Ratan Tata, Sachin Bansal, Rajan Anandan, Kunal Shal, Anupam Mittal, and Sanjay Mehta are undeniably the top few names in angel investing in India. They have been the backbone of many start-ups that have become unicorns.

But we are not here to discuss how start-ups get angel investors on board. Quite the opposite.

Let us deep dive and find out what angel investing in India is all about.

1. What is Angel Investing in India?

There is a need for capital infusion when entrepreneurs are ready to scale their businesses. That is when they approach a bunch of wealthy investors.

Investopedia defines angel investors as -high net worth individuals (HNIs) who can invest a sum of money and sometimes time and effort in a small venture. The angel investor often takes small equity in the business in return for monetary investment.

It is a risky bet on an establishment that may or may not be successful. If the start-up fails, the angel investors will lose money. On the other hand, if the venture is successful, the investor makes a higher return than a typical stock market investment.

It can only happen when the business attains long-term growth and large-scale success. Then, the equity that angel investors hold in the company also grows in value. Uber, Facebook, and WhatsApp are examples of angel investor-funded start-ups that have become enormous success stories.

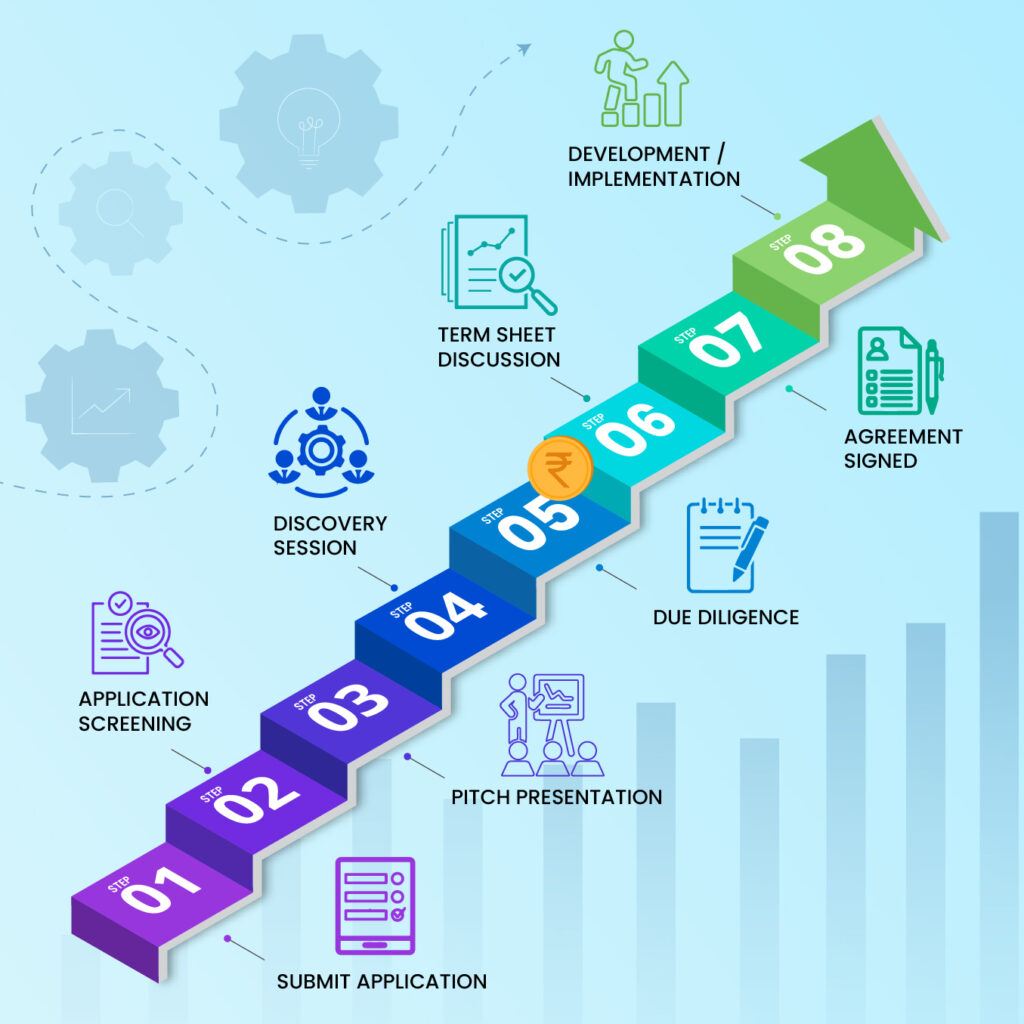

2. What Is The Process of Angel Investing in India?

The process kick starts with a business owner approaching an angel investor(s). Although rare, sometimes, angel investors also look for businesses in which they can invest. The crux of the matter is that the business pitch must draw the attention of the angel investor enough so that they decide to fund the start-up.

Here are the separate phases of getting angel investing in India:

If both parties agree, the next step is to decide the amount of money the investor will put into the business against what percentage of equity. The monetary help can also be in direct funds, a line of credit, or a low-interest loan.

Once the negotiations are over, the entrepreneur and the angel investor sign an agreement outlining the terms and conditions of the deal. The angel investor will receive a proportionate share of the future profits of the business depending on the percentage of equity they own in the company.

Any form of angel investing is a considerable risk. That said, the potential rewards can be very lucrative.

3. Who Can Be Angel Investors in India?

The term angel investor originated from the Broadway theatre in New York. Angel investors were those wealthy patrons who provided funding to a select few struggling Broadway productions that had the content but not the means to finance the shows. In the late 1980s, the term found an association with funding entrepreneurs.

An angel investor is anyone who provides early-stage start-ups with financial support in exchange for equity ownership.

Angel investors can be

- Family and friends who wish to support the start-up venture.

- Professionals such as doctors, lawyers, and bankers are looking for portfolio diversification.

- Business executives who have exposure to running big businesses.

- Entrepreneurs who already have run their successful start-ups.

- Professional angel investors who make a living from it.

- An angel syndicate is a group of investors who work together on deals.

- Crowd-funders are individual, small-time investors that collectively turn their investment into a large fund.

You do not need to have special qualifications to take on the role of an angel investor. However, having an in-depth understanding and expertise of the start-up ecosystem can be a definite advantage for an aspiring angel investor.

An angel investor should also have the skills to identify which start-ups to invest in —keeping up with the latest market trends. Learning about financial risk management and investment analysis also helps.

4. At What Stage Do Angel Investors Invest?

Most angel investors opt to invest in a company in the early stages of growth. However, it could be when the venture is at its ideation stage.

Or the investment can come through when the business has just launched its product or service in the market. But, of course, no one expects the company to have customers or revenue. So, the proof of concept is yet to happen.

In most cases, angel investors are the first form of capital that an early-stage company receives other than what the founders’ have already raised. It is essential because the business is at a critical stage of growth that needs ongoing funding. However, most institutional venture capitalists typically do not come into the landscape at this growth stage of the business venture.

5. What is the Role of Angel Investors in Start-ups?

Investing can be a serious undertaking or an expensive pastime to many angels. But it can also be fun, financially rewarding, and socially impactful.

Besides funding the business, angel investors can function as mentors to entrepreneurs. The motivation to grow the venture and ensure its success is enormous as the angel investor will only profit if the business venture can be scaled and thrive in the long term.

Angel investing in India is an entirely different ballgame as the possibility of losing your total investment is high. There are around seven thousand angel investors in India already, and the number is increasing with every passing year. Increasingly HNIs are inclined to invest due to the success of several Indian start-ups in the last few years.

Check out our Latest Article on How Long term investing helps create life-changing wealth – TOI

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.