UPI Payment for International Travellers

RBI extended UPI payments for international travellers facilitating local payments at G20 meeting venues and more than five lac merchant outlets across India to provide a seamless travelling experience. This facility is available only to selected G20 travellers at selected international airports but will soon be rolled out across all entry points.

While announcing the Monetary Policy Committee (MPC) on February 8th, the Central Bank, RBI, disclosed its plans to allow inbound G20 travellers to make UPI payments at selected destinations. Later, the RBI would expand this service to all entry points, including all international airports in India.

Let us walk you through the process of making UPI Payment for Foreign tourists & travellers, including eligibility, where the new facility is available, how it works, and much more. On the way, we’ll talk about the RBI’s pilot project launch to install QR-based coin vending machines (QCVM) in 12 cities.

UPI Payment for International Travellers Eligibility Criteria

The UPI payment for international travellers from G20 countries is available at three international airports: Bengaluru, New Delhi, and Mumbai. The G20 presidency keeps rotating annually, and in 2023, India holds the presidency from 1st December 2022 to 30 November 2023.

It is a prestigious moment for India as its first-ever G20 summit is hosted in India and South Asia. Members of G20 countries include Argentina, Australia, Brazil, China, France, Italy, Germany, Italy, Japan, the Republic of Korea, Mexico, Russia, Saudi Arabia, South Africa, Turkey (Turkiye), the United Kingdom, and the United States.

But RBI has proposed extending the UPI payment facility for foreign tourists and travellers after successfully framing necessary policies and guidelines based on learnings from this initiative. It will profit foreign visitors and highlight India’s technological progress to the rest of the world.

UPI Payment for International Travellers How Will It Work?

As per the Developmental and Regulatory Policy Statement released by RBI on 8th February 2023, the facility of UPI payments to international travellers has been launched. It will let foreign travellers make local payments to identified Merchants(P2M) through a Unified Payment Interface (UPI) platform.

Eligible travellers will receive a Prepaid Payment Instrument (PPI) in the form of wallets linked to their UPI for use only at selected merchant establishments (P2M). The PPI issuer is responsible for ensuring that the PPI issuing and operating company has the required permits. And to keep RBI informed regarding the names of companies that facilitate UPI payments to international travellers.

PPIs can be loaded/ reloaded by designated Banks and non-Banks in exchange for cash or any other payment instrument. PPIs for UPI payments to international travellers are issued after complete verification of their Passport and Visa at the issuance site.

UPI Payment for International Travellers -Supporting Banks

For now, ICICI and IDFC First Bank, both banks, and Pine Labs and Thomas Cook, both non-banks, have partnered with the National Payments Corporation of India (NPCI) to ensure safe, secure, and hassle-free UPI payments to international travellers from G20 countries.

RBI issued Policy Guidelines on Prepaid Payment Instruments (PPIs) to assist UPI payment for foreign tourists & travellers. To better understand the newly introduced policy guidelines on UPI payment for travellers, it is imperative to know about PPIs.

What are PPIs?

Prepaid Payment Instruments (PPIs) allow you to purchase goods and services, financial services, remittance facilities, and so on, using the stored value of the instrument. PPIs are only issued with the RBI’s approval or authorization.

Types of PPIs

Small PPIs and Full-KYC PPIs are the two types of PPIs. PPIs can be in the form of cards, wallets, or any other instrument that can be used to retrieve the amount contained in the PPI.

Small PPIs or Minimum-detail PPIs – These instruments can be issued after knowing a few basic details of the PPI holder and are restricted to purchasing goods and services only. Cash withdrawal and transfer facilities are not allowed in this category of PPIs.

Full-KYC PPIs– These instruments are issued only after completing the PPI holder’s complete Know Your Customer (KYC) and can be freely used to purchase goods and services, withdraw cash and transfer money.

PPI guidelines for foreign nationals and non-resident Indians (NRIs) visiting India:

- Foreign nationals or NRIs visiting India can obtain rupee-denominated Full-KYC PPIs from approved banks or non-banks. This UPI payment facility for international travellers has been made available only to inbound travellers from G20 countries on a trial basis at selected airports. Considering what was learned and the system’s viability, it will be expanded to all entry points for travellers.

- PPI Issuer is responsible for physically verifying the foreign national and NRI’s visa and passport and maintaining records for future use.

- PPIs under UPI payment for international travellers can be issued only through wallets linked to their APIs. The amount in PPI wallet at any instance must not exceed the limit prescribed for the full-KYC list, i.e. Rs. 2,00,000/- at any time.

- You can encash any unutilized balance in PPI in foreign exchange or transfer it back to the payment source only in compliance with the foreign exchange regulations under FEMA.

- Conversion of PPIs into foreign currencies can be done only at FEMA-authorized centres.

- Loading or reloading balances in PPIs shall be against receipt of foreign exchange in cash or any other payment instrument as prescribed.

Conclusion

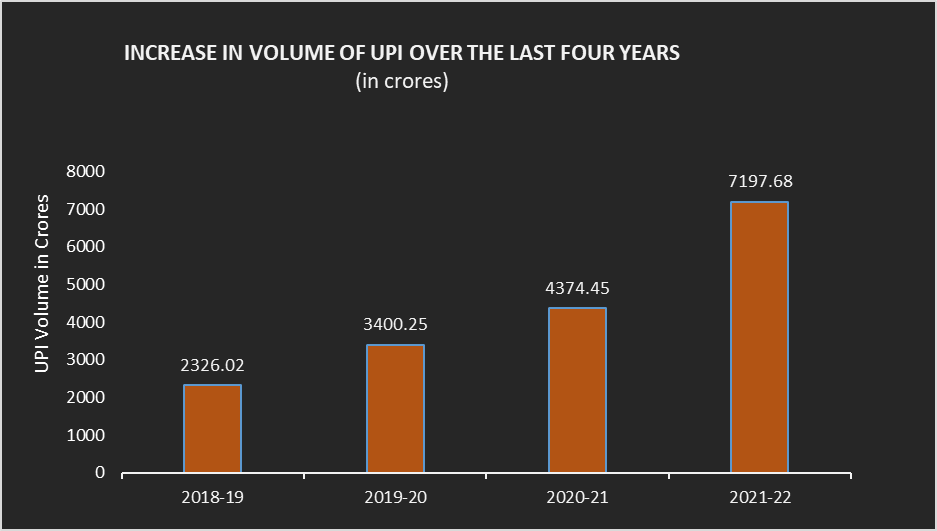

UPI transactions in India have grown more than eight times in 2021-22 and almost 50 times in the last four years with several initiatives taken by Government, Banks, and NPCI.

Earlier, NRIs from selected countries (Singapore, Australia, Canada, Hong Kong, Oman, Qatar, USA, Saudi Arabia, United Arab Emirates, and the United Kingdom) could avail of the facility of UPI payments if their international mobile numbers were linked to their NRE/NRO accounts.

India has achieved global recognition due to its extraordinary commitment to transitioning from cash to digital payments. This initiative has alleviated the burden of carrying cash, rushing to currency exchange centres, international travellers, and reliance on international debit cards with high fees. The ability to make UPI payments to international travellers will boost UPI’s acceptance and prominence in foreign territories and help it establish itself as a global payment and money transfer network.

FAQs

Who is allowed to create PPI wallets linked to UPI for international travellers?

Only two banks, ICICI and IDFC First Bank and two non-banks, Pine Labs Pvt Ltd and Transcorp International Limited have been initially authorized to issue UPI-linked wallets.

How is this facility of UPI payment for international travellers different from UPI payments to NRIs?

The main distinction is that PPI issued under the UPI payment for international travellers is a pre-paid instrument. In contrast, UPI for NRIs is associated with fully KYC-compliant NRO/NRE accounts.

NRIs will have to link their bank accounts to their non-Indian mobile phone number with international country codes to avail of the service. When UPI is used, money is directly deducted from their linked bank accounts. In the case of the former, unutilized money can be returned to the customer, whereas in the latter case, this is unnecessary.

Can international mobile numbers used by NRIs be registered for making UPI payments during their visit to India?

Yes, NRIs who maintain their NRE or NRO accounts in India can now link their international numbers for making UPI payments for foreign tourists and travellers, but there are certain conditions to be fulfilled-

– Non-Resident External (NRE) or Non-Resident Ordinary (NRO) account holders must comply with the Foreign Exchange Management Act (FEMA) or RBI regulations issued from time to time. Also, NRIs can use UPI hassle-free only with their international mobile number linked to their NRE or NRO account.

– To combat the financing of terrorism and anti-money laundering (AML), both the beneficiary and the member Bank must follow the guidelines (KYC), AML/CFT) issued in this regard.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 3.5 / 5. Vote count: 4

No votes so far! Be the first to rate this post.