We all have wished to invest in global multibagger stocks like Amazon, Apple, Google, Meta etc. 4 in every 10 investors we interacted with have asked us whether we recommend or facilitate investing in the U.S. stocks.

While we don’t facilitate trading in the U.S. stocks, NSE IFSC (NSE International Exchange), a National Stock Exchange subsidiary has recently opened trading in select U.S. stocks. In this chapter, let’s learn how you can invest in Apple, Google, Tesla, and others.

All thanks to NSE IFSC domestic investors can now invest in U.S. stocks including Amazon, Alphabet (Google), Tesla, Meta Platforms, Microsoft, etc. The exchange first announced facilitating investing in U.S. stocks in August 2021.

Until now, Indian investors could invest in U.S. stocks both directly through designated brokers, select online trading platforms/mobile applications, and indirectly through mutual funds, exchange-traded funds (ETFs) created for such stocks. Needless to say, it was an expensive affair.

But with NSE IFSC, the exchange promises to make investing in U.S. stocks easy, quick and low cost. Though the platform can list 50 U.S. stocks, NSE IFSC has announced the trading format of eight stocks from March 3. It will gradually release details about the trading format for the remaining 42 US stocks.

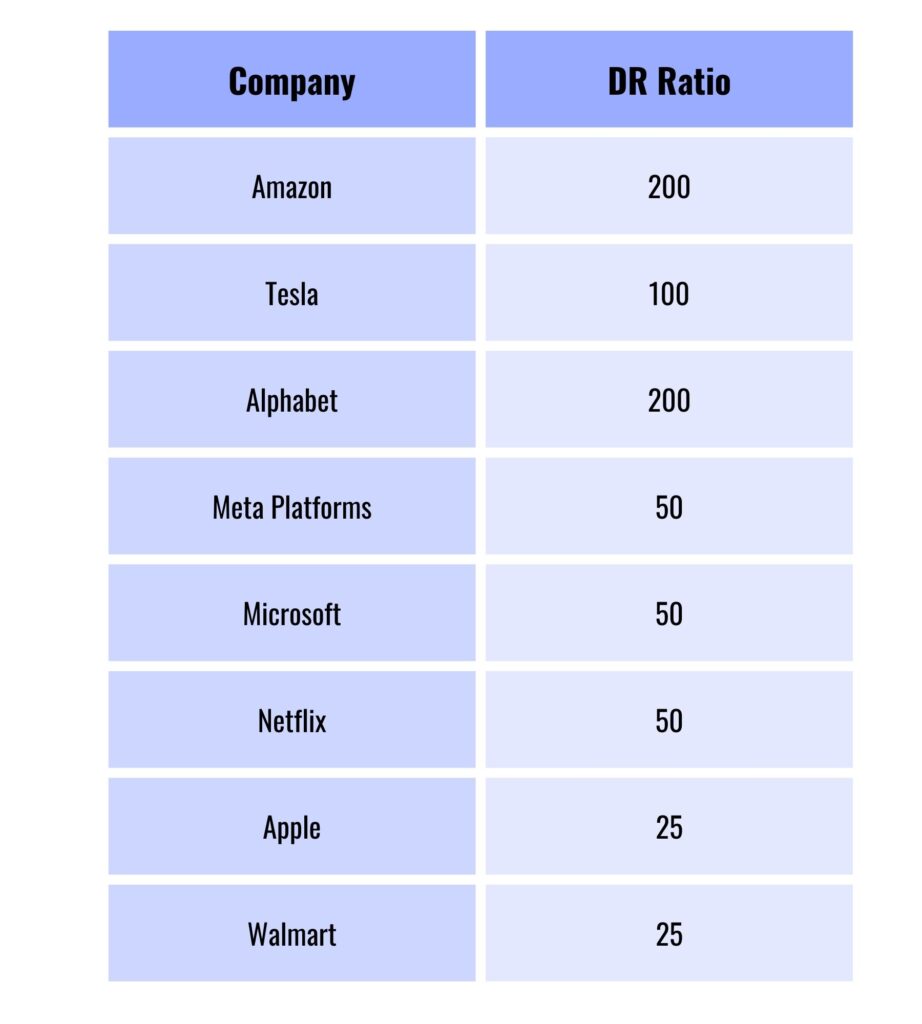

The eight stocks allowed to trade are Amazon, Tesla, Alphabet, Meta Platforms, Microsoft, Netflix, Apple, and Walmart. The exchange will gradually include other stocks like PayPal, McDonald’s, Johnson & Johnson, Nike, Adobe, Berkshire Hathaway, Mastercard, Visa, Chevron, Morgan Stanley, and JP Morgan.

Does this mean you will own these stocks as a whole unit?

Since buying U.S. stocks is expensive, investors have an option to trade in fractional quantities/value compared to the underlying shares traded in the U.S. Per NSE IFSC, this will make investing in U.S. stocks affordable to domestic investors.

The offering will be in the form of unsponsored depositary receipts (DRS). What is a depository receipt, you ask? It is a negotiable financial instrument the NSE IFSC Receipts Custodian issues to investors.

Indian investors will purchase depository receipts. Market makers will buy the U.S. shares and issue the receipts to buyers in fractions. For instance, one share of Tesla will be equivalent to 100 NSE IFSC receipts. One share of Amazon will be equivalent to 200 receipts and one share of Microsoft will be equal to 50 receipts.

These receipts give investors a proportionate beneficial interest in a purchased stock. This means they are entitled to receive corporate action benefits too. Investors can hold these receipts in their own Demat accounts opened in GIFT City.

First initiative of its kind

The entire trading, clearing, settlement, and holding of U.S. stock will be under the regulatory framework of IFSC authority. It is a unique initiative at IFSC where domestic investors can transact on the NSE IFSC platform under the Liberalized Remittance Scheme (LRS) limits prescribed by the RBI.

Under the LRS framework, investors can remit up to $250,000 per financial year for any permitted current or capital account transaction.

If you haven’t guessed yet, the trading hours will be different for transactions in these U.S. stocks. The trading will begin at 8:00 PM IST and close at 2:30 AM IST in the morning. Further, the opening time may change to 7PM when the U.S. implements its Daylight Saving Time (DST) in mid-March. Initially, all settlements will take place in T+3 days. If you are wondering whether these settlements will happen, NSE IFSC Clearing Corporation Limited will provide settlement guarantee for all trades executed on the platform.

How you can start investing in US stocks?

Getting started with investing in U.S. stocks is a no-brainer. You will have to open a Demat account at the IFSC situated in Gift City. Currently, there are 36 brokers registered with the exchange. You can open an account through any one of these brokers. Once the Demat account is created, you will need to transfer funds from your registered bank account to NSE IFSC registered broker’s account. Once the broker receives your funds, you can place your first order in NSE IFSC receipts.

We are sure you are excited to place your first order in the U.S. stocks. While you do that, please remember that there are enough investment opportunities in your backyard. Indian equity markets are as sturdy as their foreign peers and have generated fortunes for seasoned value investors.

You can be next. All you have to do is invest in fundamentally sound stocks. Subscribe to 5 in 5 Wealth Creation Strategy to get an optimally diversified portfolio of 20-25 multibagger stocks.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.