Zomato Share Price in Stock Market After The Blinkit Deal, Q1FY23 Result, And Eternal Announcement

A stock market is an unpredictable place in the short term. More so when it comes to defining how an individual stock will move. Take Zomato, a food tech giant listed on the Indian stock market.

Zomato share price in stock market has moved in all directions since its initial public offering (IPO). It reached an all-time high of Rs. 169 in November 2021 and a low of Rs. 40.6 on 27 July 2022.

In five trading sessions between July 27 and August 2, the stock increased 27% after tumbling 33% between July 22 and 27. Many factors are causing these drastic movements in the Zomato share price. Let us look at them in this article.

The Zomato Blinkit Merger

Usually, merger and acquisition announcements send share prices of the involved entities through the roof. However, the Zomato-Blinkit merger was ill-fated for the listed food-delivery platform. Zomato shareholders approved the Rs.4,447 crore all stock-deal to take over Blinkit in June 2022. Blinkit, formerly known as Grofers, is a quick commerce platform that delivers groceries and more.

What is Quick Commerce?

A step ahead of e-commerce and home delivery, quick commerce refers to delivering orders in under 30 minutes. Zepto, Dunzo, Blinkit, and Swiggy Instamart are startups leading the quick commerce industry in India today.

Analysts criticized the deal, stating it would delay Zomato’s profitability plan. Because Zomato would have to make significant cash investments to ramp up Blinkit’s business operations initially. The result…

Zomato-Blinkit deal sent the stock prices tumbling.

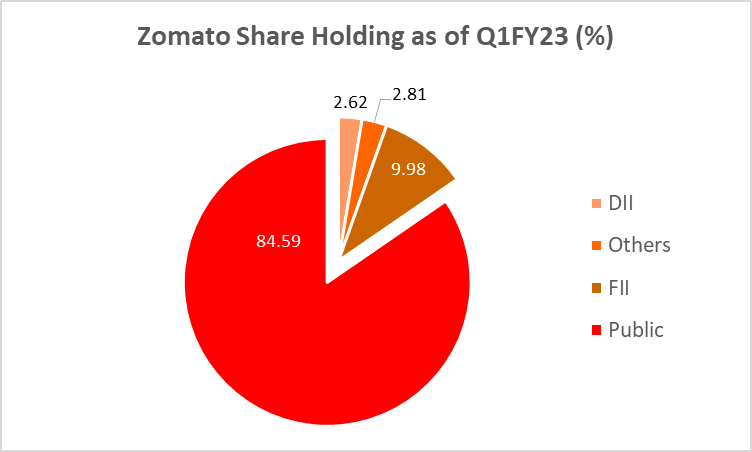

Zomato’s Lock-in Period Expired for Pre-IPO Investors

The lock-in period for Zomato’s pre-IPO shares ended on July 23, 2022. As a result, the company’s stock price nosedived 12% in a single day. This rule applies to companies with no promoter holding in the shareholding mix. Zomato is such a company. The chart below shows Zomato’s shareholding mix as of Q1FY23.

According to the rule, investors of companies with zero promoter holding must hold the pre-IPO shares for one year from the shares allotment date. After that, these investors can’t sell their holdings before the lock-in period ends.

Jefferies, Credit Suisse, and Kotak Still Positive on Zomato

The recent correction in Zomato stock divided the d-street and global analysts. While several domestic analysts sounded concerned and refrained from fresh buying in the stock, international brokerage firm Jeffries remained positive on Zomato’s share price. The firm believes the new-age company is improving its unit economics. As a result, Jeffries has kept a target price of Rs. 100, i.e. an upside potential of 45% from the closing price of Aug 3, 2022, as it remained upbeat on Zomato’s prospects.

Soon another international brokerage Credit Suisse and a domestic brokerage Kotak Institutional Equities (KEI), joined Jeffries. While Kotak upgraded Zomato to buy with a target price of Rs. 79, Credit Suisse maintained its rating as ‘outperform’, citing Zomato’s profitability in the picture.

Ashwath Damodaran Says, ‘I would buy it as part of a diversified portfolio.‘

After Zomato shares tumbled to an all-time low of Rs. 40.6, renowned finance professor Ashwath Damodaran said he would buy the food-delivery giant as a part of his diversified portfolio. Before Zomato’s IPO, Damodharan valued the company at Rs. 41/share, but no one thought it was possible.

Zomato’s Upbeat Q1 Performance

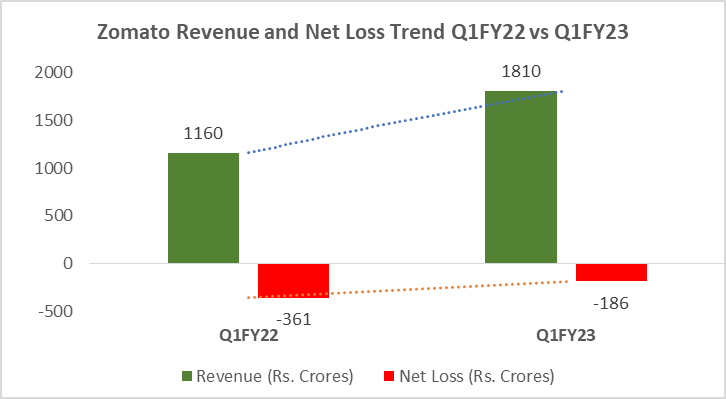

The company’s first-quarter report card is the key element that played a crucial role in pushing Zomato’s share price higher. The food-delivery giant posted an upbeat performance surprising everyone on the street.

- Revenue: Zomato generated revenue of ~Rs. 1810 crores in Q1FY23, which is 56% higher than Rs. 1160 crores in Q1FY22. The food delivery segment contributed ~Rs. 1470 and Hyperpure added Rs. 270 crores to the revenue mix. For those who don’t know yet, Hyperpure is Zomato’s B2B business line launched to provide restaurants with high-quality food ingredients and other supplies.

The consistent growth in the Gross Order Value (GOV) contributed to the jump in first-quarter revenue. Please read our separate article on how to find good new-age companies to get familiar with terms like GOV. In addition, the 36% year over year (Y-O-Y) increase in monthly transacting users (MTU) drove order volume growth, which helped boost revenues.

- Net profit/loss: As you see in the graph above, the Zomato management has been able to control losses. In Q1FY23, the company made a loss of ~Rs. 186 crores in Q1FY23 compared to ~Rs. 361 cores in Q1FY22, which is a narrowing of 48% in a year.

- EBITDA: Zomato’s food delivery business achieved a crucial milestone – EBIDTA breaking even, i.e., the company’s revenue matched the EBITDA. It is a significant achievement for Zomato as new-age companies tend to burn cash to acquire and retain customers or users.

EBITDA break-even implies that the company is capping its cash burn, which will help Zomato’s path to profitability without compromising growth.

Understand investing jargon

What is EBITDA?

EBITDA stands for Earnings before interest, taxes, depreciation, and amortization. Measuring a company’s financial performance before accounting and financial deductions is a more precise metric.

Zomato becoming Conglomerate – Eternal

Ahead of Q1 results, Zomato’s founder surprised everyone with an announcement to become a conglomerate. The food-delivery giant will rebrand itself to “Eternal” –a conglomerate (parent company) that will host multiple businesses/brands with a new chief executive officer (CEO) each.

Here is what the founder Deepinder Goyal said while announcing the rebranding plan

“We are transitioning from a company where I was the CEO to a place where we will have multiple CEOs running each of our businesses (E.g., Zomato, Blinkit, Hyperpure, Feeding India), all acting as peers to each other and working as a super-team with each other toward building a single large and seamless organization.”

Currently, Albinder Dhindsa leads Blinkit and Rahul Ganjoo heads Zomato’s food delivery operations, while Ramit Goyal heads the B2B platform Hyperpure. But what is not clear is who will be the CEOs of these companies post-Eternal?

Final Words – Zomato Share Price in Stock Market

We believe it is a well-thought move by Deepender Goyal to transition into a large-scale entity and treat each business individually for better governance, business, and profitability.

Zomato has made strategic investments in several other entities too. Food robotics startup Mukunda, hyperlocal discovery business Magicpin, logistics player Shiprocket, fitness platform Curefit, ad-tech player Adnomo and B2B software platform UrbanPiper are some of Zomato’s investments.

The conglomerate’s name ‘Eternal’ feels well thought out. Eternal describes something that lasts forever or without an end. But only time will tell how things will play out for Zomato and its shareholders.

Read more: About Research and Ranking

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Vinay Mahindrakar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/

-

Vinay Mahindrakarhttps://www.equentis.com/blog/author/vinay/