Merger and Acquisition activities are in full swing this year. After companies from the Media, Banking, Financial Services and Insurance sector (BSFI), and Fast Moving Consumer Goods (FMCG), players from the Information Technology (IT) are riding the bandwagon now.

We are talking about the fresh amalgamation announcement of L&T Infotech (LTI) and Mindtree a deal that was widely speculated and hinted at. The merger deal is worth ~$3.5 billion and the merged entity will be called LTI Mindtree.

Before you know more about the deal in detail, did you know that Mindtree is also part of the engineering and construction behemoth Larsen & Toubro (L&T) group?

L&T acquired stake in Mindtree in 2019

Founded in 1996, LTI made an attempt to buy the ailing Satyam Computers in 2019. But Tech Mahindra beat LTI and bought Satyam Computers the same year.

Soon another opportunity came LTI’s way. Late Café Coffee Day founder, V.G. Siddhartha, riddled with debt obligations decided to sell his 20% stake in Bangalore-based Mindtree to L&T. Industry experts deemed it a “hostile takeover”. Following the merger, the employees took to social media to voice their concerns.

After the acquisition, both L&T and Mindtree traded separately on the exchanges. Mindtree’s share price rose four times while the Nifty IT index increased only two times. LTI’s share price performance also beat the broader market and the IT Index.

Now the group has decided to merge both Tier-II IT players to form a bigger entity.

| Tier-II Company means a mid-size company based on the size and market capitalization. TCS, the #1 IT services provider in India is a Tier-I company with a market capitalization of ~Rs. 12.6 lakh-crore. The market capitalization of LTI and Mindtree is Rs. ~50 thousand-crore and Rs. ~75 thousand-crore respectively. *The market cap figures are as of 17 May 2022. |

Birth of LTI Mindtree

The merger announcement came in last week; however, the transaction is expected to complete within 9 to 12 months. With the exit of LTI’s CEO, Sanjay Jalona, Mindtree’s CEO Debashis Chatterjee will lead the new entity LTIMindtree. After the merger, shareholders will get 73 shares of LTI for every 100 shares of Mindtree

Wondering why the L&T group wants to merge operations of LTI and Mindtree to form a new entity. The reasons behind the amalgamation are valid and make sense.

Firstly, LTI and Mindtree are two medium-sized IT companies, and the problem lies there. Large (Tier-I) IT companies have an advantage over Tier-II and Tier-III players when it comes to acquiring contracts, geographical expansion, attracting talent at a reasonable cost, etc. So, the merger enables LTIMindtree to compete for large-scale deals.

Secondly, both companies cater to different business verticals. While LTI has gathered major contracts from BFSI, Manufacturing, Retail, Healthcare, and Energy sectors, Mindtree provides services to Communication and media technologies (CMT), transport, and hospitality segments. BFSI contributed ~46% to the LTIs revenue mix in FY22, while CMT contributed ~45% to Mindtree’s revenue mix the same year.

Once these two entities merge, LTIMindtree will have a diverse portfolio of services under one roof. In addition to this, the deal will

- Provide access to a wider talent pool

- Bring in the combined client base of ~750 under one umbrella

- Provide the new entity with a negotiating muscle

- Bring in a diversified suite of services to cross-sell

- Consolidate several delivery centers

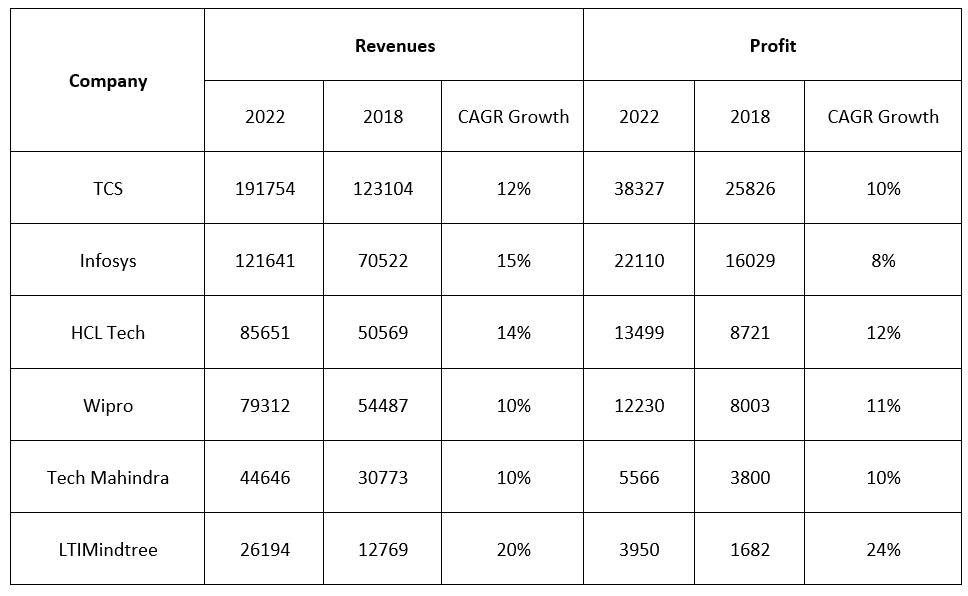

The combined entity will not only join the league of large IT companies but will also become the sixth-largest IT player in the country behind Tech Mahindra. Look at the table below to know where the company stands among peers and its growth rate.

The table above clearly indicates that LTIMindtree’s combined revenue and net profit grew at a CAGR of 20% and 24% respectively. However, the IT giant TCS saw its revenue and net profit compound at 12% and 10%. That is nearly half of LTIMindtree.

These growth metrics state that LTIMindtree has performed better than its peers. But, are these growth metrics enough to compete with large players?

No!

Roadblocks on the way

There are several roadblocks that can affect the steady outlook for LTIMindtree.

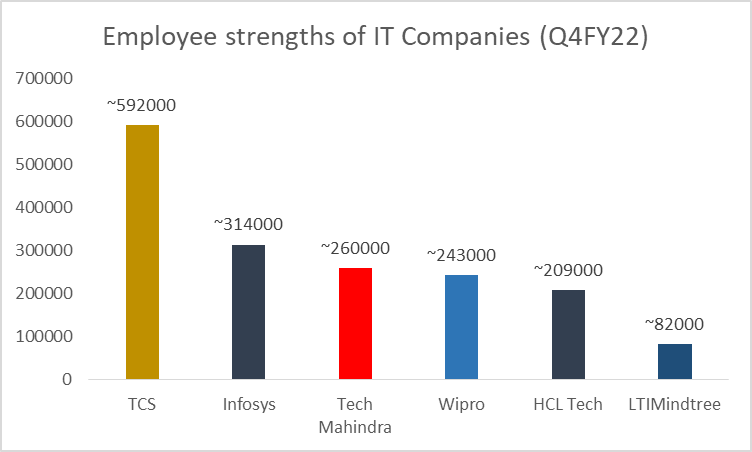

A) Low employee strength

The profitability alone does not guarantee a strong foothold in the industry. The stock markets tend to value Tier-II companies higher than large caps because of their higher growth rate. But with reference to the balance sheet, employee strength, and geographical expansions the combined entity still lacks in size.

Over the past five years, employee expenses have been growing faster than revenue for LTI. IT talent is already scarce and there is a persistent problem of attrition across the industry. The resignation of LTI CEO Sanjay Jalona has shocked the industry experts. They see it as an abrupt exit.

B) Building capabilities to Compete for large deals

LTIMindtree must continue the pace at which it is growing, develop its brand, and bolster balance sheets to compete with the likes of TCS and Infosys. Without realizing these factors, the merged entity may not be able to achieve large-scale deals.

| Note: The IT industry has something known as large deals. Usually, these are valued at over $10Mn. |

Tier-I heavyweights bag large deals usually. Currently, TCS and Infosys combined have close to four thousand deals, while LTI and Mindtree combined have around six hundred deals.

Number of Deals

| Deal Value ($Mn) | LTI | Mindtree | TCS | Infosys |

| 1Mn+ | 198 | 139 | 1182 | 853 |

| 5Mn+ | 74 | 56 | 638 | NA |

| 10Mn+ | 44 | 32 | 439 | 275 |

| 20Mn+ | 24 | 14 | 268 | NA |

| 50Mn+ | 8 | 1 | 120 | 64 |

| 100Mn+ | 1 | 1 | 58 | 38 |

C) Concentrated revenue stream

Another roadblock LTIMindtree may face is the over-dependence on the Americas region for business. Tier-II IT companies usually struggle to expand geographically because opening new centers need huge capital and talent acquisition ability.

An article in the Economic Times notes, that the Americas account for 69% of the total revenue for LTIMindtree, Europe contributes 17% and the remaining 14% come from the rest of the world. However, for TCS and Infosys 40% to 45% of their revenues come from regions other than North America. They use this strategy to hedge revenues from the economic crisis in any one country.

The endnote

In our opinion, despite the roadblocks, LTIMindtree synergy looks like a great combination. Both companies have different strengths and stronger relationships with their business partners. There is little scope for overlap in services and clients as we saw both the companies essentially cater to different sectors. While Mindtree is famous for data and analytics, L&T has a strong muscle in cloud services.

Moreover, LTIMindtree will be backed by an engineering and construction behemoth L&T group with a ~69% stake in the merged entity.

The merger will deliver higher value for all stakeholders-

- End-to-end solutions under one roof for all needs with deeper domain expertise will create value for customers.

- Broader collaboration opportunities improved integrated solutions, and stronger implementation capabilities will strengthen the bond with business partners.

- Consolidation of financials, headroom for profitability, and the opportunity to win large-scale business deals will create higher value for investors’ money.

That’s it from us. We hope we could add to your knowledge about LTI and Mindtree through this article. If you think we missed something, let us know by writing to us at createwealth@researchandranking.com.

Read more: About Research and Ranking.

How useful was this post?

Click on a star to rate it!

Average rating 3 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Vinay Mahindrakar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/