Introduction

If we ask you to name India’s biggest wealth destroyers, Yes Bank would probably be the first to come to your mind. Over the last five years, the Bank has seen it all – from being a darling of investors to being bailed out by SBI and other banks to raising multiple rounds of capital and finally turning profitable.

Let us understand more about Yes Bank

Yes Bank Overview

Yes Bank Limited is a private sector bank in India, headquartered in Mumbai. It was founded in 2004 by Rana Kapoor and Ashok Kapoor and started its operations in 2005. Yes Bank offers a wide range of banking and financial services to retail, corporate, and institutional customers.

The bank has a network of over 1,192 branches and 1,300+ ATMs across 300 districts of India, and it also has a presence in Singapore, Dubai, the United Kingdom, and the United States. Yes Bank offers various products and services, including savings accounts, current accounts, fixed deposits, loans, credit cards, insurance, and investment options.

However, Yes Bank faced financial difficulties in recent years, and the Reserve Bank of India (RBI) had to intervene in March 2020 to restructure the bank’s operations and management. As a result, the RBI imposed a moratorium on Yes Bank and capped withdrawals at INR 50,000 for a month. The government of India also approved a reconstruction scheme for Yes Bank, which involved the infusion of capital by the State Bank of India and other investors.

Since then, Yes Bank has been working to improve its financial position and operations. The bank has also been focusing on digital transformation and has launched various initiatives to enhance its digital capabilities and offer innovative products and services to its customers.

Yes Bank Company Journey

Here is a brief timeline of significant events in the journey of Yes Bank:

- 2004: Yes Bank was founded by Rana Kapoor and Ashok Kapoor.

- 2005: Yes Bank started its operations as a private sector bank in India, with its headquarters in Mumbai.

- 2007: Yes Bank listed its shares on the Bombay and National Stock Exchanges.

- 2010: Yes Bank acquired the retail banking business of the Bank of Punjab.

- 2015: Rana Kapoor was named the Entrepreneur of the Year at the Economic Times Awards for Corporate Excellence.

- 2016: Yes Bank became the first Indian bank to partner with the London Stock Exchange to launch a green bond to raise funds for renewable energy projects in India.

- 2018: Yes Bank reported a gross NPA (non-performing asset) ratio of 1.31%, higher than the RBI’s threshold of 1%.

- 2019: The RBI raised concerns about the bank’s governance and risk management practices, and the bank’s shares started to decline in value.

- March 2020: The RBI imposed a moratorium on Yes Bank and capped withdrawals at Rs. 50,000 monthly.

- April 2020: The RBI announced a draft reconstruction scheme for Yes Bank, which involved the infusion of capital by the State Bank of India and other investors.

- July 2020: The government of India approved the reconstruction scheme for Yes Bank, and the bank’s operations resumed.

- November 2020: Yes Bank launched its ‘Loan in Seconds’ digital lending platform, allowing customers to instantly get personal loans and credit cards.

- January 2021: The bank raised Rs. 3,000 crores through a qualified institutional placement (QIP) of shares, which helped to improve its capital adequacy ratio.

- April 2021: It reported a net profit of Rs. 207 crore in the first quarter of 2021, a significant improvement from the net loss of Rs. 1,506 crore in the same quarter of the previous year

Yes Bank Management Profile

Mr Prashant Kumar was appointed as the Managing Director and CEO of Yes Bank in March 2020. He has over 35 years of experience in the banking industry and has worked with various banks, including SBI, where he served as the CFO.

Mr Sachin Raut has been recently appointed as the COO of Yes Bank. He was the Country Head of Retail and Corporate Operations earlier. He has been part of the management team overseeing business operations spanning all dimensions of retail and corporate functions. Before this, he was associated with large and mid-size private banks and held several leadership positions.

Mr Niranjan Banodkar is Yes Bank’s Chief Risk Officer (CRO). He joined the bank in August 2020 and has worked with various banks, including HSBC and Deutsche Bank. Before joining, he was the Head of Risk for Standard Chartered Bank’s retail banking business in India. Banodkar has also worked with ICICI Bank, where he was responsible for credit risk management and portfolio quality monitoring.

Mr Anurag Adlakha is the CHRO at Yes Bank. Adlakha has over 25 years of experience in senior technology leadership roles across Citibank, HDFC Bank, and Standard Chartered Bank.

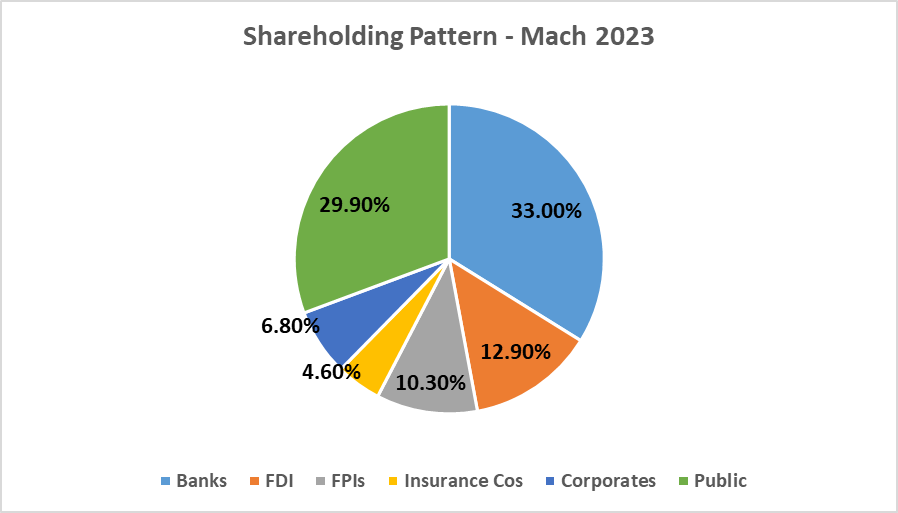

Yes Bank Shareholding Pattern

Yes Bank Business Segments

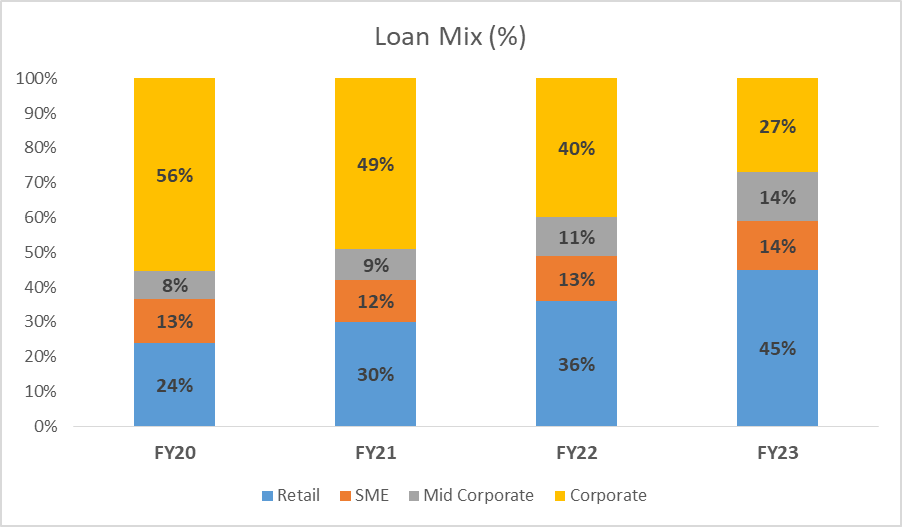

Since the bailout by SBI and other lenders in March 2020, Yes Bank has been focusing on reducing its corporate exposure and strengthening its retail offerings as part of its turnaround plan.

As seen in the chart below, Retail advances share as a percentage of Net Advances has grown from 24% to 45% from Mar 2020 to Mar 2023.

Yes Bank Financials

Core Operating Profit & Net Profit

The Bank is going through a turnaround phase and has posted profits after booking losses for two consecutive years in FY20 and FY21. The company has reported a total income of Rs. 11,844 crores during the Financial Year ended March 31, 2023, compared to Rs. 9,760.30 crores during the Financial Year ended March 31,2022.

The company has posted a net profit of INR 717 crores for the Financial Year ended March 31, 2023, as against a net profit of INR 1066 crores for the Financial Year ended March 31, 2022.

| In INR Cr. | FY19 | FY20 | FY21 | FY22 | FY23 |

| Interest Income | 29,624.8 | 26,066.6 | 20,041.8 | 19,023.5 | 22,697.4 |

| Interest Expense | -19,815.7 | -19,261.4 | -12,613.2 | -12,525.7 | -14,779.9 |

| Net Interest Income | 9,809 | 6,805 | 7,429 | 6,498 | 7,918 |

| Non-Interest Income | 4,590 | 3,441 | 3,341 | 3,262 | 3,297 |

| Operating Income | 14,399 | 10,246 | 10,770 | 9,760 | 11,215 |

| Profit After Tax | 1,720 | -16,418 | -3,462 | 1,066 | 717 |

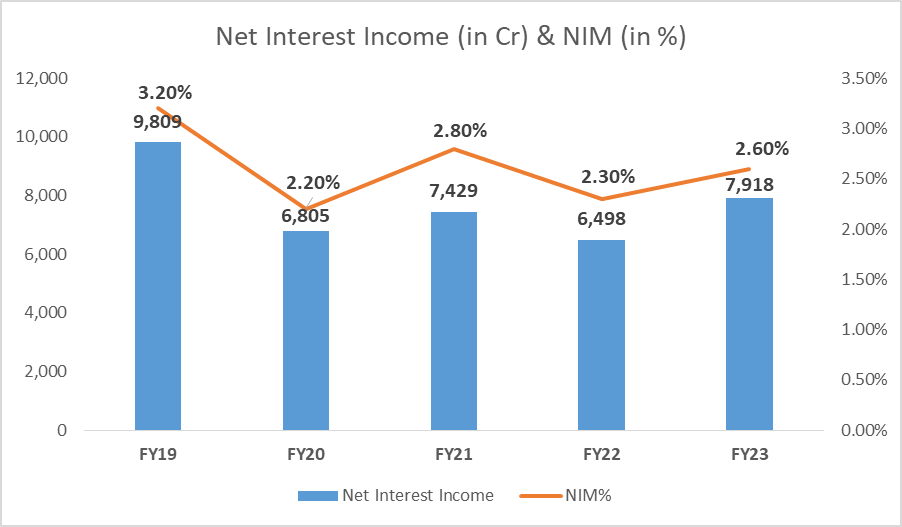

Net Interest Income & Net Interest Margin

Net Interest Income (NII) is the difference between the interest earned on a bank’s assets (such as loans and investments) and the interest paid on its liabilities (such as deposits and borrowings). The Bank reported Net Interest Income at INR 7,918 Cr for FY23, up 21.8% from INR 6,498 Cr posted in FY22.

Net Interest Margin (NIM) is calculated by dividing the NII by the average interest-earning assets. The Net Interest Margin stood at 2.6% for FY23, up 30 bps from 2.3% posted in FY22.

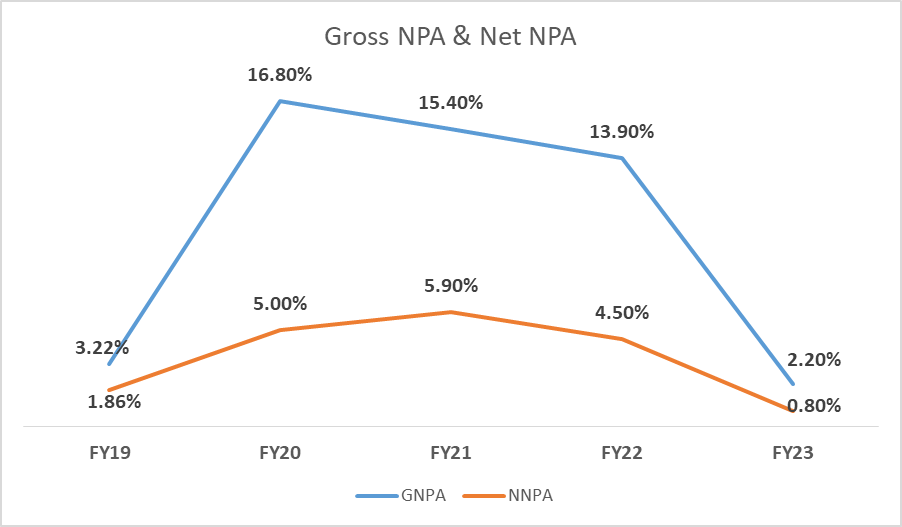

Asset Quality

NPA stands for Non-Performing Asset. It refers to a loan or an advance where the borrower has not paid the interest or the principal amount for a specified period, usually for 90 days or more.

Gross NPA refers to the total value of a bank’s non-performing assets. Net NPA, on the other hand, is the value of NPA after reducing the provisions made by the bank to cover the losses that may arise from such non-performing assets.

The Bank has significantly improved its asset quality over the last three years. As a result, the Bank reported a Gross NPA of 2.2% for FY23 against 13.9% last year in FY22. Similarly, Net NPA also reduced to 0.8% in FY23 from 4.5% last year in FY22.

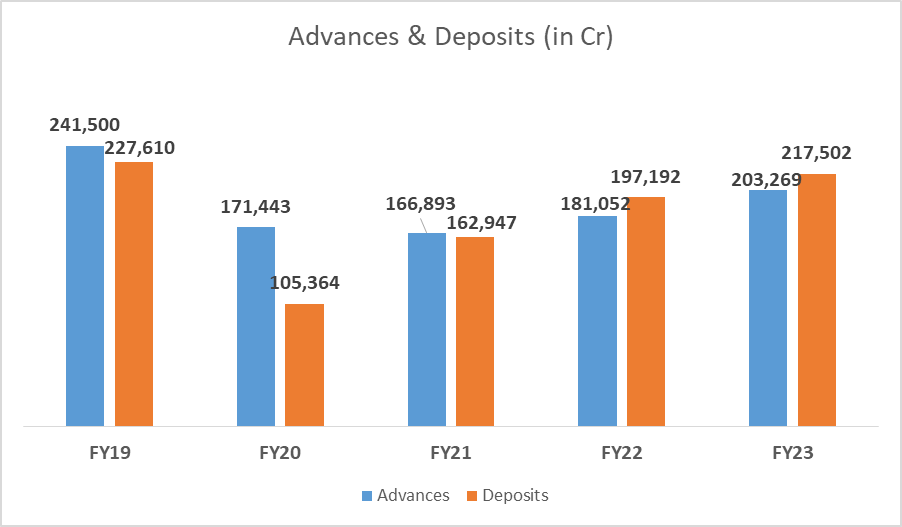

Advances & Deposits

An advance refers to a loan or credit extended by a bank to its customers. Banks offer various advances such as personal, business, home, education, vehicle, and credit card loans. Deposits are a critical source of funding for banks, and they use these funds to provide loans and advances to customers.

Advances grew at a healthy 12.3% y-o-y, led by Retail and Mid-Corp, while the corporate book de-grew during the same time. Deposits grew at 10.3% y-o-y and 2.1x since the reconstruction of the bank amidst a challenging backdrop.

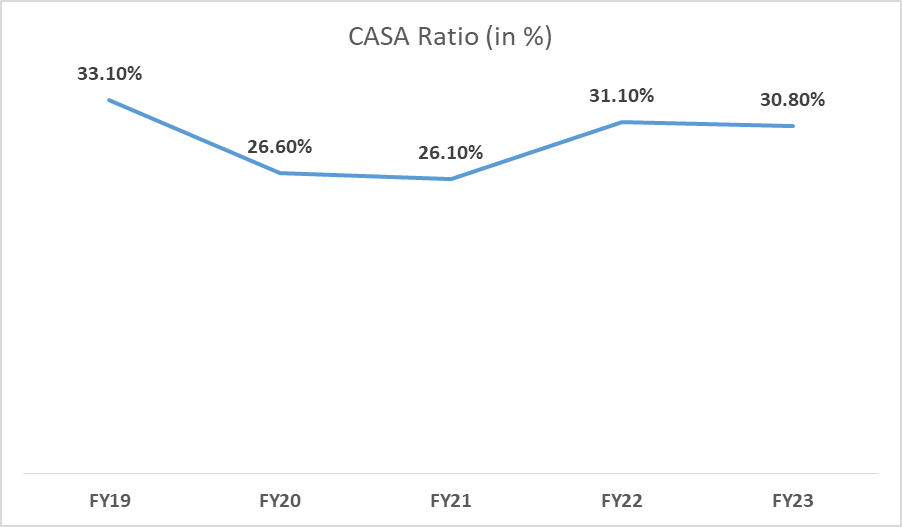

The bank’s average CASA (Current Account & Savings Account) deposit growth is 26.3% y-o-y, and the average CA (Current Account) growth is 30%. The bank continues to focus on growing better CASA deposits, which will help it reduce the overall cost of deposits and manage liquidity.

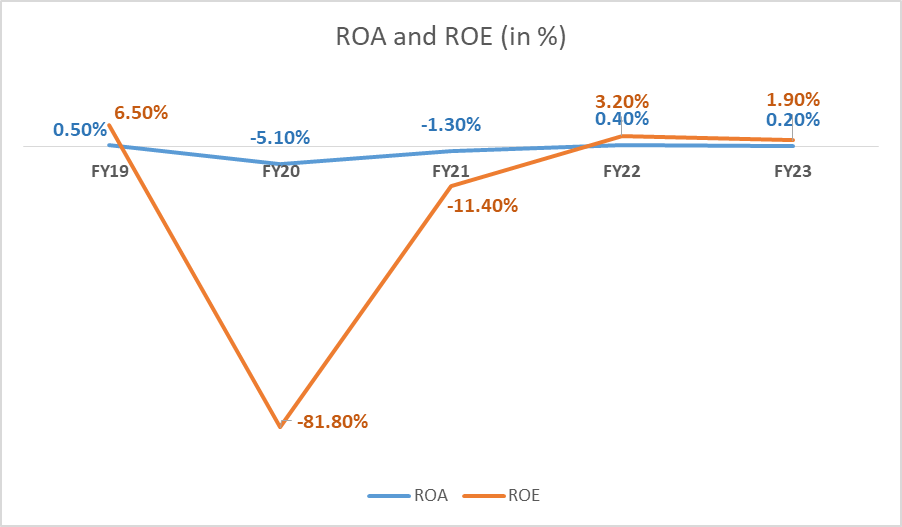

Improving Return ratios (ROA & ROE)

Yes bank has been improving its RoA (A higher RoA suggests that a bank is more efficient in generating profits from its assets) & ROE (the higher the ROE, the more efficient a company’s management is at generating income and growth from its equity financing) over the last few years since the bailout of the bank. It reported an ROA of 0.2% and an ROE of 1.9% in FY23. This, however, is much lower than peers and indicates that it may take more time for the bank to increase ROA to 0.5%+ and ROE to 10%+.

Yes Bank Share Price Analysis

From trading at a high of INR 393 (in August 2018) to trading at a mere INR 16 (in May 2023), the stock has destroyed 96% of the wealth over the last five years. That said, the stock has given 24% returns over the last year, rising from INR 13 in April 2022 to INR 16 in April 2023.

Yes Bank Strengths and Risks

The bank’s profitability has improved for the last five consecutive quarters against fiscal 2021 and 2020 losses. On the asset side, the bank has realigned its business model, focusing on more granular lending, with the share of retail and small and medium enterprises (SMEs) increasing. Even within the corporate book, the bank focuses on lower exposures than in the past and with a higher proportion of working capital loans, with term lending mainly to better-rated corporates.

While the CASA level may not see a sharp increase in the near term, given the interest rate cycle and a consequent potential shift to term deposits, which carry higher rates, and the greater comfort of institutional depositors with the bank, the overall stability of deposits is expected to be sustained.

Key Strengths:

- Growth in advances and deposit base of the bank with increased CASA on a sustained basis.

- Comfortable capitalization levels on the back of multiple fundraising over the last 4-5 years and improving profitability.

- Improvement in profitability and increase in the bank scale with ROA above 0.5% on a sustained basis.

- Improvement in asset quality parameters and resolution of the stressed accounts and recoveries.

Key Risks:

- Deterioration in asset quality parameters from existing levels due to higher-than-expected slippage.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Can I buy shares of Yes Bank?

Yes, you can buy shares of Yes Bank. However, you should evaluate the risk vs. rewards before investing in the shares. Additionally, the time horizon of the investment also matters a lot in this decision.

What are the 52-week highs and Lows of Yes Bank?

52 Week high is INR 24.75, whereas the 52 Week low is 12.15 for Yes Bank.

Does Yes Bank pay dividends?

The Yes Bank has not paid dividends over the last four years since March 2020.

Read more: About Research and Ranking

How Long-term investing helps create life-changing wealth – TOI

How useful was this post?

Click on a star to rate it!

Average rating 4.1 / 5. Vote count: 27

No votes so far! Be the first to rate this post.