Eight sectors are considered core sectors in India, and cement is one of them. The sector has given good returns to investors over the long term. For example, Shree Cement, one of India’s premier cement companies, has given investors a CAGR return of 18% last 10 years. Shree Cement share price rose from ₹4,455 in February 2013 to a high of ₹32,048 in April 2021.

In this blog, we will conduct a detailed analysis of Shree Cement’s business performance and long-term growth prospects to assist you in making investment decisions.

History of Shree Cement

Shree Cement was started in 1979 by Benu Gopal Bangur in Jaipur. In 1,983, the company commissioned its first integrated cement plant of 0.6 million tons per annum (MTPA) in Beawar, Rajasthan, starting production in 1985. Despite its initial roots in Rajasthan, the company’s head office is located in Kolkata.

Mr Hari Mohan Bangur is the Chairman, and Mr Prashant Bangur is the Vice Chairman. The company went public in 1984, and its shares were listed on the Bombay Stock Exchange. Since listing, Shree Cement share price has risen steadily, helping it to be known as a consistent compounder in the Indian stock market.

Over the years, Shree Cement has become a dominant player in the Northern and Eastern parts of India, with 14 manufacturing locations across 10 states. The company has a total cement production capacity of 46.40 MTPA and 29.60 MTPA clinker production capacity.

Hey,

Need a customized investment portfolio?

We have one for you!

Hey,

Need a customized investment portfolio?

We have one for you!

The company has a total installed power capacity of 820.4 MW, of which 48.2% comes from green sources. In FY22, the company posted a consolidated revenue from operations at ₹15,009 crores, growing at a CAGR of 9.45%0.43% in the last 10 years. And posted an EBITDA of ₹4,185 crores.

At the end of 2022, Shree Cement had a market capitalization of ₹86,711 crores, which has grown at a CAGR of 23.40% in the last 10 years from ₹10,590 crores.

Shree Cement Business Performance

Shree Cement is primarily engaged in the manufacturing and selling of cement and cement-related products, and there are no other reportable segments.

The company operates outside India in Ras Al Khaimah, UAE, with a cement production capacity of 4 MTPA. In FY 2022, revenue from outside India came in at ₹898.81.60 crores, up from ₹847.18 crores in the previous year.

In terms of capacity utilization, the company maintains a healthy capacity utilization ratio of over 60%. In FY22, the company held the capacity utilization ratio of all its plants at 63.7%, producing 276.92 MTPA cement.

Product Portfolio

The company specialises in manufacturing ordinary portland cement, portland slag cement, portland pozzolana cement, and composite cement. Its products are sold under the brand name Shree Jung Rodhak Cement, Bangur Cement, Rockstrong Cement, Concrete Master Roofon Cement, Bangur Power Cement, and Shree Cement.

Green Initiatives

Shree Cement is consciously moving towards building sustainable manufacturing capabilities for a lesser impact on the environment. In FY22, the share of alternative fuels in total fuel consumption was 9.8%, and we want to increase the share of green power in total power consumption to 55% from the present 48.2%. The company has also pioneered the manufacturing process of synthetic gypsum, replacing the use of mineral gypsum.

Shree Cement Customer Profile

In FY 2022, Shree Cement sold 79% of its products to retail customers and the rest, 21%, to institutional clients.

Shree Cement Management Team

Chairman Shri HM Bangur, Vice Chairman Mr. Prashant Bangur, a Managing Director Neeraj Akhoury lead the company. Shri HM Bangur is a chemical engineer from IIT Bombay, and Prashant Bangur is a management graduate from ISB, Hyderabad.

Other key management professionals include Shri Diwakar Payal – President (Marketing), Shri Sanjay Mehta – President (Commercial), Shri Man Mohan Rathi- Jt. President (Power Plants), and Shri Subhas Jajoo (Chief Financial Officer).

Shree Cement Financial

Revenue

In FY22, revenue from operations was at ₹ 14,306 crores, up by 13% from ₹ 12,588 crores in FY21, driven by cement sales volume growth of 4.7% over the previous year. In the last 10 years, Shree Cement recorded a compounded sales growth of 9.45%.

In H1FY23, the revenue from operations stood at ₹7,984 crores, compared to ₹6,655 crores in H1FY22.

EBITDA

In FY 2021-22, the EBITDA came in at ₹4,185 crores, down 5% from ₹4,13 crores in FY 2020-21. In the last 10 years, Shree Cement reported 8.75X% compounded growth in EBITDA.

In H1FY23, EBITDA came down to ₹1,477 crores from ₹2,201 crores in H1FY22, down by 32.9%.

EBITDA margins in FY22 and H1FY23 were 29.3% and 18.5%.

Profit after tax (PAT) for the FY22 came in at ₹2,377 crores, compared to ₹2,312 crores a year earlier. In H1FY23, PAT came in at ₹505 crores, compared to ₹1,239 crores, down by 59.2%.

Shree Cement Key Ratios

Interest Coverage Ratio: In FY22, the interest coverage ratio improved to 19.22 times from 17.86 due to reduced finance costs.

Debt-to-equity Ratio: In FY22, there was not much change in the debt-to-equity ratio, which was 0.10 times, meaning the company has near zero debt in its books.

Current Ratio: The liquidity ratio indicates the company’s ability to meet its short-term obligations or those dues within one year. In FY22, the current ratio stood at 1.69 times, meaning the company has enough liquidity to service all its obligations.

Operating and net-profit margin: In FY22, the operating and net profit margins declined significantly due to increased power and fuel cost. The operating profit margin stood at 25.50%, and the net profit margin was 16.61%.

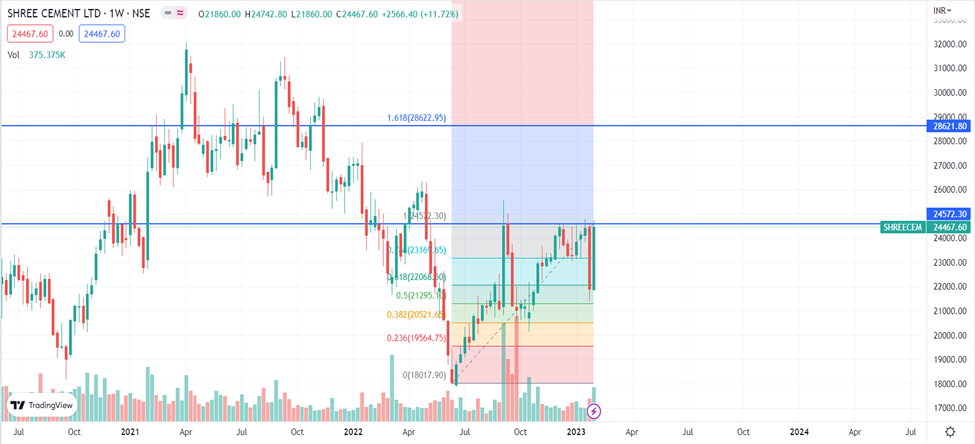

Shree Cement Share Price Analysis

Shree Cement shares were listed on the Bombay Stock Exchange after a successful IPO in 1984 and are one of the top-performing stocks in India and have grown at a CAGR rate of 18% in the last 10 years. However, Shree Cement share price has underperformed the Nifty 50 index over the previous three years.

In the pandemic-led market crash in March 2020, Shree Cement share price made a low of ₹15,410 but quickly recovered, hitting a high of ₹31,990 on 9th April 2021.

The face value of Shree Cement shares is ₹10, and the company had its last right issues in December 1996. Here, the promoters hold the majority with a 62.55% stake in the company, institutional investors hold a 24.47% stake, and the public holds the remaining 12.99% stake.

Dividend Payout

Shree Cement consistently pays dividends to its shareholders and has an uninterrupted and increasing dividend payout track record since 2000-01. In the last three financial years, Shree Cement has paid dividends of FY 2019-20- ₹110, FY 2020-21- ₹60, and 2021-2022- ₹90.

Shree Cement Share Price Target

Shree Cement share price has declined by more than 40% since its peak as raw materials, power, and fuel prices have significantly impacted profitability. In addition, macro uncertainty due to worsening geopolitics also weighed on the stock. Also, cement stocks fall under cyclical stocks, meaning the stock closely follows the economic growth trends.

Now, coming to the Shree Cement share price growth outlook. The company has invested significantly in ramping up capacity through strategic expansion projects. By FY25, the company is working on expanding its capacity from 46.4 to 55.9 MTPA, and by FY30, the company aims to increase it to 80 MTPA.

Looking at the macro data, India’s cement production increased at a CAGR of 5.65% between 2016 and 2022, while consumption grew at a rate of 5.68% during the same period, implying that growth in cement consumption is slightly higher than growth in production capacity, indicating a considerable growth potential.

With a strong project execution capability, organic growth primarily funded by its funds, and the lowest capital cost per ton, Shree Cement has a clear advantage over its peers. Therefore, the return of the realization rate on the sale per ton of cement to or above the Q1FY23 level (₹5,926), which fell to ₹5,384 in Q2FY23, is likely to be a catalyst for Shree Cement share price growth.

Shree Cement Future Growth Potential

India is the world’s second-largest producer and consumer of cement, with increased spending on housing and real estate, infrastructure, industrial development, and low-cost housing projects driving demand. In FY22, cement demand in India is expected to range between 353 and 358 million tons, up from 153 million tons in FY07.

With the government increasing capital expenditure by 33% to ₹10 lakh crores and announcing the revival of 50 airports in budget 2023, demand for cement is expected to rise significantly, and Shree Cement’s growth plan and manufacturing capabilities will help to capitalize on the market’s opportunities. Also, the company has started diversifying its presence in India from a 100% North player four years back.

However, some risks that can adversely impact Shree Cement share price growth are volatility in the price of imported coke/pet coke and delay in the commissioning of new plants.

Disclaimer Note: The numbers mentioned in this article are only for information purposes. He/she should not consider this a buy/sell/hold recommendation from Research & Ranking. The company shall not be liable for any losses that occur.

FAQs

How has the Shree Cement share price performed in the last 10 and 5 years?

Shree Cement share price has given a CAGR return of 18% and 8% in the last 10 and 5 years, respectively. However, due to not-so-favorable unit economics because of adverse macro conditions and a challenging business environment, Shree Cement share price has underperformed the Nifty 50 index in the last year.

What is the all-time high of Shree Cement share price?

The all-time high of Shree Cement share price is ₹32,048, which it made on 8th April 2021. Shree Cement had a market capitalization of ₹86,711 crores at the end of 2022.

Who owns Shree Cement?

Shree Cement was founded by Shri Benu Gopal Bangur in 1979 at Jaipur and commissioned its first integrated cement plant of 0.6MTPA Beawar, Rajasthan. Currently, Shri Hari Mohan Bangur leads the company as Chairman. The promoters hold a 62.55% stake in the company.

Related investing topics

Read more: About Research and Ranking

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 6

No votes so far! Be the first to rate this post.