As a teenager, was instant noodle your favorite food like us? Not because it was healthy but because it was tasty and would be ready in just 2 minutes.

Two minutes, yes that was what the manufacturer claimed. Though it did take a little more than 2 minutes, we really wouldn’t mind as it was quick and instant.

We live in the era of fast food, where everyone wants instant results. Today we prefer to watch 20-20 matches in cricket, instead of 50 over matches, want one day delivery for our packages and like to eat ready to cook meals.

So, this expectation of quick service may explain why a majority of investors in the stock market in India have a short-term mindset.

But are quick results always better?

Are we becoming too focused on instant gratification (short-term benefits) that we are overlooking delayed gratification (long-term benefits)?

With an aim to understand long term gratification better, Walter Mischel, a Stanford professor conducted a thought-provoking experiment called the ‘Marshmallow Experiment’ in the year 1960.

Marshmallow is a chewy sweet made with sugar, water and gelatin. According to the experiment, a group of children were offered a marshmallow each. The researchers told the children that they were going to leave the room for 15 minutes. If the children didn’t eat the first marshmallow while they were gone, then that child would be given another marshmallow when they returned.

So the children had two choices. Eat a marshmallow now or wait and eat 2 marshmallows later.

Some children ate the first marshmallow as soon as the researchers left the room, while some tried to control themselves, but ultimately gave in to temptation a few minutes later. Few children however, did manage to wait the entire time and were rewarded with a second marshmallow.

The experiment did not just stop there but tracked the children’s progress as they grew up. It was observed that those children who waited patiently for the second marshmallow ended up having higher scores, lower likelihood of obesity, better responses to stress, and fantastic social skills.

In simple words, this series of experiments proved that the ability to delay gratification i.e. waiting for long term rewards, was critical for success in life.

Are you wondering why I am telling you about this experiment? Because we often hear people ask why invest for the long-term and who has seen five years?

We have only one question for such people. Will the world end in five years?

Obviously no. Neither will your responsibilities, expenses or desires. In fact all these will increase with age.

Many investors who had invested in TCS, L&T, Eicher Motors, and MRF, would have multiplied their wealth many times over a long term period. Unfortunately, most of them sold off these stocks early for a small profit.

Can you imagine the kind of wealth they would have created if they would have remained invested for a long term? If you wish you can also check out the outstanding performance of Research & Ranking’s model portfolio here.

Instant foods have their own perils. They are associated with health problems such as diabetes, obesity, heart disease. Similarly, investing for short term in stock market has several drawbacks such as:

Risk of financial loss

Short-term investing in stock market is very risky because it is very difficult to earn profits in a short period. Share prices may fluctuate wildly in the short term but grow steadily over the long term with increasing returns.

High brokerage costs

Every time you buy and sell stocks you have pay brokerage charges. So, the more you churn your portfolio, the more brokerage you must pay.

Depository expenses

Depository charges are applicable whenever you sell any shares from your Demat account.

Short term capital gains:

Short term capital gains from sale of shares held for less than 12 months before being sold are taxed at 15% (plus applicable surcharge and cess). So, even if you manage to make some profit through short term investing, your profit would reduce because of STCG.

Given the above drawbacks you know exactly why short term investing in the stock markets in India makes no sense. Short term investing cannot make you rich overnight. Only a lottery can do it. On the contrary, long term investing in the stock markets is a rewarding experience but requires patience, commitment, and the will power to remain calm when the market fluctuates.

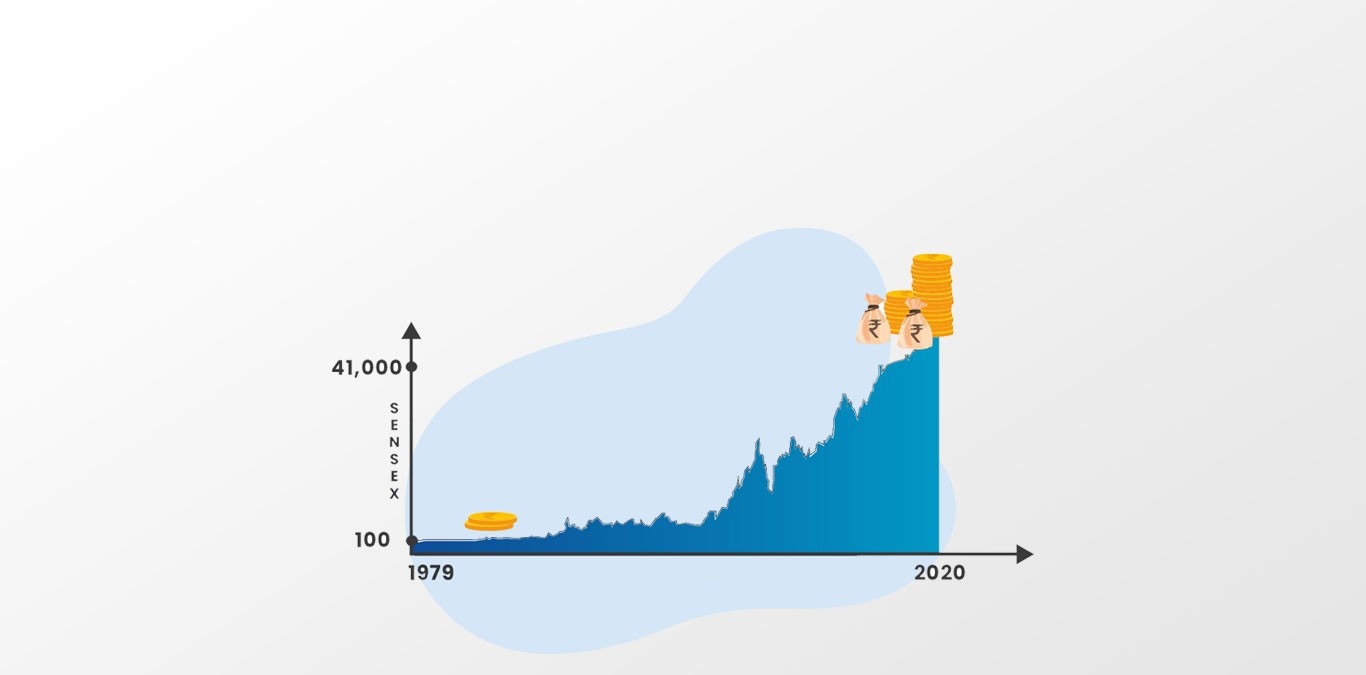

Only when you think beyond the short-term benefits and look at the long-term benefits of investing in the stock markets in India, you will realize its true potential to create enormous wealth for you.

Click here if you want to create wealth by investing in a personalized portfolio of 15-20 high conviction stocks.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.