The LIC IPO is here. Finally!

Have you wondered when the Public Offer opens and what you need to do to get your hands on a few of those shares?

Well, we have the lowdown on all things about the LIC IPO. Before you do, there are some differences from the details we had shared in our earlier blogs.

In the last chapter on LIC we said, “Per brokerages, LIC is expected to be valued around Rs. 13-15 lakh crore, with the insurance titan raising between Rs. 70,000 and Rs. 1,00,000 crore from the public issue.”

That is no longer the case.

The IPO size has reduced, yet it will be one of the largest IPOs in India, even more than the 18000cr Paytm IPO. The Government plans to raise Rs. 20,557.23 crore from the IPO. LIC is valued at 6-lakh crore, which is ~1.12x the embedded value of Rs. 5.4-lakh crore.

The corporation’s profit soared 10% in FY21 to Rs. ~37.46 thousand crores from ~Rs. 34.14 thousand crores the previous year. The net profit for the period ended 31 December 2021 was Rs. 1715.31crores with an AUM of ~Rs. 40.91 thousand crores.

Let’s look at the offer details you must know now

| Details | Information |

| Opening Dates | 4th May 2022 |

| Closing Date | 9th May 2022 |

| Listing Dates | 17th May 2022 |

| Lot size | Minimum 15 shares |

| Price band | 902 -949 |

| Policy holder cost | 889 |

| Retail & Employees | 904 |

| Face value | Rs. 10 per equity share |

| Listed on | BSE and NSE |

Can you apply multiple times?

If you are a retail investor, employee, or HNI investor, you can have a single application only. However, if you are a policyholder, then you can apply twice in the categories mentioned below

- Policyholder and Retail Investor

- Policyholder and HNI (NII) Category

Policyholders –Things to know

The IPO has a reserved category for policyholders with a special discount of Rs. 60 per share. Policyholders with one or more policies as of 13 February 2022 and on the IPO date can apply. Moreover, their PAN number must be linked to the policies before 28 February 2022. Remember, you can apply based on one policy only, even if you have multiple policies.

There is an employee reservation of 15.81 lakh shares, while 2.21 crore shares are for policyholders. Half the shares from the net issue are earmarked for qualified institutional buyers (QIB), 15% for non-institutional buyers, and 35% for retail investors.

LIC IPO Review

We are sure you don’t need a brief background of LIC since it has been a part of households for decades, insuring the lives of your loved ones and more. We’d like to give you a picture of the business before the IPO through this review.

Who is selling?

The President of India, acting through the Ministry of Finance is selling. The government will disinvest 3.5% of its holdings to raise Rs. 20,577 crores through the IPO.

The IPO is a pure Offer for Sale (OFS) by the GOI. The sum raised will be transferred to the seller after deducting Offer expenses and relevant taxes. LIC will not receive any proceeds from the offer.

Objects of this offer

LIC expects to accrue the benefits of listing Equity Shares on the Stock Exchanges. It is looking to enhance the visibility and the brand image of LIC while offering the public a chance to invest in it. The corporation will carry the Offer for Sale of up to 221,374,920 Equity Shares for the President of India.

Industry Prospects

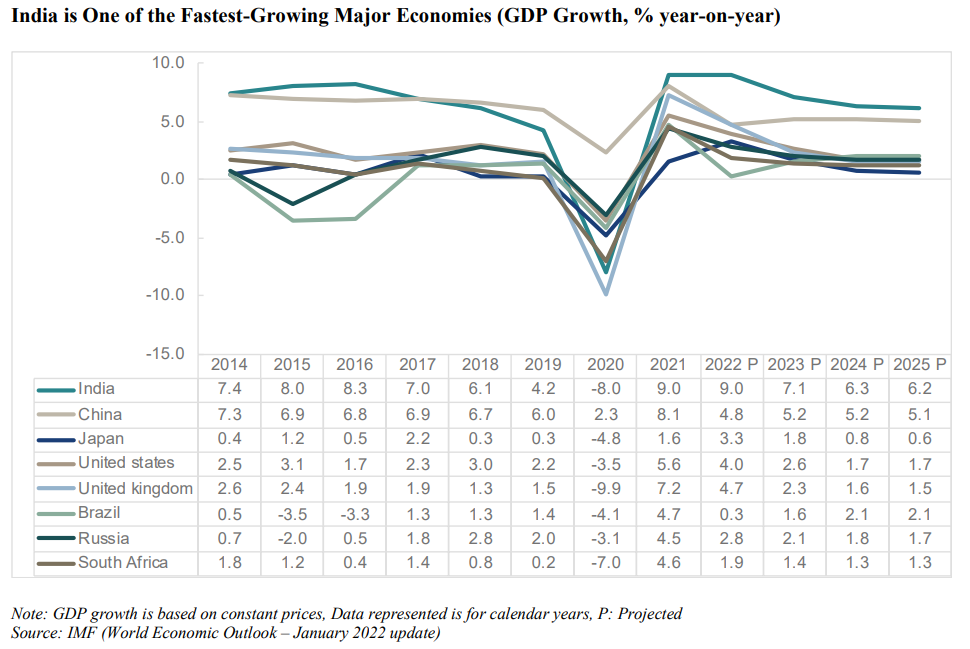

India is one of the fastest-growing economies in the world. It ranks fifth in the world for nominal GDP for the CY2020. In the case of Purchasing Power Parity (PPP), India is the third-largest economy after China and the US.

Factors That Will Aid The Industry:

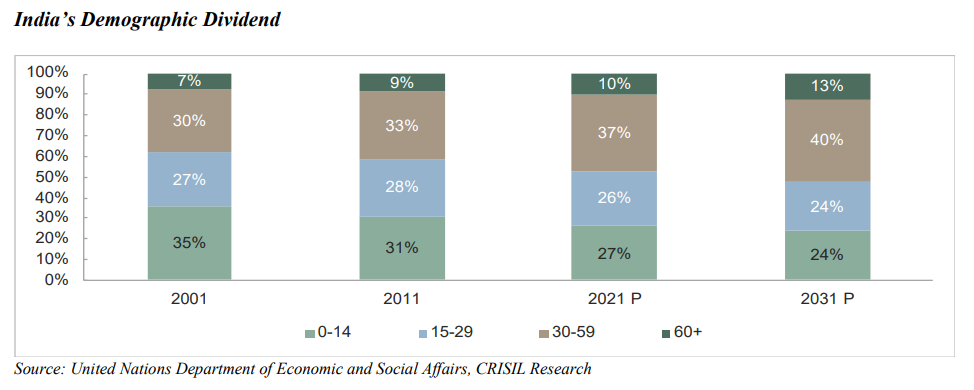

India’s Population and Demographics Advantage: Per India Census 2011, India had ~1.2bn people with ~245mn households. The population will reach 1.5bn with an estimated 376mn households by 2031.

India’s median age is 28 years, and over 90% of the population is below the age of 60 by CY2021. A CRISIL Research predicts almost 63% of the population will be between 15 to 59 years. Population in the US, China, and Brazil below the age of 60 in CY2020 was 77%, 83%, and 86%.

Urbanization: Urbanization in India will drive substantial investments in infrastructure development that will lead to the creation of new jobs, new consumer services, and a better ability to mobilize savings. Per the 2018 revision of the World Urbanization Prospects, it was 34% for India, which could grow to 37% by 2025. Rising urbanization will lead to higher consumption expenditure though household consumption is the lowest; compared to developed economies.

High Per-Capita GDP: The per capita income is estimated to have contracted 8% in FY2021 compared to its growth of 2.9% in FY2020. IMF estimates India’s per capita income at constant prices to grow to 6.2% CAGR between FY2021-2025.

Rising Middle India Population: In the last decade, the number of households with an annual income of up to a million has grown. The number could increase further with a rise in disposal incomes.

The number of affluent households with income above 1 million may rise from 3 million to 35 million by FY2030. The desire for a better lifestyle will, in turn, translate into more opportunities for financial service providers too.

Increased Financial Assets in Savings: Savings in the financial assets grew from 31% in 2012 to 41% in FY2020. Volatility in the stock market after COVID, the low-interest rates on fixed income products, and high liquidity mean some savings may still be in physical assets. But, CRISIL expects the share of financial assets in savings to increase between FY20 to FY25, boosting investment in insurance and mutual funds.

Key LIC Success Factors

LIC is one of the largest life insurers even after the liberalization with private players entering the industry. It had 286mn active policies on 31st March 2021, more than the fourth-largest populous country in CY2020.

LIC has a market share of 61.4% in New Business Premium (NBP) for both individuals and groups compared to the next largest competitor with a market share of 9.16% based on NBP. LIC’s NBP in FY21 was over 1.8 trillion, representing 66% of the cumulative industry NBP.

What could help LIC succeed?

- Having a great track record servicing customers and honoring claims

- Offering innovative and customized products

- Creating and maintaining a robust distribution network

- Efficient underwriting and cost management

- Increasing customer engagement

The most pertinent details are now available in this article. The information may help you understand the business, the environment in the country, and industry prospects to help you decide if you want to invest in the IPO or not.

Read More

- LIC IPO – The government made BIG changes over the last 2 years

- LICs Blue Chip Investments – Know Its Investment Value Today

Read more: About Research and Ranking.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/