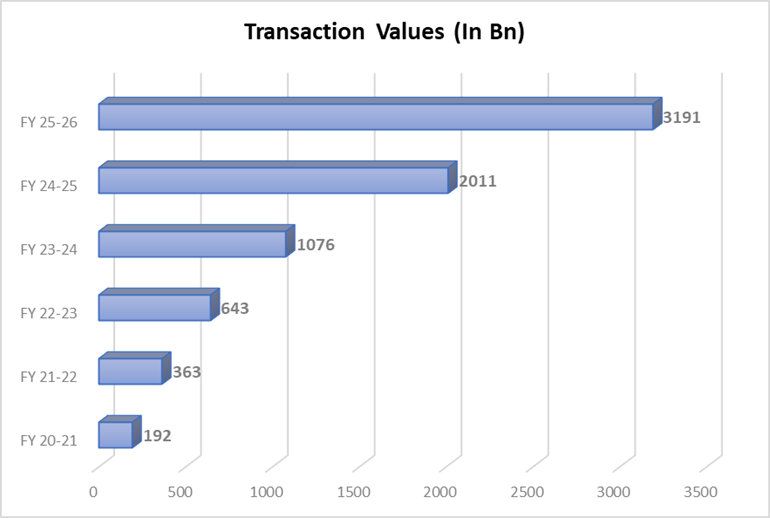

Transaction Value: BNPL is set to witness an impressive 779% growth by FY 25-26, with the transaction value expected to surge from ₹ 363 billion to ₹3,191 billion.

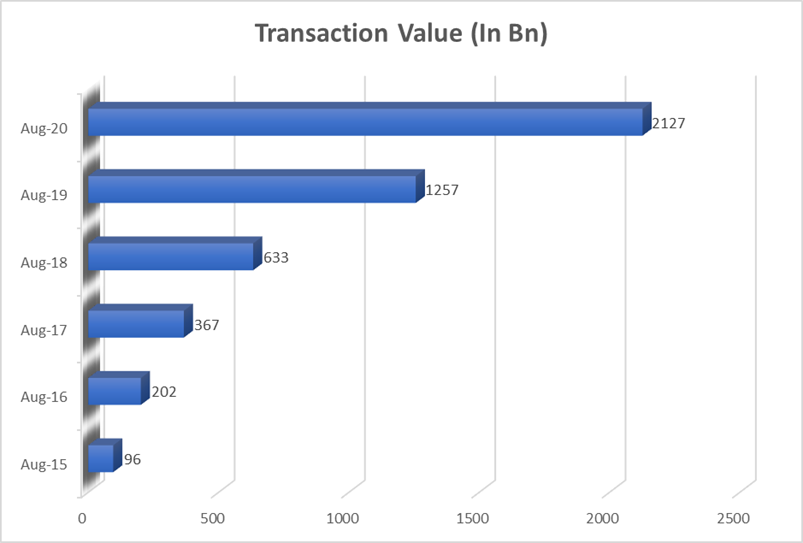

Transaction Volumes: BNPL users are projected to reach 202 million this fiscal year, with a remarkable CAGR of 67% since inception. By FY 25-26, the transaction volumes are estimated to skyrocket by 953% to reach 2 billion.

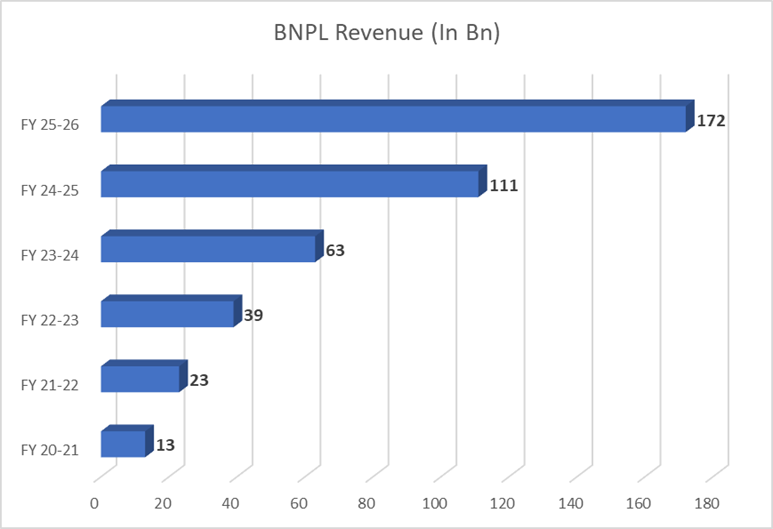

Revenue Growth: The increased adoption of BNPL will contribute to Fintech revenue growth, expected to soar by 648% by FY 25-26. The total revenue is anticipated to reach ₹172 billion, displaying a robust CAGR of 54% since FY 20-21.

Final Words

Digitalization, enhanced security, personalized services, and sustainable investing are changing the financial services landscape. Buy Now, Pay Later (BNPL) is a popular trend, reshaping finance with convenient payment options. BNPL’s growing adoption among young consumers and projected exponential growth in transaction value, volumes, and revenue highlight its promising future. Embrace trends to stay competitive in the industry.

FAQs

What’s next for BNPL?

BNPL’s future growth depends on delivering omnichannel experiences, strengthening collection mechanisms, and regulatory oversight for customer protection in the evolving financial services landscape.

What are the other trends that are redefining the Indian financial service landscape?

Key trends include IndiaStack, digital payments, neo banks, embedded finance, blockchain/CBDC, evolving regulations, and engineering finance.

How are blockchain, CBDC, and e-RUPI impacting the financial service landscape?

Blockchain is being explored for CBDC, and e-RUPI vouchers are used for secure, contactless government benefits.

How has IndiaStack transformed the financial sector?

IndiaStack’s decentralized public utility enables paperless and cashless services, lowers loan costs, and improves financial inclusion.

What is embedded finance, and how is it changing the industry?

Embedded finance integrates financial services directly into non-financial platforms, streamlining payments and bypassing third-party providers.

What regulatory developments are shaping the financial sector?

RBI’s digital lending guidelines, Account Aggregator framework, and adherence to Responsible Digital Payments principles are driving regulatory advancements.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.