“Where did the stellar IPOs disappear?” asked a colleague of mine.

“See, the slowdown in the markets despite the economic revival that has made companies put a brake on their going-public plans,” I answered.

In 2021, we saw the markets touch new highs with stellar listings of disruptive, new-age start-ups. As mentioned in our annual magazine Sage Page more than sixty companies raised a record-breaking Rs. 1.19 trillion via public issues in 2021. Zomato, Nykaa, PB Fintech, One 97 Communications, MTAR Technologies, and Devyani International are some companies that listed on BSE and NSE last year.

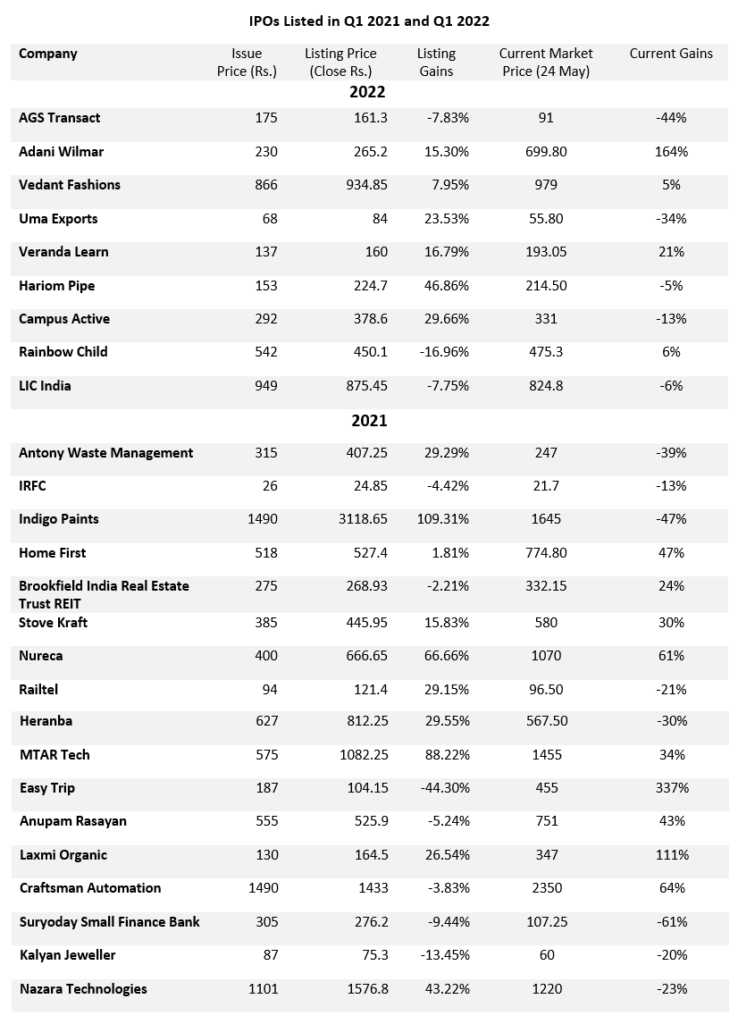

However, the IPO boom came to an end this year. For this article, we looked at the mainline IPOs in the first quarter of 2022 and 2021. In Q1 2021, 17 companies went public, of which 10 companies i.e., 59% listed with higher listing prices than the issue prices. But in Q1 2022, only nine companies went public, including the most anticipated LIC IPO. The number of deals dropped to 47% in Q1 2022.

A drop in the number of companies going public is not limited only to India. Developed economies like the United States and the United Kingdom have witnessed a similar trend. According to an EY report, “Global IPO market experiences significant slowdown in Q1 2022”, despite the strongest first month (January) in more than two decades by proceeds, Q12022 global IPO volumes tanked 37%, and the proceeds plunged 51% year-on-year (YOY).

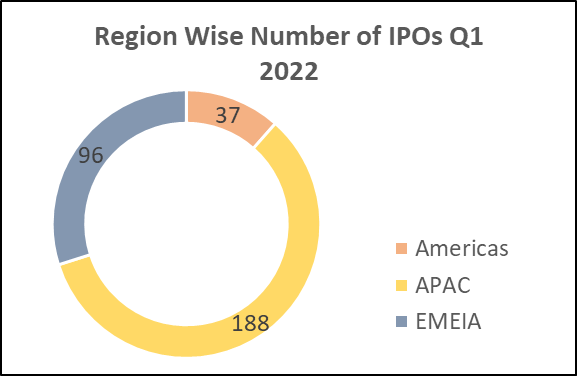

Global IPOs Proceeds and Deals

IPOs in the Americas* region completed 37 deals in the first quarter of this year, raising $2.4 billion in proceeds. It is a decline of 72% in the number of IPOs and a 95% drop in proceeds YOY, the report noted.

The Asia-Pacific countries registered 188 IPOs raising $42.7b in proceeds, a decline of 16% for volume but an increase of 18% in the money raised.

EMEIA** market IPO activity in Q12022 reported 96 deals and raised US$9.3b in proceeds, a decline of 38% and 68%, respectively.

*The Americas region includes complete North and South America.

**EMEIA stands for Europe, Middle East, and Africa

What’s Stopping Companies from Going Public?

Several obstacles have put a brake on the IPO boom globally. We list the reasons below:

Interest rate hikes

Major economies cut the interest rates to limit the economic impact of the pandemic. Fed rate cut brought foreign institutional investors (FIIs) to emerging markets like India. This move offset the pandemic blow but cheap money sent inflation through the roof. As a result, central banks decided to hike rates, pulling excess liquidity from the economies.

The Reserve Bank of India and the Monetary Policy Committee (MPC) held an unplanned meeting earlier this month. They announced a rate hike of 40 basis points, changing the repo rate from 4.00% to 4.40%. The decision shook the markets.

Companies had anticipated the potential risk of an interest rate hike, so many halted their plans to go public.

Corrections in the over-valued stocks from recent IPOs

Over the last year, many new-age start-ups went public and achieved higher valuations. The likes of Zomato and Nykaa listed at 65.59% and 96.15% premium, respectively. However, the stock prices dropped swiftly this year. Some new-age start-ups that listed at high valuations are down between 40% and 60%.

| Company | Listing Price (Rs.) | CMP (Rs.) | % Change |

| Zomato | 125.85 | 65.45 | -48% |

| PB Fintech | 1202.9 | 696 | -42% |

| Nykaa | 2206.7 | 1408 | -36% |

| CarTrade | 1500 | 607 | -60% |

| Paytm | 1564 | 643.7 | -59% |

Geopolitical Tensions

Russia’s attack on Ukraine was unfathomable. Economies, as well as the corporate sector across the globe, had not anticipated it. It forced many companies in the EMEIA region to postpone their IPOs or look for alternatives to raise money. While it is difficult to time the market entry for companies, many have decided to delay their IPOs until the tensions calm down.

The Markets Are In Red

Due to the reasons mentioned above, global markets are in the red. Both Sensex and Nifty are down between -8 and -8.5% on the year-to-date (YTD) basis. Their global peers such as NASDAQ Composite (-27.14%), Standard & Poor (S&P) 500 (-17.15%), Hang Seng (-13.59%), and FTSE (-0.21%) are down, too.

It was not the case last year. The markets reached new milestones thanks to the surplus liquidity-led Bull Run. As a result, more companies launched their IPOs.

It implies that the market performance, and the number of IPOs are directly correlated. As the adage goes, it pours when it rains. It means that when a bad incident occurs, there will be others.

Here it means, that the markets are volatile. So, the companies have delayed their IPO plans.

Such unfavorable market conditions have made High Net worth Individuals (HNIs) – the highest bidders in recent IPOs, hold back from investing more money in IPOs than permitted.

Let us put this into perspective. According to an article in The Economic Times, combined bidding by HNIs in nine IPOs launched since 1 April 2022 was Rs. 15,900 crores. However, Nykaa alone received bids worth Rs. 91,000 crores from the same category of investors last year.

You see how all category of investors change their outlook about the market debutants when the markets are volatile.

Does this mean you should stop investing in IPOs?

No! You may continue to bid for the public issues, but don’t do it from the listing gains perspective. Investing in a company means buying a part of ownership. Like when you buy a house with a long-term outlook, treat your equity investments similarly.

Read more: About Research and Ranking.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Vinay Mahindrakar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/