India has seen a noticeable rise in the percentage of women in the workforce, from entry-level to executive positions, due to multiple favorable factors. However, according to a Tata AIA Life Insurance survey, women are still hesitant to make independent financial decisions.

Financial Awareness Survey by Tata AIA Life Insurance Included

Tata AIA Life instructed the specialized brand research firm eRusaem to study how familiar women are with money and how empowered they are to make financial decisions. The sample size for the study consisted of a total of 1000 respondents from 18 significant Indian cities, including metropolises and Tier 1 and Tier 2 markets. They were 25 to 55 years old.

According to the survey about financial awareness, 59% of career women who responded do not make financial decisions on their own, despite being the earners for the household. At the same time, 56% of married career women are not allowed to make financial decisions. However, 44% of women are confident in making financial decisions.

Key highlights from the Financial Awareness Survey by Tata AIA Life Insurance Included

- Women believe their families’ financial security is more important than their own

- 59% of working women do not make their own financial decisions

- 39% of women believe financial planning is limited to monthly budgeting.

- Off the 42% of women who understand financial planning better, only 12% are housewives.

- 44% of women prefer making their own decisions if they are given a chance to do so.

- 72% of women believe life insurance is crucial to their financial planning after the pandemic

Impact of marriage on financial decisions

According to this survey, 89% of married women rely on their spouses for financial planning. Before the wedding, the father is responsible for financial decisions for the woman, which are then tacitly passed on to the husband after marriage. The survey found that because the average age of women getting married is 20-22 years, they are not free to make financial decisions. Thus, marriage is one of the most powerful barriers to women’s financial independence.

The freedom to make financial decisions

Financial planning only includes creating the monthly budget for 39% of the women surveyed. In addition, only 12% of the 42% of women who understand financial planning better are homemakers.

Per the survey findings, being financially independent does not necessarily imply having the freedom to make financial decisions for women. It is higher in Tier III markets, where 65% of working women cannot make financial decisions.

Although the passionate narrative of women’s empowerment and gender equality has been extensively discussed over the years, this behavior persists. Additionally, laws that discriminate against women have been strengthened, and there has been a positive change in women’s status in society over time. However, women do not have the final say regarding financial planning.

The Intention of Women in Financial Planning

However, 44% of women prefer to make their own financial decisions when given the option. In tier-2 markets, women are warming to the idea of making their own financial decisions, which is encouraging. However, this change could be aided by increased awareness of their rights and a general lifestyle improvement.

When asked about priorities, the survey found that women prioritize their family’s financial security over their own. Among the various financial instruments, 62% of women prefer to invest in bank FDs to benefit their families. When asked about their preference, they trusted their spouse’s decision.

Women’s insights on life insurance

72% of women believe life insurance is essential to their post-Covid-19 financial planning. Respondents from Tier III cities express a more positive sentiment about this. Savings plans and term insurance were the two most popular life insurance products. Pension plans and ULIPs are the options that are least preferred. After thoroughly understanding the different types of life insurance policies, women chose ULIPs and term insurance options.

“Trust” is vital to 75% of respondents in the survey, and they would invest in a company in which they have faith. A thorough understanding of the product, in addition to online channels and social media reviews, is an essential factor in the purchase decision. Furthermore, women are willing to invest in life insurance but expect to pay a lower premium. They are also looking for guaranteed income through the policy.

Women & Money Power 2022 report Axis My India Survey by LXME – India’s first financial planning platform for women

In another survey conducted with Axis My India by LXME, a financial platform for women, 33% of Indian women make no investments, with the percentage rising to 40% for those aged 21 to 25. Moreover, 55% of women in the country either do not invest or are unaware of their investments.

This survey included 4,000 women of various ages, life stages, and occupations from metros, Tier II, and Tier III cities. It reveals where women stand on financial planning.

Women’s spending and saving patterns

Although it is generally accepted that women are excellent savers, the LXME report indicates that 78% of women save less than 20% of their income, 56% save less than 10%, and 14% do not save any money. Therefore, most women must adhere to the golden saving rule that they should save at least 20% of their income.

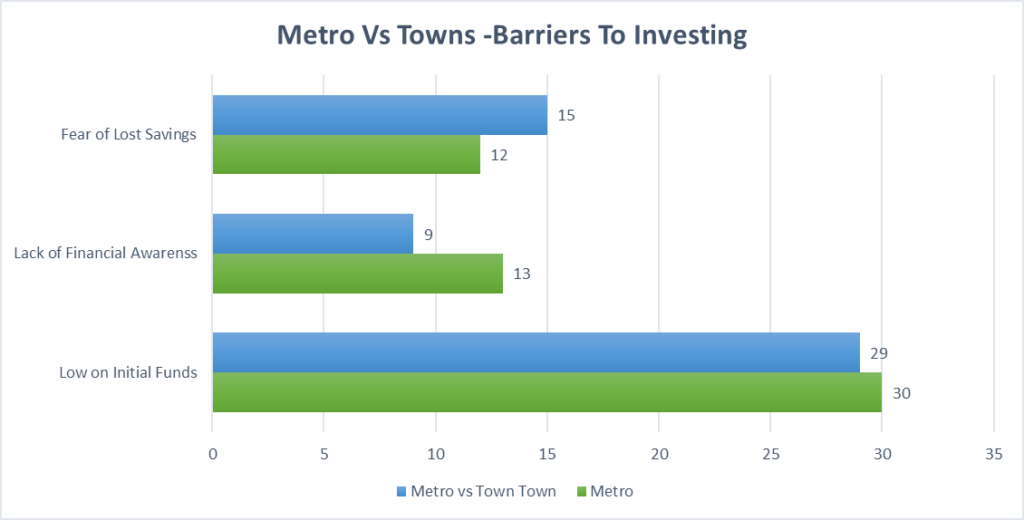

The majority of women only invest 6-10% of their income. This could be attributed to investment hesitations primarily from a lack of knowledge. A staggering 92% of women said they do not visit any financial investment websites. According to the participants, 39% of women mentioned a shortage of funds as a reason for not investing their money. Following this are a 12% lack of financial awareness and a 10% fear of losing savings.

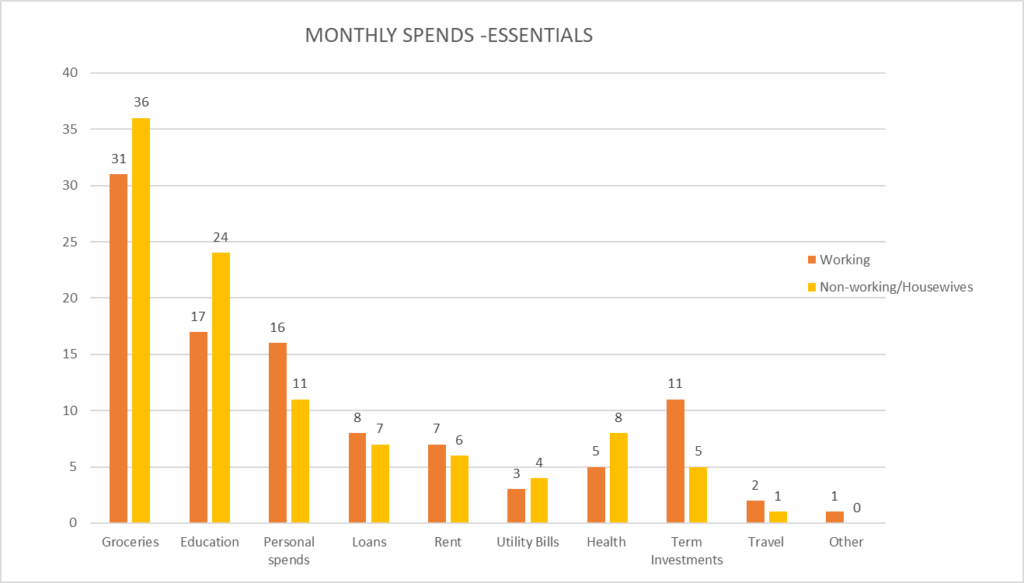

The graph highlights both working women and Homemakers spend more on groceries.

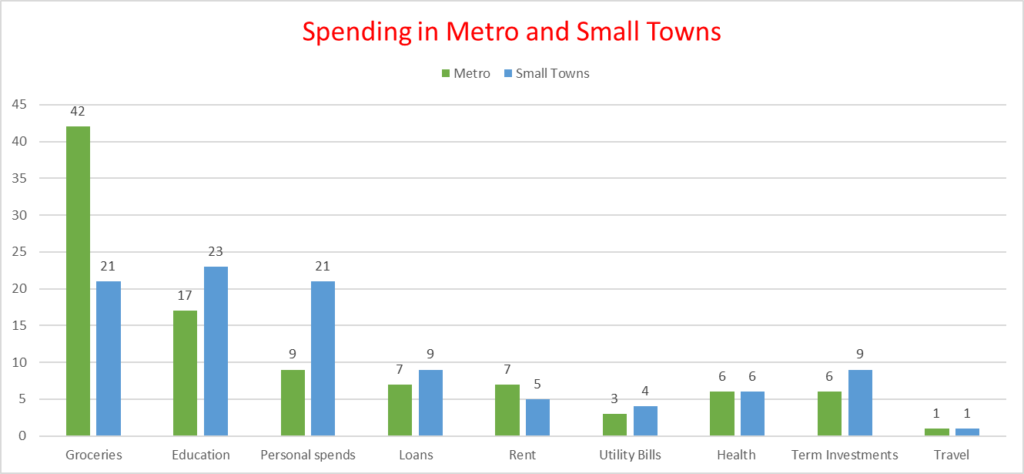

Comparing trends of women living in metro vs. small towns, grocery spending is still higher than any other essentials, per the survey report.

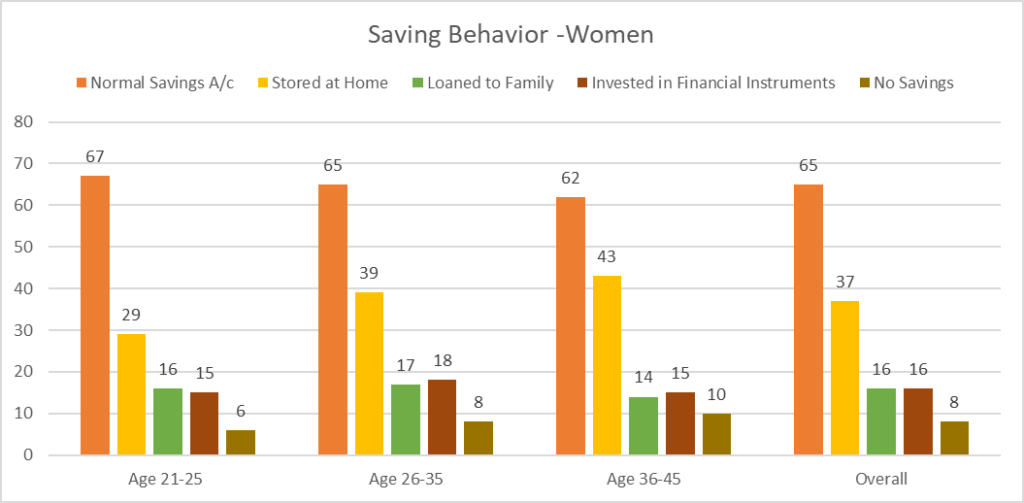

Women’s Saving Behavior

Most women park their money in a regular Savings Bank Account. Following that, the money is kept at home for any financial emergencies. But women between the age of 21-45 are starting to invest in different financial instruments.

Women’s Investing Trends

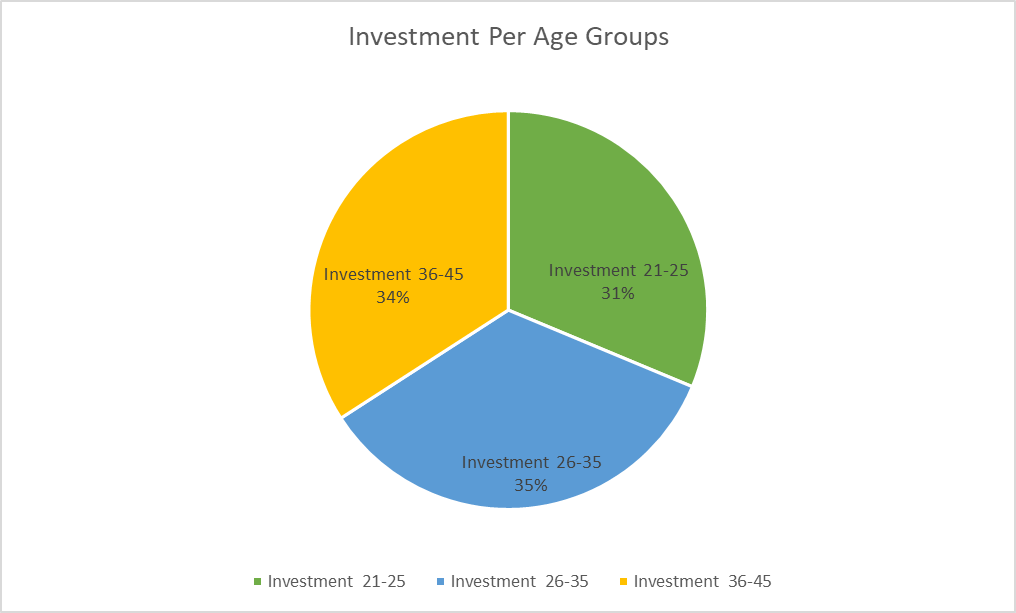

Among the survey respondents, over 71% of women of all ages are investing, while 29% don’t. However, the survey found women over 26 years preferred investing their money in different financial instruments.

The pie above gives you a better idea of investment trends among women based on their age. The LXME survey shed light on female investors’ preferences too. Despite the two-year pandemic, 59% of women still do not have life or health insurance.

Women prefer the following investment instruments.

| Financial Instruments | Women’s Investment Trend (%) |

| Gold | 42% |

| Fixed Deposit | 35% |

| Public Provident Fund (PPF) | 23% |

| Mutual Funds | 14% |

| Stocks | 10% |

| Chit Funds (Traditional Instruments) | 17% |

Only 13% of women invest in financial assets, compared to 35% in traditional instruments like fixed deposits.

Significant Barriers To Investing

The top three barriers that women face when making financial decisions about investing are

- Low on initial funds to invest in stocks and mutual funds

- Lack of knowledge about financial products

- Fear of losing their money.

It’s time for women to take control of their financial decisions

The survey above is a wake-up call for women to step up and educate themselves about financial products and regulations that can help them be financially free. As much as keeping your family financially safe is important, it is also vital for you to be financially secure. You are the role models of the family. Being financially independent can help you fulfill your goals independently.

Here’s a four-step process to protect your financial future

- Budgeting your expenses: You must first create a budget for all of your expenses. Then, you can either use an electronic application to keep track of all your expenses or a separate book to maintain records. Budgeting is crucial because it’s easier to spend money than save. Additionally, you must budget for an emergency fund, which covers at least six to nine months of expenses.

- Invest: Create financial goals and invest across various asset classes to maximize your investments. Make a monthly contribution toward these investments based on your financial objectives. Instead of keeping your money in FDs and gold, invest more in growth assets like stocks, as they will yield higher returns over the long term.

- Insurance is essential: Choose health insurance that covers all illnesses and unexpected accidents, as it can protect you from a mountain of medical debt. If you already have these, you must check your Insurance to ensure you have enough coverage to meet future needs. If not, you should increase your level of protection.

- Gain financial knowledge: You must develop your financial knowledge and understanding when you are entirely independent and may have to remain so. As much as you can, read more about financial concepts and terms in books and on the Internet. Making informed financial decisions and choices is essential, as is raising your level of financial literacy.

As a married woman, your relationship with money changes. With little or no income, your first step is to create a source of income. Have a candid financial discussion with your spouse and upskill if you need more financial knowledge. Create joint and individual financial goals. Investing in different asset classes can generate passive income, which will help you achieve your financial goals.

So, while saving is the first step to creating wealth, you must make your money work for you. Be ready to make a few financial decisions to help you achieve all you’ve set out to do. If you are confused with many investment options available, then connect with your financial advisor, who can help you build a financially secure life.

Final Words

Financial literacy plays a significant role in women’s financial decision-making. Whether you budget for your home or want to create a financial plan, deciding on the plan’s components is a must. Both these surveys found women had plenty of input once they understood the financial product and its benefits.

Not only traditional instruments but investing in equities long-term will help you create wealth. This article on why women must invest in the stock market will help you understand better.

Want to achieve your long-term financial goals? Then begin by investing equity. To get started, check out the 5 in 5 Wealth Creation Strategy, a customizable portfolio of the best long-term stocks that will help you diversify, reduce risk, and boost returns. Begin now by investing in equity.

FAQs

1. How can a woman achieve financial security?

While the gender pay gap still exists, women can ensure their financial safety by understanding their finances, saving money, creating sound financial planning, setting financial goals, building credit, minimizing high-interest debt, and developing a relationship with their preferred bank.

2. How can women accumulate wealth?

Here are steps women can follow to become wealthy:

1. Set aside at least 10% of your income for savings.

2. Develop a saving mindset.

3. Take a look at Financial Plans.

4. Understand your risk tolerance

5. Hire a professional guide

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.