ESG lending has gained significant attention in recent years due to the increasing focus on sustainable and socially responsible investment practices.

As businesses and financial institutions recognize the importance of addressing environmental, social, and governance (ESG) risks, the rise of ESG lending is an innovative solution to drive positive climate change while generating financial returns.

This article provides a comprehensive overview of ESG lending, including its definition, importance, benefits, challenges, and prospects.

What is ESG Lending?

ESG lending refers to integrating Environmental, Social, and Governance (ESG) considerations in the lending process. The rise of ESG lending reflects a growing awareness of the impact of businesses on the environment and society and the need to encourage sustainable practices.

Environmental factors considered in ESG lending include a borrower’s carbon footprint, energy efficiency, and resource management. Social factors include human rights, labor standards, and community engagement. Finally, governance factors consider the borrower’s management, including executive compensation, board diversity, and shareholder rights.

ESG Lending: Fundamental Principles

- Environmental sustainability: ESG lending requires the borrower to demonstrate that the project or business is environmentally sustainable. This includes minimizing environmental impacts, reducing greenhouse gas emissions, conserving natural resources, and promoting renewable energy.

- Social responsibility: ESG lending requires the borrower to demonstrate that the project or business is socially responsible. This includes promoting diversity and inclusion, respecting human rights, promoting fair labor practices, and supporting local communities.

- Good governance: ESG lending requires the borrower to demonstrate that the project or business has good governance practices. This includes promoting transparency, accountability, and ethical behavior.

- Risk management: ESG lending considers the risks associated with the project or business. This includes assessing the potential financial, environmental, and social risks and ensuring appropriate risk management practices are in place.

- Impact measurement and reporting: ESG lending requires the borrower to measure and report on the impact of the project or business. This includes reporting on environmental, social, and governance performance and the positive impact on stakeholders and the community.

ESG Lending: Importance

ESG lending incorporates environmental, social, and governance factors to drive positive change and mitigate financial risks, promoting sustainable practices and investments that benefit society. And the environment, encouraging socially responsible practices that promote fair treatment of employees and respect for human rights.

And community engagement promotes good corporate governance, mitigating risks associated with a borrower’s sustainability practices, reducing the risk of reputational damage and default, and improving the long-term performance of the lender’s portfolio.

ESG lending can provide several benefits to both lenders and borrowers

ESG lending can offer a competitive advantage for lenders by attracting socially responsible investors and borrowers who prioritize sustainability.

- Positive impact on the environment and society: ESG lending prioritizes sustainable practices and governance, positively impacting the environment and society by promoting reduced carbon emissions, improved working conditions, and better community engagement.

- Lower risks and higher returns: ESG lending can reduce risks associated with environmental and social issues, leading to better long-term financial performance and higher returns for investors by promoting sustainable practices and good governance.

- Enhanced reputation and branding: ESG lending can help improve the reputation and branding of lenders and borrowers. Companies prioritizing sustainable practices and social responsibility are often seen as more attractive to customers, investors, and employees, leading to increased brand value and a positive reputation.

Challenges of ESG Lending – Lenders, Borrowers and Investors

A survey conducted by the Foundation for Ecological Security (FES) and Access Development Services found that most Indian banks have ESG policies.

- They lack the necessary infrastructure and expertise to implement them effectively, with only 53% having dedicated teams or resources.

- Only 33% have a mechanism to measure and report on the impact of their ESG initiatives. The main challenges cited were a lack of awareness and understanding, limited resources, and the absence of a regulatory framework.

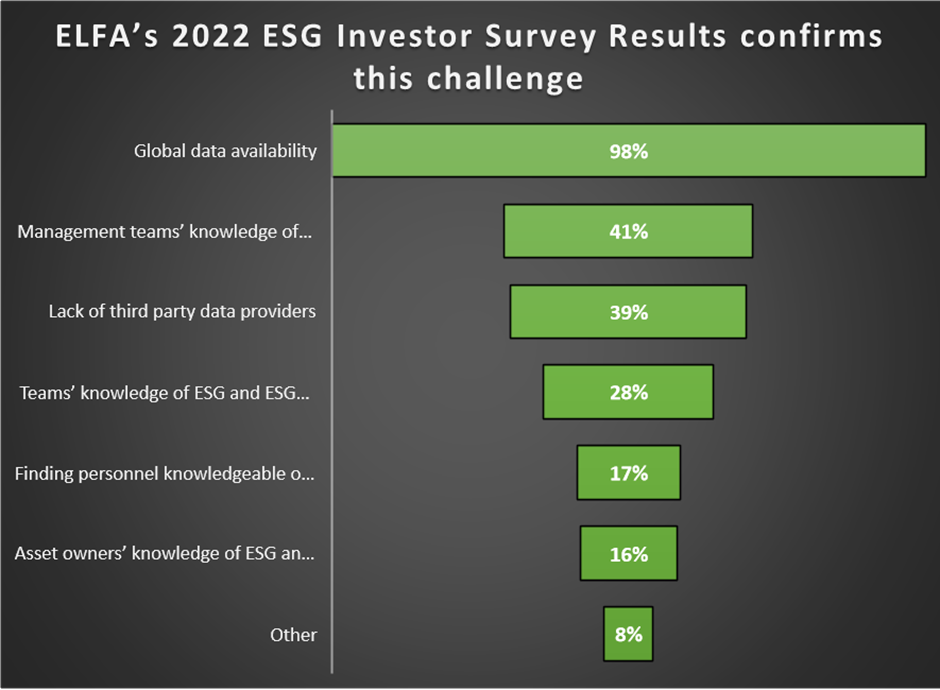

As you can see in the graph above, the lack of reliable ESG data and third-party providers challenges banks to undertake comprehensive ESG analysis.

ESG Lending in Real Estate

ESG factors can evaluate the environmental impact of a project, the social impact on the surrounding community, and the governance practices of the borrower in real estate lending. Lenders can then use this information to adjust the terms and conditions of the loan, such as offering lower interest rates for more sustainable projects or requiring borrowers to meet specific ESG performance targets.

However, there are challenges associated with ESG-based lending. One of the main challenges is measuring and reporting on ESG performance, which can be complex and require significant resources. Another challenge is aligning lending practices with ESG principles, which may require changes to traditional lending practices.

ESG-based lending has significant potential to improve the sustainability of lending practices and reduce risks for lenders, but it also requires careful consideration of the challenges involved.

Final Words

ESG Lending is still nascent and has good potential to drive positive change while generating financial returns. It promotes sustainable practices and good governance, reduces risks, and improves the long-term performance of lenders’ portfolios. However, challenges remain, such as measuring and reporting ESG performance and aligning lending practices with ESG principles.

FAQs

In what ways can ESG initiatives enhance investor relations?

By adopting a robust ESG program, companies can enhance communication with investors, comprehend their demands, and share progress. Additionally, investors, particularly asset owners and asset management institutions, increasingly anticipate comprehensive ESG policies and practices covering environmental, social, and governance concerns.

Could there be any ESG-related legal obligations?

Your jurisdiction might have legal and regulatory requirements concerning ESG issues like worker welfare, human rights, governance practices, and emissions. Typically, ESG legal requirements refer to measuring impacts and reporting. Various voluntary reporting standards exist to assist firms, and some nations may enforce them as laws in the future.

What is the function of ESG risk scores and ratings?

ESG scores or risk ratings help companies gauge their ESG performance, offer transparency to investors, enable specialized financing, benchmark performance, and aid fund managers in selecting sustainable investment options.

Related investing topics

How useful was this post?

Click on a star to rate it!

Average rating 4.4 / 5. Vote count: 7

No votes so far! Be the first to rate this post.