Haven’t we all used stabilizers at some point in our life? These days you also get in-built stabilizers for consumer electronic products we use. But do you know how that came to be and who invented stabilizers? Well, this blog will take a look at the Genisys of stabilizers in India and the birth of a company that grew leaps since it began.

V Guard – The Company

They say you must first identify a problem and then provide an effective solution to that problem to be successful in business. And Mr. Kochouseph Chittilappilly, the owner of V Guard company, did the same in 1977, solving one of the most common problems affecting almost every Indian household with an electricity connection at the time.

Yes, we mean the voltage fluctuations and the man in question is the founder of V Guard Industries. V Guard is one of the best-selling voltage stabilizers in India, and the brand has become synonymous with the product due to its high quality and effective marketing. V Guard is now more than just a voltage stabilizer manufacturer, having expanded into the other verticals of the Fast-Moving Electrical Goods (FMEG) segment.

The V Guard Company Story

The story of the success of V-Guard is not a usual one, and it has overcome all of the challenges that any business enterprise established prior to liberalization faced. The Indian economy was a struggling economy before the liberalization, marred by inefficient government machinery, license-raj, and most importantly, erratic power supply with wide voltage fluctuations. It is where Mr Kochouseph Chittilappilly sensed a business opportunity and make a small impact on people’s lives.

It was not an easy journey for Chittilappilly, who comes from a traditional agricultural family in Thrissur, Kerala. His father desired that he pursue a traditional career in the government or the banking sector. However, Chittilappilly persuaded his father to invest in the business and borrowed a princely sum of Rs. 1 lakh from him. The journey to building one of the finest FMEG businesses in India started.

He hired a couple of high-school dropouts and started manufacturing voltage stabilizers under the brand V Guard from a 400 sq ft shed in Kochi to protect TV and refrigerators.

V Guard Market Foray

There are a few critical growth factors that should work in the favor of any business enterprise for it to succeed- like the right product fit for the addressable market, social impact, and identifying the future growth potential. And, for Mr Chittilappilly, V Guard happened at the right time.

The weaknesses of the Kerala State Electricity Board (KSEB) became the strength of V Guard Industries. Erratic power supply with wide voltage fluctuations resulted in the demand for voltage stabilizers from consumers to protect their expensive electrical appliances.

The big break for the company came when televisions first arrived in 1984 in Kerala, which shot up demand for stabilizers. In addition, Kerala was about to experience the Gulf Boom, as the families of NRIs working in the Middle East gradually began to improve their standard of living and splurged on expensive electrical appliances such as TV sets and refrigerators. V Guard’s promise to safeguard those devices from wide voltage fluctuations helped it to capture the market.

Today, V Guard has ventured into other businesses also, including the garment business (V-Star), amusement parks (Wonderla Amusement Park), NBFC and more.

V Guard Company Journey

During the early years of V Guard, Mr Chittilappilly’s astute business judgment ensured that his company was not adversely affected by trade union squabbles. He included women in the manufacturing process and outsourced a portion of the manufacturing process, which not only reduced the likelihood of disruptions but also enabled him to obtain excise duty exemptions by hiring women groups.

V Guard Company Analysis

Mr Chittilappilly and his son knew that in order to expand its product reach outside Kerala, he needed effective market strategies. Proper segmentation, testing, and positioning of products were done to help V-Guard penetrate the market deeper. Short, aggressive, and clutter-breaking TV commercials featuring the V-Guard product range helped to improve brand recall among users and sales too.

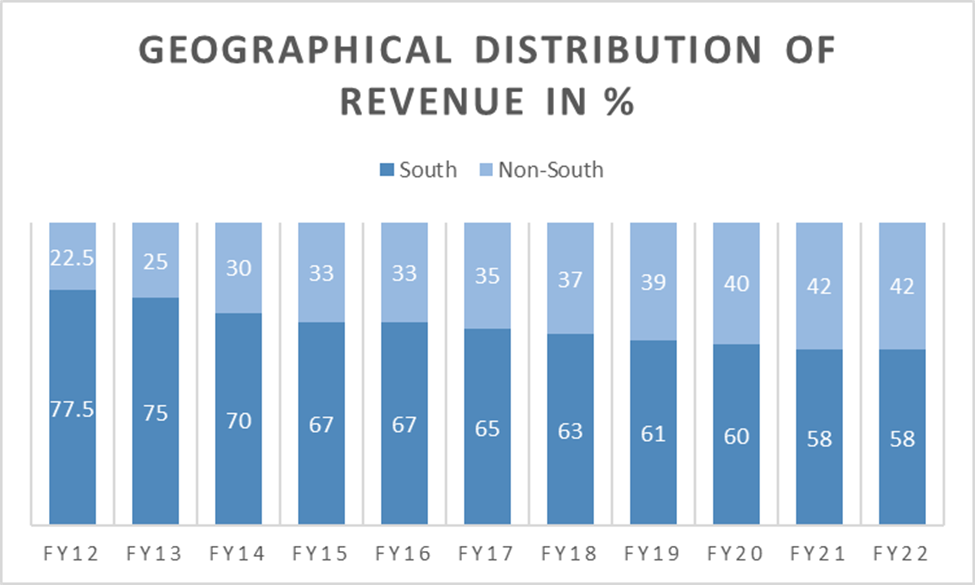

And, the result- revenue from the non-south region doubled for V-Guard in the last 10 years and soared over 40% with a leadership position in the stabilizers.

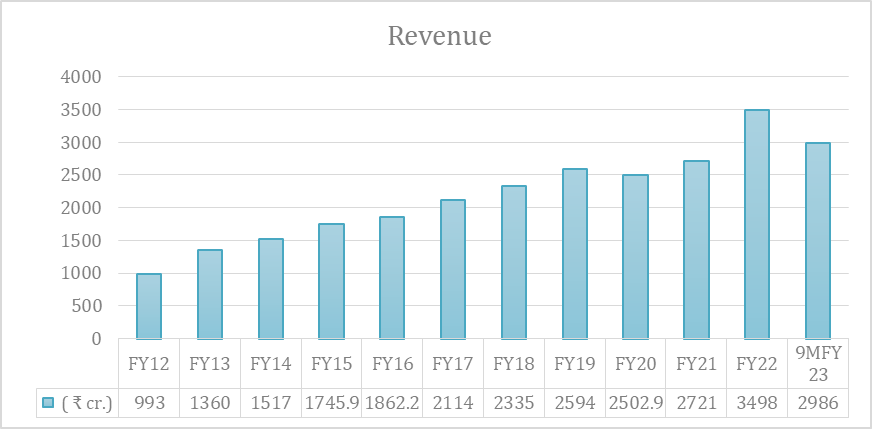

Revenue Growth

Expanding in the northern states and expanding its product portfolio has helped V-Guard Industries to more than triple its revenue from operations in the last 10 years. V-Guard’s revenue increased at a CAGR of 13.74% during the period between FY12 and FY22.

Change in the Geographical Distribution of Revenue

In the last 10 years, V-Guard has steadily reduced its revenue concentration from southern states in India and expanded its customer base across the country. The company looks to achieve equal revenue distribution coming from south and non-south regions in the country.

Segment Revenue Breakup

| Operating Segments | Q3 FY23 (in ₹ cr.) | Q3 FY22 (in ₹ cr.) | 9M FY23 (in ₹ cr.) | 9M FY22 (in ₹ cr.) | FY22 (in ₹ cr.) | FY21 (in ₹ cr.) |

| Electricals | 435.82 (▲1.5%) | 429.23 | 1,273.53 (▲15.3%) | 1,104.94 | 1,596.15 (▲32.6%) | 1,203.46 |

| Electronics | 191.35 (▼4.3%) | 199.91 | 722.27 (▲27.1%) | 568.24 | 815.12 (▲7.4%) | 758.87 |

| Consumer Durables | 353.67 (▲4.5%) | 338.43 | 990.10 (▲28.9%) | 767.84 | 1,063.38 (▲44.3%) | 736.66 |

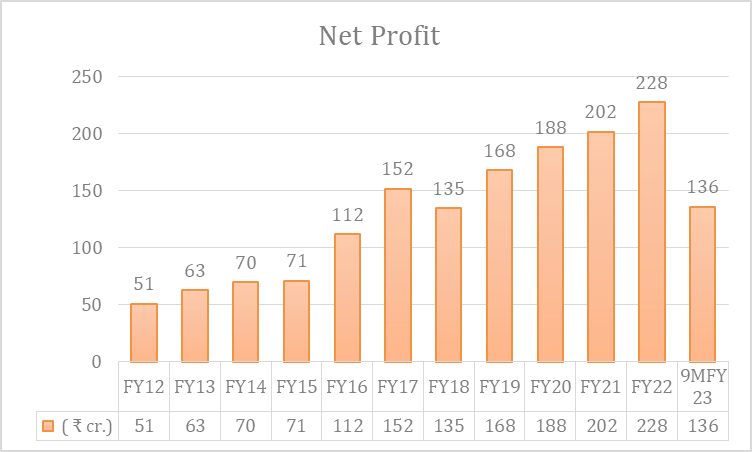

EBITDA and Net Profit

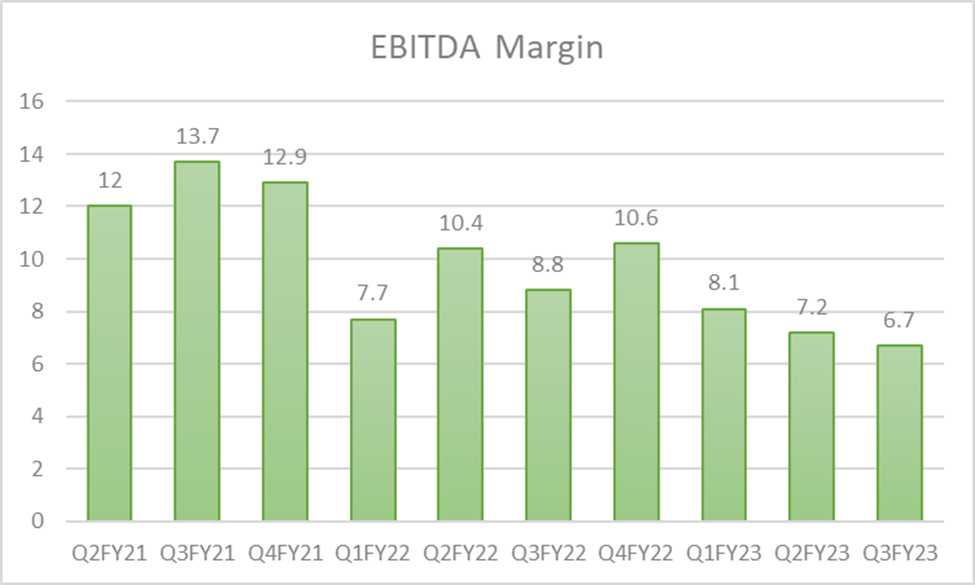

EBITDA margin in the last 10 quarters

One of the concerning developments in the company is the falling EBITDA margin, despite the increase in sales numbers. The company’s management has attributed the pressure in margins in the last few quarters to commodity price inflation and supply chain disruptions.

V-Guard Industries has managed to increase profit year-on-year. Still, a lower single-digit net profit margin is a cause of concern as it impacts the financial flexibility of the company during an uncertain business environment. In FY22, the net profit margin declined to 6.5% from 7.4% in FY21.

Key Financial Metrics

Current ratio: In FY22, the current ratio improved by 4% to 2.48 times from 2.36 times in FY21.

Debt-to-equity ratio: V-Guard’s debt-to-equity ratio for the last five years is zero, as reported in the company’s FY22 annual report. However, the company has taken ₹275 crores debt at 8.95% to fund a part of the Sunflame Enterprises acquisition in Q3FY23.

Gross Profit Margin: In FY22, V-Guard’s gross margin was 30.5%, which declined from 31.5% in FY21.

Net Profit Margin: In FY22, V-Guard’s net profit margin was 6.5%, which declined from 7.4% in FY21. The company attributed the fall in net profit margin due to high-cost inventory and supply chain disruptions.

Return on Capital Employed (ROCE): In FY22, the company attained a ROCE Of 20.3%, which declined from 22.2% in FY21.

V Guard Industries Share Price Analysis

V Guard IPO

V-Guard Industries launched its IPO on 18th Feb 2008, which was undersubscribed at that time. The IPO size was ₹65.6 crores. The company offered eight million equity shares to the public at a face value of ₹10 and at a price of ₹82 per equity share. V-Guard Industries shares were listed on 13th March 2008 at discount on the BSE at ₹60.

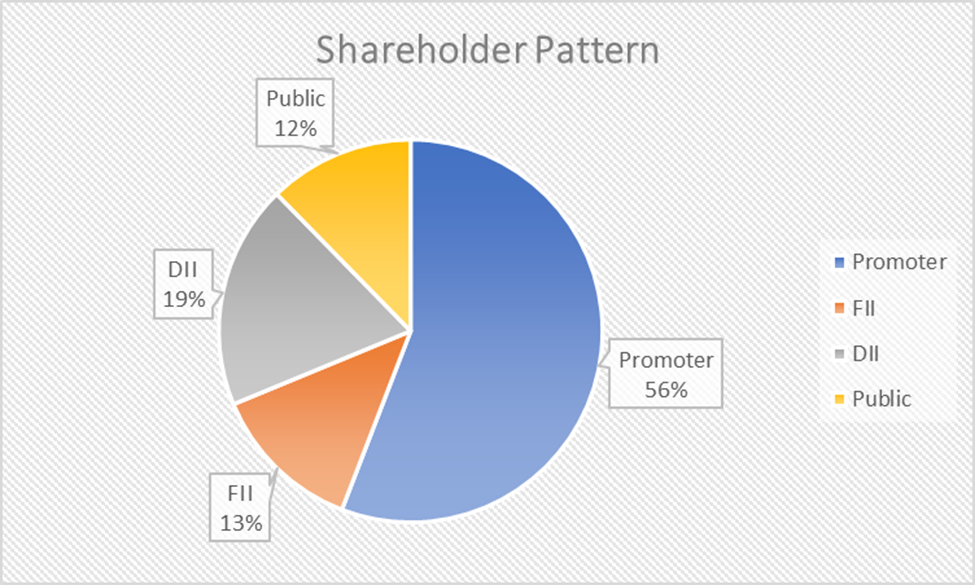

Shareholder Pattern

V-Guard Share Price Performance

Since its listing on the stock market, V Guard share price has given solid returns to its investors. In August 2016, stocks were split in the ratio of 1:10 and are currently trading with a face value of ₹1.

And on 15th March 2017, the company issued bonus shares at a ratio of 2:5, meaning for every five shares held, the shareholder received two new shares.

As of 28th March 2023, the V Guard share price (split and bonus adjusted) is trading at ₹241 a piece. The market cap is ₹10,426 crores.

In the last 3, 5, and 10 years, V Guard Industries share has given a CAGR return of 15%, 2%, and 23%, respectively.

Dividend payout

V-Guard Industries has a consistent track record of paying dividends to its shareholders. However, it has a low dividend-yield ratio of around 0.54. In 2020, 2021 and 2022, V Guard Industries paid ₹1.3, ₹1.2, and ₹0.90, respectively, as dividends to its shareholders.

V Guard Industries Share Price Future Growth Potential

From a single-product company to a multi-product company, V-Guard Industries has come a long way.

V Guard is the market leader in stabilizers, with a 42-45% market share in the organized market. However, the segment (Electronics) is witnessing slower growth in revenue compared to the other two segments. Also, the declining margin is a cause for concern. In Q3FY23, the segment witnessed a 530 bps drop in the margin in profit before tax and depreciation. The company has attributed the decline in margin due to high-cost inventory issues.

While the Electricals segment showed an 80-bps expansion in the margin of profit before tax and depreciation.

Strengthening Consumer Durables Portfolio

The company has increased its focus on the consumer durables segment, which has high margins and will benefit directly from the expansion of economies in Tier II and Tier III cities and rural areas.

Acquisition of Sunflame Enterprises

To become a significant player in the kitchen appliances segment, V-Guard acquired Sunflame Enterprises in January 2023 for an aggregate consideration of ₹680.33 crores. The acquisition will help to unlock synergy benefits, taking advantage of each other’s geographical spread, distribution touchpoints, product portfolio, and sales channel. Additionally, Sunflame is a dominant player in the non-south regions. The financial benefit will likely reflect in the balance sheet in the coming quarters.

V Guard Ramping Up In-house Manufacturing Plans

The company is slowly moving towards increasing in-house manufacturing capabilities and local sourcing, which is likely to improve competitiveness and improve margins in different segments. The combined V Guard and Sunflame in-house and outsourcing mix is expected to shift from 65:35 to 75:25 over the next five years.

V Guard Key Risks

- V Guard is a dominant brand in southern India, where it has been present since the early 1980s and 1990s. Still, it faces stiff competition in non-south regions, where it is a late entrant. The market is crowded with regional players and strong players like Havells, Finolex, Luminous, and Symphony.

- Operating with thin margins across segments due to price sensitivity, persistent high commodity inflation, and supply chain disruption can impact profitability.

In the next phase of growth and to achieve billion dollars in revenue, V-Guard is focusing big on the Consumer Durables segment. Therefore, if the segment witnesses higher growth in the next few quarters, along with improvement in margins in the Electronics segment, it could trigger a sharp rise in V Guard share price.

Disclaimer Note: The stocks and financials mentioned in this article are for information purposes only. They shouldn’t be considered as a recommendation by Research & Ranking. We will not be liable for any losses that may occur.

FAQs

Who is the founder of V Guard Industries?

Mr Kochouseph Chittilappilly founded V Guard Industries in 1977 in Kochi and started manufacturing voltage stabilizers.

What are the products of V Guard Industries?

V-Guard Industries has products across segments like Electronics, Electricals, and Consumer Durables. It is the market leader in voltage stabilizers across India, with a market share of 42-45% in the organized market. The company has acquired Sunflame to improve its product portfolio in the kitchen appliance segment.

When did the V Guard Industries IPO launch?

V-Guard Industries IPO was launched on 18th Feb 2008, and the stock was listed on 13th March 2008. The IPO size was ₹65.6 crores.

Read more: About Research and Ranking

How Long-term investing helps create life-changing wealth – TOI

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.